CVS Well being Inventory: Shares Decimated, However I am Shopping for For 4.6% Yield And Rebound Potential

JHVEPhoto

CVS Well being Company (NYSE:CVS) is well-known for its CVS pharmacy retail shops. It additionally has CVS Caremark, which is a pharmacy advantages supervisor, Oak Road Well being, which is a main care firm, and Aetna, which is without doubt one of the largest medical health insurance suppliers. This inventory plunged after the corporate reported Q1 2024 outcomes and it made me need to take a recent take a look at this inventory as a result of the valuation has modified a lot in such a short while.

The scenario with CVS jogs my memory of when Goal (TGT) shares plunged late final 12 months to round $100 after reporting outcomes that disillusioned buyers. Goal shares ended up surging and virtually doubled in worth once they went over $180 per share in April (though it’s off that degree now). It is clear that buyers are inclined to overdo enthusiasm to the upside when issues are going properly, and it is usually clear that shares can go under truthful worth when buyers are overly unfavorable. With that in thoughts, let’s take a better take a look at what seems to be a perfect shopping for alternative in CVS:

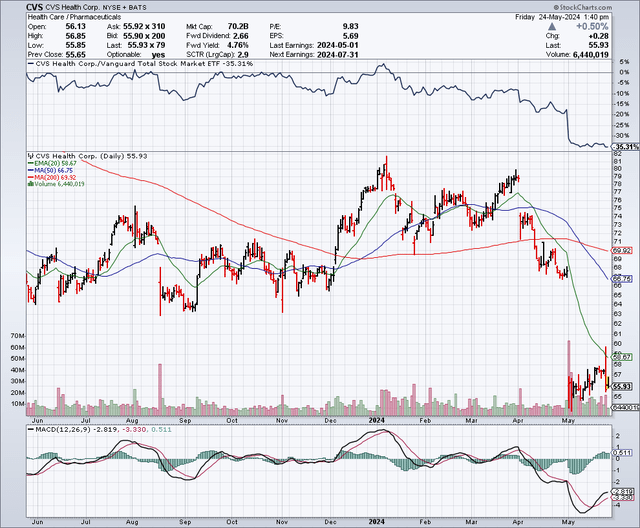

The Chart

Because the chart under reveals, this inventory plunged after earnings have been reported in early Could 2024. This inventory was even buying and selling at round $80 per share in April and after the earnings plunge, it’s right down to about $55 per share. The 50-day shifting common is $67.14 and the 200-day shifting common is $70. This inventory is now deeply oversold and I imagine it’s due for a rebound for each technical and elementary causes.

For extra perspective from a longer-term viewpoint, let’s take a look at the chart under which works again to round 2012. As proven under, this inventory topped out twice at simply over $110 per share. This occurred in 2015 and in 2022. So, the subsequent time this inventory goes over $110 per share, it may be time to promote. The inventory is buying and selling for about half that degree now, and it seems very undervalued.

What’s notable to me on this chart is the 200-week easy shifting common, which is represented by the brown trendline. Since 2012, CVS shares by no means went under this trendline, till now. It did mainly contact this trendline in 2020 and got here near it a few different instances. Over all these years, and every time, it was a shopping for alternative. With the inventory now solidly under this trendline, you might both view this as a “this time it is totally different” view and assume the corporate is “damaged”, or you might see this as a damaged inventory that has doubtlessly given us an distinctive shopping for alternative, which has not occurred in over a decade. I do not suppose the CVS enterprise mannequin is damaged or so totally different now than it was when it traded at a lot larger ranges. That is one purpose why I view this plunge as extreme and a perfect shopping for alternative.

Earnings Estimates And The Stability Sheet

Analysts count on CVS to earn $6.99 per share in 2024, on revenues of practically $369 billion. For 2025, earnings are anticipated to rise to $8.03 per share, with revenues coming in at about $388 billion. For 2026, analysts count on a major improve in each earnings and revenues with earnings estimates at $8.83 per share and revenues reaching practically $411 billion. These estimates indicate a worth to earnings ratio of simply 8 instances the estimates for 2024, and round 6.5 instances estimates for 2026. That is very undervalued when you think about the S&P 500 Index (SPY) is buying and selling for about 22 instances earnings. It is usually very undervalued when in comparison with different main retailers and medical health insurance corporations.

