Coya: Potential Milestone For The Remedy Of Alzheimer’s

John M Lund Images Inc/DigitalVision by way of Getty Pictures

Thesis

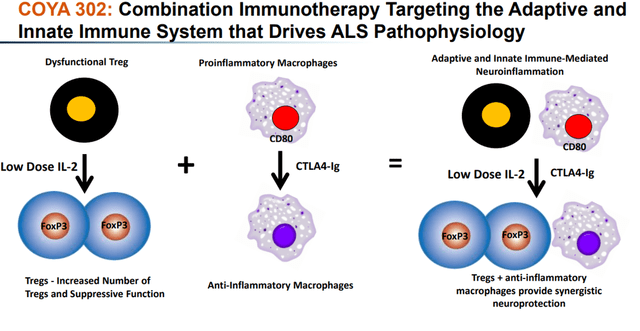

I contemplate Coya Therapeutics (NASDAQ:COYA) one in every of a number of high-potential neurodegenerative performs. The corporate was first lined by me in Could of final yr. On the time, it had simply introduced knowledge from two open-label medical research in ALS and in Alzheimer’s illness [AD]. These research have been small and open-label, however persistently confirmed enhancements or stabilization of sufferers handled with low-dose IL-2 [LD IL-2] or LD IL-2 + CTLA-4 Ig. Coya considers COYA 302, which is Coya’s proprietary formulation of LD IL-2 and CTLA-4 Ig packaged in a mix equipment, because the extra promising drug candidate. COYA 302 not solely promotes anti-inflammatory regulatory T cells (Tregs) but additionally down regulates inflammatory macrophages.

The previous yr, the corporate’s development was targeted on financing, partnering and pipeline growth.

Two near-term catalysts might now change the outlook of Coya. The corporate plans to provoke a Section 2 trial in ALS – the lead indication in the meanwhile – within the coming weeks. In the summertime of 2024, Coya will report on a placebo-controlled randomized trial with LD IL-2 in AD.

Firm

Introduction

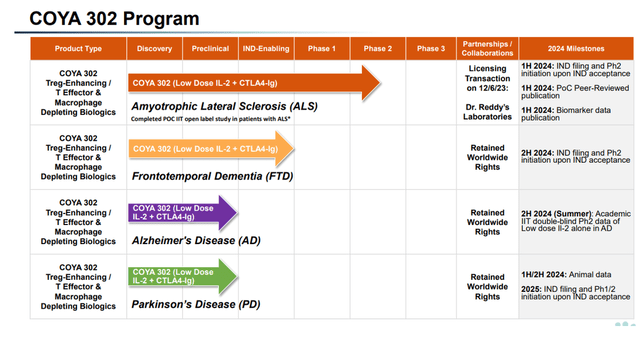

Coya Therapeutics is a biotech firm targeted on the therapy of neurodegenerative ailments. Its therapy candidates, with Coya 302 because the lead drug, accomplish that by modulating neuroinflammation. Coya’s COYA 302 goal indications have expanded final yr, together with ALS, AD, frontotemporal dementia [FTD] and Parkinson’s illness [PD].

COYA 302 pipeline (Company Presentation)

Coya needs to prioritize the event of COYA 302. Its pipeline consists of Coya 301, Coya 201 and Coya 206, which I’ve lined earlier than.

Coya’s pipeline seems fairly completely different from that of a yr in the past, which isn’t atypical to biotech corporations with a pretty latest IPO. On the time, applications have been both discovery-stage, preclinical or IND-enabling, and AD was not but a part of the pipeline.

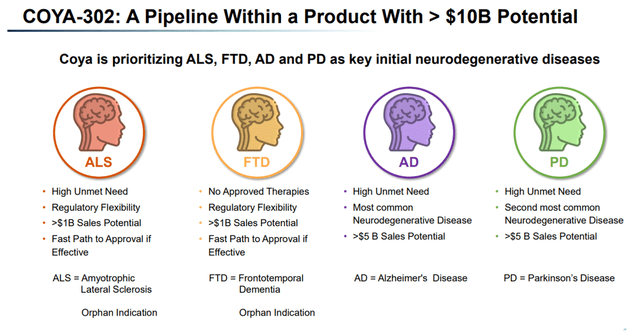

Every of the indications listed above is a significant neurodegenerative indication with excessive unmet want. From that perspective, Coya seems appropriate to think about that COYA 302 is a pipeline inside a product with >$10 billion annual gross sales potential, with Alzheimer’s as the biggest neurodegenerative illness within the lead.

