Expedia Inventory Is A Cut price Even As The Financial system Deteriorates (NASDAQ:EXPE)

JHVEPhoto/iStock Editorial through Getty Photos

Govt abstract

Expedia Group (NASDAQ:EXPE) has largely been a disappointment to long-term traders, nonetheless we consider that the fortunes of the enterprise are about to vary.

As you will have guessed, Expedia is a worth play, not a deep worth scenario, although. The corporate is robust in its key markets because of the main scale, additionally it is very cash-generative and its revenues are rising.

The B2B division of Expedia is experiencing speedy progress and driving the entire group ahead, and the pinnacle of this division has now turn into Expedia’s CEO.

The corporate has now moved to a brand new expertise platform and can also be making the most of the low inventory worth and is aggressively shopping for its shares again.

Placing the frustration apart, this text is a couple of competitively robust, rising and worthwhile enterprise buying and selling at solely 11X subsequent 12 months’s earnings.

The journey enterprise is cyclical, although, and the economic system appears to have began to chill as of late. Expedia will hit a rocky patch eventually, however will nonetheless be carried ahead by the structural progress.

We consider Expedia presents a sexy risk-return tradeoff.

The brand new tech stack and One Key maintain future potential

The journey business has confronted vital challenges over the previous 5 years, primarily because of the pandemic, which severely restricted journey as individuals had been compelled to remain indoors. Even after restrictions had been lifted, the business struggled to recuperate, going through points like lowered capability in airways and accommodations and rising prices resulting from inflation. These components slowed the tempo of restoration and made it troublesome for the business to return to pre-pandemic ranges.

It’s not stunning that Expedia struggled to develop on this difficult surroundings. Whereas Reserving (BKNG) aggressively expanded and gained market share in the course of the reopening, Expedia possible confronted setbacks resulting from its ongoing expertise stack migration. These points could have hindered its capability to market successfully, slowing its restoration in comparison with friends.

Expedia has now been in a position to put its three principal manufacturers Expedia.com, Lodges.com and Vrbo on a single tech platform. Total, the corporate went from 21 to only one expertise stack. The brand new platform nonetheless must be fine-tuned, however the enterprise has largely accomplished the undertaking that was began in 2020.

The operational points at Expedia stemmed from a progress technique that targeted on business consolidation by means of consolidation, the place inner competitors between manufacturers acquired was inspired.

Surprisingly, till just lately, Expedia didn’t have a cross-brand loyalty program, which is essential in an business the place buyer acquisition prices are excessive, and buyer loyalty is essential to success. In such a aggressive area, the shortage of a unified loyalty scheme possible hindered the corporate’s capability to retain and develop its buyer base successfully.

Expedia’s technique has shifted from acquisition-driven enlargement to a give attention to natural progress and integration. The pandemic offered a possibility to transition to new expertise platforms with much less danger, enabling the corporate to streamline operations and enhance effectivity.

Expedia has just lately launched its One Key loyalty program, permitting prospects to earn and redeem rewards throughout its manufacturers, together with Expedia, Lodges .com, and Vrbo. It operates as a cash-back type scheme, the place members accumulate factors that can be utilized for future journey bookings. Moreover, One Key presents elite standing for frequent travellers, offering bigger reductions, and just like Reserving’s Ranges.

Whereas the success of One Key or the total advertising advantages from Expedia’s built-in tech stack can’t be assured, it’s clear that Expedia has shifted its strategic focus. The corporate has moved from being an business consolidator to an operator targeted on inner enhancements and natural progress. We do like this strategy.

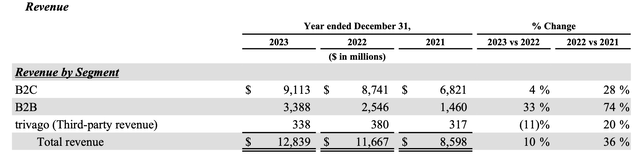

B2C enterprise progress slows

Expedia bears have expressed issues concerning the slowdown in progress throughout the firm’s shopper division ( B2C), which has been minimal within the newest quarter. Nonetheless, the patron enterprise is only one a part of Expedia’s operations.

Expedia’s shopper division consists of well-known manufacturers like Expedia.com, Lodges.com, and Vrbo. Not too long ago, these companies underwent a serious migration to a brand new expertise platform, which is commonly likened to “altering the engines of a aircraft mid-flight.” We’re not shocked that among the opponents carried out higher throughout this migration course of. We’d additionally not be shocked if it could take the enterprise a number of extra quarters to fine-tune new processes.

It stays unsure whether or not Expedia’s shopper division will regain market share within the U.S. after the brand new programs are totally optimized. Nonetheless, even when this restoration is sluggish, it might not be a big concern, as the corporate’s B2B division is now the first progress engine.

B2B enterprise progress

The corporate’s wholesale (B2B) division is rising quickly and has turn into a big a part of the enterprise. Notably, the previous head of this division has now been appointed as Expedia’s new CEO.

B2B now accounts for ~40% of group revenues and rising. Expedia is white labelling its reserving system and likewise opening up its lodging inventories to loyalty scheme operators in addition to abroad and native unbiased journey brokers.

B2B income share (Expedia)

Most notably, Expedia powers American Specific Journey, the journey reserving system of Walmart in addition to the lodge reserving system of Delta Air Traces. Thirty p.c of B2B bookings are linked to associate loyalty packages.

Expedia can also be providing its American and European lodge inventories to abroad on-line journey brokers equivalent to Journey.com (TCOM). Whereas the Expedia manufacturers might not be well-known in markets like China, travellers there can nonetheless ebook U.S. lodging by means of Expedia’s extensive stock. Sixty p.c of B2B bookings are coming from outdoors the USA.