As for the steadiness sheet, CVS has practically $82 billion in debt and simply over $13 billion in money. I favor to put money into corporations with very sturdy steadiness sheets, however after I take a look at monetary power, it is usually necessary to think about whether or not or not the enterprise mannequin is cyclical or not. Since CVS isn’t in the kind of enterprise that sees large ups and downs (like a automotive producer, or residence builder would possibly see), I’m keen to be extra lenient with regards to steadiness sheet debt. I additionally be certain that the extent of revenues is commensurate with the extent of debt, and once more, with the extent of revenues this firm has, I’m comfy with the steadiness sheet. Credit standing company, “AM Finest” charges the Aetna division as glorious and since that is without doubt one of the most necessary elements of this enterprise, it’s reassuring as properly.

Talking of the steadiness sheet, on Could 23, 2024, a report got here out suggesting that CVS was in search of a personal fairness investor to assist develop its Oak Road Well being main care division. CVS acquired Oak Road Well being in 2023, for about $10.6 billion, which added to the debt load at CVS. Shortly after this report got here out, I observed the inventory took one other leg down on what was already a really unhealthy day for the inventory market usually. However, regardless that the response from the market appears to be unfavorable for now, I’m glad to see that CVS isn’t planning so as to add extra debt as a way to develop this division.

Valuation

Walgreens Boots Alliance (WBA) has a equally low worth to earnings valuation when in comparison with CVS. It is usually buying and selling close to 52-week lows. Buyers are clearly down on the retail pharmacy sector, as a result of pricing pressures, rising labor prices and hard comparisons from when Covid was bringing nearly everybody in for normal vaccinations. I believe as we get additional previous Covid, the comps can be a lot smoother and simpler to beat. This might assist to enhance sentiment for the valuation of all retail pharmacy shares.

As for the valuation of CVS when in comparison with different main medical health insurance corporations, this inventory appears deeply undervalued because it owns Aetna, one of many largest medical health insurance corporations within the trade. For instance, UnitedHealth Group (UNH) which has additionally seen its inventory lately come underneath stress, is buying and selling for about 19 instances earnings. Additionally, this inventory solely yields about 1.45%. CVS provides a yield of about 4.63% (nearly triple the yield of UnitedHealth Group), and a worth to earnings ratio that’s lower than half of the value to earnings ratio for UnitedHealth Group. Based mostly on this, CVS shares look deeply undervalued and have a variety of room for a number of growth.

With retail pharmacy shares out of favor and buying and selling at or close to 52-week lows, that’s positively weighing on CVS shares, however this sector may be due for a rebound. When wanting on the valuation of the medical health insurance sector, it appears that evidently CVS has been punished too harshly by the market because it owns Aetna and will not less than get a blended valuation that’s perhaps not as excessive as UnitedHealth Group, however not virtually as little as different retail pharmacy shares.

CVS Has A Distinctive Ecosystem Which Supplies Progress Potential

One main development driver that I do not imagine the market is giving CVS sufficient credit score for is the distinctive healthcare ecosystem which incorporates the Caremark pharmacy advantages supervisor, the over 9,000 retail pharmacy shops, the Aetna insurance coverage division and Oak Road Well being main care clinics which it plans to develop. In totality, this assortment of healthcare companies provides CVS distinctive talents to be concerned in each facet of a affected person’s healthcare, from analysis, to offering drugs to processing medical claims and offering insurance coverage for tens of millions of Individuals. The Oak Road Well being main care clinics are poised to develop sooner or later and doubtlessly develop revenue margins.

This ecosystem of healthcare corporations helps CVS to decrease bills, improve efficiencies and presumably achieve this whereas increasing income margins for the complete vary of healthcare corporations it owns. Most significantly, having this full vary of healthcare companies may enhance the healthcare expertise for sufferers and drive development as a result of CVS is more and more a singular “one cease store” for healthcare. On this investor presentation, CVS has guided for long run development charges of 6% and as proven under, there are a variety of development drivers that the corporate expects will profit future outcomes together with improved margins with Medicare Benefit beginning in 2025:

Medicare Benefit Is A Headwind In 2024, However A Progress Driver In 2025 And Past

The Medicare Benefit market has brought about headwinds by way of diminished income for medical health insurance corporations (like Aetna) this 12 months largely as a result of extra seniors are getting healthcare points handled now, and had not sought care as a lot throughout the pandemic years. Nonetheless, regardless that this has impacted the share worth of CVS and the opposite large gamers on this house, that is more likely to simply be a velocity bump for anybody with a long run view. The rise in well being care claims from this phase is predicted to average after this 12 months, and the Medicare Benefit market is predicted to supply stronger revenue margins in 2025, and past. Some analysts are seeing a possibility within the latest selloff in medical health insurance shares as a shopping for alternative as a result of there’s sturdy long run development potential. That is detailed on this Searching for Alpha article which states:

“We imagine Managed Care is structurally properly positioned to drive sustainably enticing long-term development, margin growth and a number of growth past historic ranges,” Baird analyst Michael Ha wrote.