COYA 302 >10 Billion potential (Company Presentation)

Coya’s explicit anti-inflammatory strategy

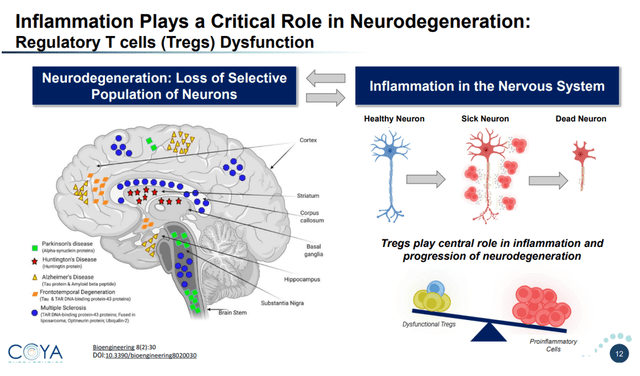

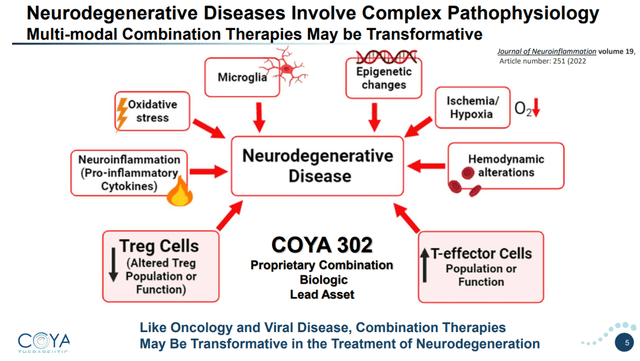

Modulation of the mind’s resident immune cells could also be a possible therapy for neurodegenerative ailments pushed by neuroinflammation, equivalent to AD, ALS, FTD and PD. Every yr, the variety of medicine focusing on neuroinflammation for these ailments turns into extra considerable.

I imagine that the way in which one lowers irritation could also be of crucial significance; focused discount that permits the mind’s immune cells to carry out their unique features is crucial.

Regulatory T-cells or Tregs are CD4-positive T cells that are grasp regulators of inflammatory signaling. Within the mind, they regulate immune response immediately or by means of signaling to brain-resident immune cells equivalent to microglia and astrocytes. Irritation and Treg dysfunction appear to be intricately associated within the mind.

Position of irritation on neurodegeneration (Company Presentation)

The brain-resident immune cells have two primary features. Their main operate is to nurture and sculpt the mind. Their secondary operate supplies an inflammatory response to overseas insults. Aggregated proteins seen in neurodegenerative ailments might also result in pro-inflammatory signaling, together with an inflammatory loop involving the brain-resident immune cells.

Advanced pathophysiology of neurodegenerative ailments (Company Presentation)

Coya’s strategy for the therapy of neurodegenerative ailments doesn’t stand alone. In 2023, there have been extra medicine in human trials for neuroinflammation than for every other AD-modifying issue.

Coya 301

Introduction

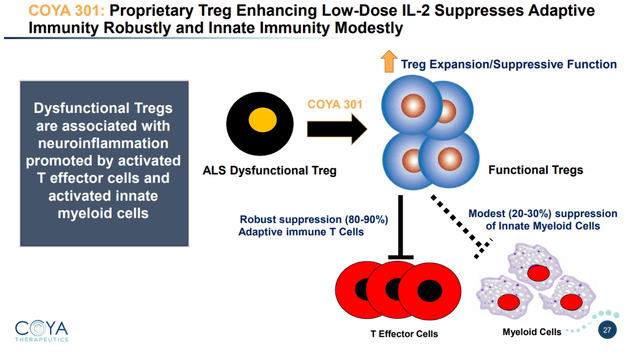

Coya 301 consists of proprietary subcutaneous low-dose IL-2 to upregulate Treg operate and suppress pro-inflammatory T cells.

