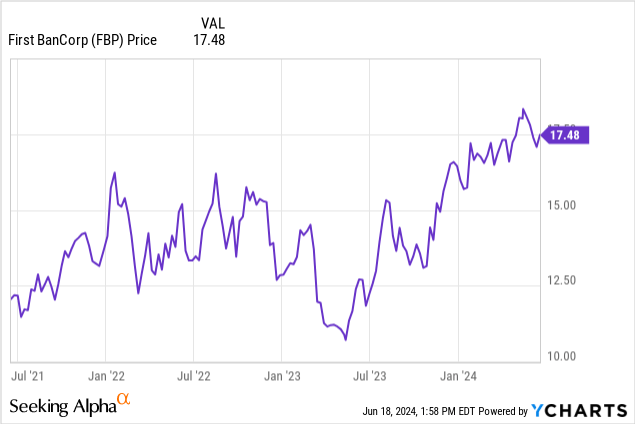

First BanCorp: A Name Choice On Puerto Rico (NYSE:FBP)

Eminaldo/iStock Editorial by way of Getty Photos

Introduction

First BanCorp (NYSE:FBP) is the holding firm for FirstBank in Puerto Rico. The financial institution has 58 branches in Puerto Rico and eight branches on the (US and British) Virgin Islands. Moreover, there are one other eight branches in Florida. As First BanCorp is closely uncovered to Puerto Rico, you can say the financial institution is a name possibility on Puerto Rico.

Whereas the financial institution’s earnings stay sturdy – however recording in extra of $12M in internet mortgage loss provisions within the first quarter of the 12 months, I am not an enormous fan of the financial institution’s deal with shopping for again inventory at a premium of in extra of 100% to the tangible e-book worth per share.

The web curiosity earnings remained comparatively steady

Puerto Rico has been a troubled area for some time, so I’m primarily thinking about seeing the financial institution’s monetary efficiency and its stability sheet energy to ensure it could actually face up to financial shocks.

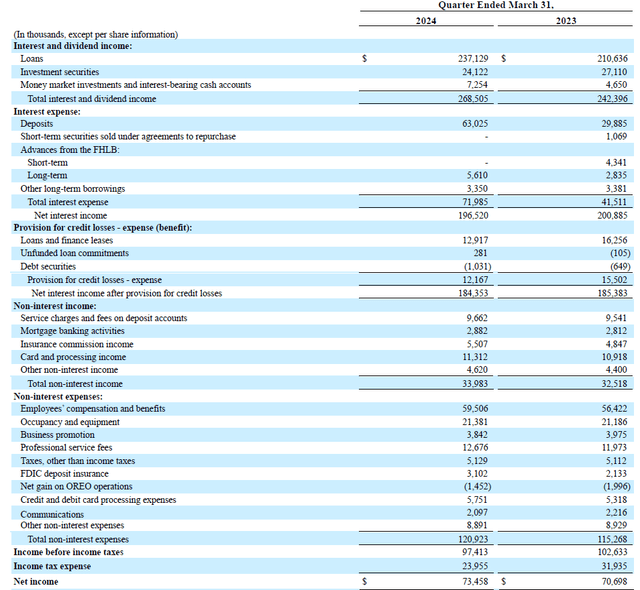

Fortuitously, the financial institution’s internet curiosity earnings remained very sturdy. As you may see beneath, its curiosity earnings elevated by roughly $26M to $268.5M, whereas the curiosity bills elevated by $30.5M. Whereas this certainly ends in a barely smaller internet curiosity earnings ($196.5M versus $200.9M), the ‘injury’ stays fairly restricted.

The financial institution additionally reported roughly $34M in non-interest earnings and nearly $121M in internet non-interest bills. This resulted in a pre-tax and pre mortgage loss provision earnings of roughly $109M. The financial institution has put $12.2M apart in mortgage loss provisions leading to a pre-tax revenue of $97.4M whereas the online revenue was $73.5M for an EPS of $0.44.

The financial institution at the moment pays a quarterly dividend of $0.16, which suggests nearly all of its earnings are retained on the stability sheet.

Conserving an in depth eye on the Puerto Rico heavy mortgage e-book

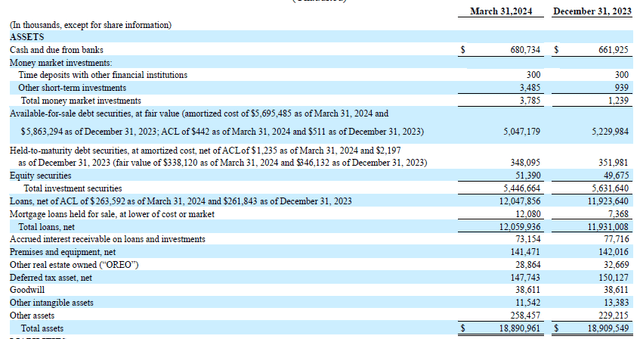

that stability sheet, there are a couple of attention-grabbing components value highlighting. As you may see beneath, the financial institution had roughly $18.9B in complete belongings. The stability sheet is fairly liquid because the financial institution has nearly $700M in money and $5.05B in debt securities out there on the market. There is also a place of $348M in securities held to maturity (with a good worth of $338M, so there is not an enormous valuation discrepancy).