The Dividend And Share Buybacks

Within the first quarter of 2024, CVS accomplished a share buyback price round $3 billion. This can be a significant buyback, particularly since CVS has a market capitalization of about $67 billion. Share buybacks will be a further development driver since a diminished share depend can enhance future earnings.

CVS pays a quarterly dividend of $0.665 per share. This supplies a yield of about 4.63%. Ten years in the past, the quarterly dividend was simply round $0.275. This reveals the dividend has greater than doubled up to now ten years. On an annual foundation, the dividend from CVS totals $2.66 per share. That is approach under the earnings estimates, and due to this fact it suggests a payout ratio of simply round 31%. This implies there’s loads of room for future dividend will increase.

What I Like About CVS

Because the saying goes “purchase what you understand”, and I do know CVS since I store at their retail shops and I’ve had varied vaccinations on the pharmacy. I do order a variety of objects from Amazon (AMZN), however there are various instances after I simply need or must go to a CVS retailer.

I just like the valuation of CVS with a yield that may compete with cash market funds, which yield simply round 5%. If I park my money in a cash market account, I’ll get nearly the identical yield, and cash market yields are anticipated to plunge when the Federal Reserve possible decrease charges sooner or later; however with CVS I get a beneficiant yield that I can lock-in and doubtlessly additionally get vital upside from future share worth appreciation.

CVS is the “go to” place for a lot of Individuals at any time when they want a vaccine of any type. This helps to drive visitors into the shop. There are new Covid variants and there are issues about a spike in circumstances. A summer season spike in Covid circumstances may improve demand for Covid and the flu pictures, in addition to RSV, within the Fall.

I additionally like that the healthcare enterprise supplies a gradual and stable income stream, and that CVS has a historical past of profitability. Because the inhabitants grows and as extra individuals age and dwell longer lives, this might profit CVS within the long-run. As well as, the medical health insurance enterprise and pharmacy enterprise is comparatively recession-resistant and that could be a optimistic to think about.

Potential Draw back Dangers

There’s all the time stress on medical health insurance corporations to decrease charges and improve advantages, and pharmacies additionally need to take care of pricing pressures. Retail pharmacies are additionally seeing elevated competitors from the likes of Amazon and different corporations. Nonetheless, I believe there’s room for development for on-line and retail retailer pharmacies and demand exists for each as properly.

With this being an election 12 months, there may very well be elevated stress and rhetoric on decreasing drug prices and decreasing the price of medical health insurance. This may very well be one other draw back threat issue that weighs on this inventory by the November election cycle.

In Abstract

Whereas the market at present appears to be centered on the negatives, I see many optimistic causes to purchase this main pullback within the inventory. CVS shares are oversold and haven’t been buying and selling with such a excessive dividend yield and such a low worth to earnings a number of in a few years. The corporate is guiding for six% development and this appears reasonable as it may be pushed by growing old demographics and inhabitants development. I count on that within the not too distant future, buyers will understand this inventory doesn’t should be buying and selling for a single digit PE ratio. I additionally imagine buyers will need to purchase this inventory for the yield it supplies when the Federal Reserve begins decreasing charges, and this might push the inventory larger. This firm is an important a part of the healthcare system and it deserves extra credit score for having constructed an ecosystem that isn’t straightforward to copy or obtainable elsewhere.

Sentiment is clearly unfavorable, however as we all know, sentiment can change, typically even pretty rapidly. There are indicators that the economic system is weakening, and that might imply buyers will take a recent take a look at extra defensive industries like healthcare, and particularly at shares that may present a excessive yield like CVS does. If a recession hits, rates of interest will plunge and that makes excessive dividend shares much more enticing.

I only recently purchased a small place. My plan is to purchase extra shares over the subsequent few weeks and months, and acquire the dividend whereas ready for a rebound on this inventory.

No ensures or representations are made. Hawkinvest isn’t a registered funding advisor and doesn’t present particular funding recommendation. The knowledge is for informational functions solely. You must all the time seek the advice of a monetary advisor.