B2B companies profit from not having to spend closely to amass prospects, because the site visitors is offered by companions, equivalent to monetary establishments, journey firms, and retailers by means of loyalty packages. So long as these firms proceed to spend money on journey as a part of their rewards choices, Expedia will obtain a gradual stream of consumers.

Though the take charges in Expedia’s B2B wholesale enterprise is perhaps decrease in comparison with its B2C division, the corporate powers this phase utilizing its current programs and stock. This enables Expedia to keep away from spending massive sums on gross sales and advertising, leading to comparable revenue margins between B2B and B2C.

B2B Earnings (Expedia)

The expansion potential of influencer advertising

Expedia additionally powers unbiased journey brokers. The corporate supplies brokers with entry to Expedia’s stock and permits them to ebook on behalf of shoppers and earn a fee.

Native journey influencers could certainly appeal to customers away from Expedia’s shopper platforms, probably resulting in some gross sales cannibalization. We’re, nonetheless, we’re joyful that the enterprise is embracing this pattern.

Influencer advertising within the journey business is rising quickly, particularly by means of platforms like TikTok. Youthful generations are more and more partaking with content material throughout completely different digital channels, making it important for companies like Expedia to determine a presence the place customers are most energetic.

In abstract, Expedia’s B2B division is experiencing speedy progress and is each worthwhile and well-established. Whereas some B2C gross sales could also be cannibalized by this shift, the general gross sales of Expedia Group are anticipated to rise because of the firm’s enlargement right into a broader vary of progress alternatives

Expedia can proceed rising even with out top-line enchancment

Regardless of uncertainties about income progress, Expedia stays a well-entrenched, worthwhile and cash-generative enterprise. The management of the corporate additionally appears to have realised that the most effective acquisition goal may very well be their very own firm.

So long as the inventory continues buying and selling on the depressed worth and elevated free money circulation multiples, Expedia will proceed shopping for again the inventory and rising the Earnings Per Share.

Final 12 months Expedia spent 2.1 billion on inventory buybacks, whereas the free money circulation technology was roughly 1.8 billion. The corporate has purchased again 19.1 million shares, or about 12% of inventory excellent at first of the 12 months. Expedia repurchased one other 9.2 million shares for $1.2 billion year-to-date, equal to 6% of inventory excellent.

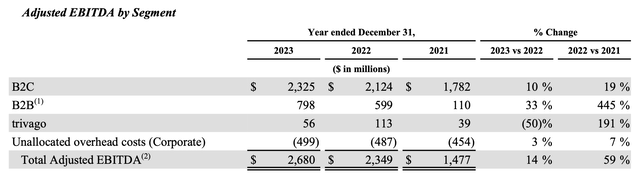

Adjusted EPS within the second quarter has elevated by 21% as in comparison with final 12 months when adjusted web revenue solely grew by 10%, this distinction stems from accelerated buybacks during the last 12 months.

Expedia is anticipated to ship $11.77 of earnings for the total 12 months and proceed rising thereafter. The corporate is buying and selling at about 11 instances subsequent 12 months’s anticipated earnings. We consider it is a compelling valuation a number of for a rising enterprise of this high quality.

EPS Estimates (Looking for Alpha)

Present estimates counsel that Expedia will keep EBITDA margins of over 20%, barely increased than pre-pandemic ranges. That is supported by the rising B2B division, which operates with a 22-24% EBITDA margin. With this division contributing an rising share of income, the projected 20% margin for all the group appears affordable.

Macro dangers

The journey business is cyclical although and no one ought to count on Expedia to generate a gradual degree of earnings going ahead. A more difficult interval will come eventually, revenues will dip and so will the margins. The primary indicators of financial weak point have began rising as of late.

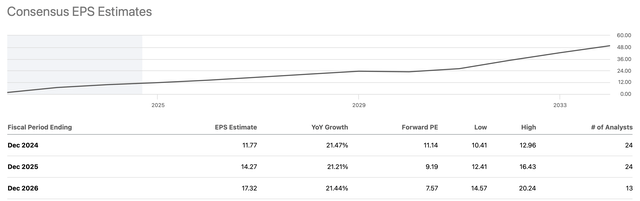

Inflation has hit laborious many households within the U.S. Nonetheless, customers had been in a position to keep spending by drawing from financial savings amassed in the course of the pandemic. Now that these financial savings are gone, the prospects for shopper spending look extra grim.

Pandemic financial savings (FED)

File low unemployment was additionally serving to many to safe these much-needed wage will increase. The unemployment fee has began climbing most just lately and the wage progress has slowed.

A extra hostile macro surroundings will possible cap income progress over the following few quarters, however, the enterprise will proceed producing earnings and shopping for shares again. Absent a pronounced recession Expedia will possible proceed rising earnings per share.

The Backside Line

Expedia, a legacy participant within the on-line journey business, has grown by means of consolidation however has misplaced some floor to newer opponents. Regardless of this, it stays the biggest journey retailer within the U.S. with in depth lodging stock and powerful distribution. The corporate is shifting its focus from acquisitions to integration, operational effectivity, and natural progress, notably in its B2B division. Whereas short-term market situations are unsure, Expedia’s long-term progress prospects and engaging valuation make it a compelling possibility for traders.

Market timing is difficult, even for professionals. Nonetheless, given Expedia’s long-term progress potential and present engaging valuation, it’s a inventory that ought to undoubtedly be on the radar of traders.