I am clearly extra within the $12.05B mortgage e-book.

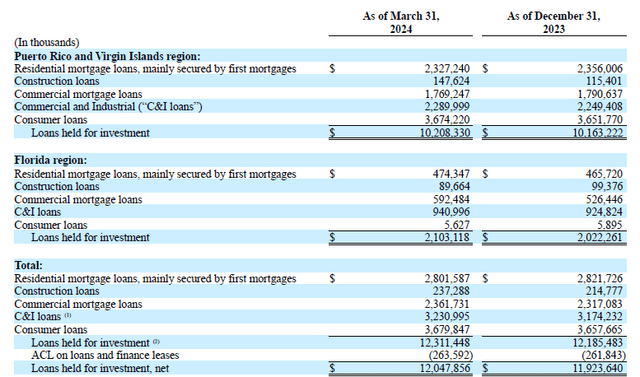

As you may see beneath, the overwhelming majority of the loans are specializing in Puerto Rico and the Virgin Islands, the place $10.2B of the mortgage e-book has been invested. A big portion is said to mortgages, however the financial institution has a good greater publicity to client loans, particularly in Puerto Rico. And though it has barely issued any client loans in Florida, the place in Puerto Rico alone is excessive sufficient to make the buyer loans a very powerful publicity of the complete mortgage e-book.

The picture above additionally reveals the financial institution has already recorded a complete mortgage loss provision in extra of $260M, and it is clearly essential to take a look at what proportion of the mortgage e-book is classed as ‘late’.

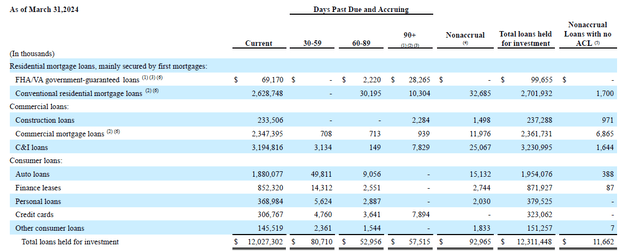

The footnotes to the monetary statements present a really helpful look underneath the hood. As you may see beneath, there’s a complete of $93M in loans which are categorized as non-accrual loans, whereas a further $57.5M in loans are greater than 90 days late.

Moreover, roughly $133M of loans are greater than 30 however lower than 90 days late.

It is attention-grabbing to see that not the buyer loans, however the residential mortgage loans are the issue youngster. Of the $92.7M in non-accruing loans, $32.7M was associated to residential mortgages, representing roughly 35% of the entire quantity of non-accruing loans. And once you have a look at the loans which are greater than 90 days late however nonetheless accruing, nearly 70% of the $57.5M is said to residential mortgages. The financial institution is at the moment within the strategy of foreclosing on $37.7M of the residential actual property loans.

Whereas the ratio of client loans versus the entire quantity of loans late is considerably greater within the 60-89 day section and undoubtedly the ‘worst’ class within the 30-59 day section, it nonetheless seems to be manageable. The vast majority of the buyer loans (and nearly all of the buyer loans late) are associated to automotive loans, which suggests there’s collateral that may very well be seized and monetized. And with a complete internet mortgage loss provision of simply over $12M within the first quarter, the financial institution ought to be capable to enhance its mortgage loss provisions ought to the necessity come up.

Funding thesis

Whereas the financial institution is comparatively enticing from an earnings profile (because it seems to be buying and selling at simply 10 occasions earnings and 9 occasions ahead earnings), the e-book worth as of the tip of the primary quarter was simply $8.88 per share. And one would deduct the $50M in goodwill and different intangible belongings, the online tangible e-book worth could be roughly $1.43B. Divided over the online share rely of 166.7M shares, this represents a tangible e-book worth of roughly $8.56/share.

Whereas I would not thoughts ‘betting on the way forward for Puerto Rico’ and having publicity to a big financial institution with a core deal with the world could be a great transfer, I am unsure I am prepared to pay a 104% premium over the tangible e-book worth. Whereas the financial institution retains nearly all of its earnings on the stability sheet, the online retained quantity is simply over $1/share (excluding the influence from the objects on the great earnings assertion), which suggests the e-book worth per share will probably be positively impacted by the earnings retention, however the financial institution’s share buyback plan is not actually serving to, contemplating the inventory is being repurchased at a considerable premium to the TBVPS. Within the first quarter of this 12 months, for example, First BanCorp spent in extra of $52M on shopping for again 3.1 million shares.

Taking all these components into consideration, I feel First BanCorp is a ‘maintain’ at its present valuation. Whereas enticing from an earnings a number of, I am not eager on paying the present premium to the TBVPS and the present capital allocation precedence to repurchase inventory can be one thing I am not completely in favor of.