COYA 302 MoA (Company Presentation)

Outcomes thus far: enhancing cognitive operate or halting illness development

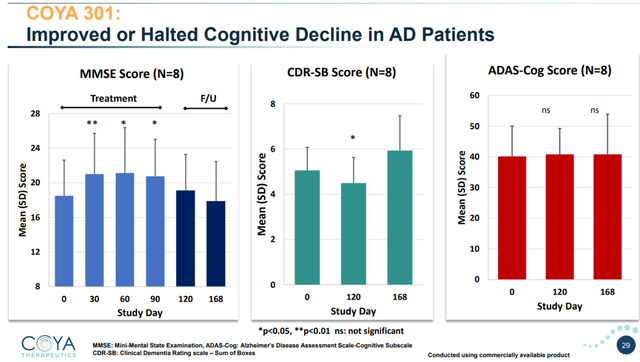

Cognition sometimes declines in AD sufferers. The imply yearly price of decline depends upon the ranking scale: +4.58 factors for the 7-point Adas-Cog ranking scale, -4.4 factors for the 30-point MMSE scale, and +1.2 factors for the 18-point CDR-SB scale.

In an investigator-initiated open-label examine of 8 sufferers with AD, 4 five-day month-to-month therapy cycles administered to sufferers with mild-to-moderate AD confirmed a statistically vital enchancment in cognitive operate, as measured by the MMSE. On 2 different validated scales, cognition both improved or stabilized.

COYA 301 improved or halted cognitive decline – open-label (Company Presentation)

On the MMSE scale, LD IL-2 improved cognition in a statistically vital method at 30, 60, 90 days. Reaching statistical significance in 8 sufferers is a significant accomplishment. Through the first a part of the follow-up interval, when no additional therapy was given, cognition remained improved in comparison with baseline. Through the second a part of the follow-up interval, cognition worsened, which was anticipated as no additional therapy had been given.

On the 18-point CDR-SB scale, typical cognitive decline is about +1.2 factors per yr. LD IL-2 improved cognition throughout therapy and as much as 30 days post-treatment . At the moment level, the outcome was additionally statistically vital. On the finish of the follow-up interval, cognition had worsened as anticipated, as no additional therapy was administered.

On the 70-point Adas-Cog scale, cognition remained secure over at 120 and 168 days.

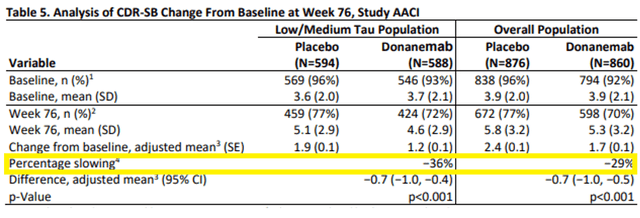

Sometimes, therapy impact could be measured as a operate of cognitive decline. Biogen’s (BIIB) amyloid antibody Leqembi led to 27% slowing of cognitive decline, and Eli Lilly’s (LLY) donanemab carried out barely higher at 35%.

MMSE and CDR-SB right here, we’re seeing a halting of cognitive decline over the therapy interval, with statistical significance at a number of time factors even on this small affected person inhabitants. Adas-Cog, LD IL-2 therapy additionally confirmed arrest of cognitive decline. No matter how one seems at this, if these outcomes would be capable to be repeated in a bigger, randomized, placebo-controlled trial, we’re huge outperformance of anti-amyloid antibodies.

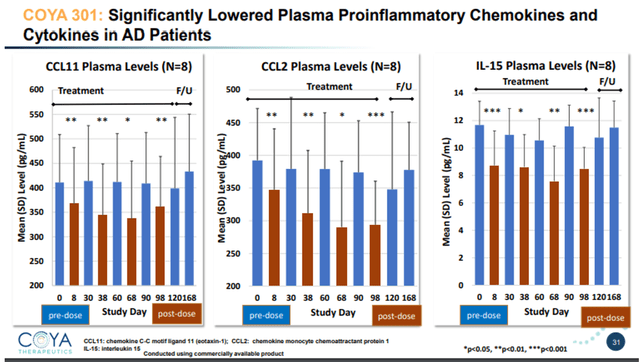

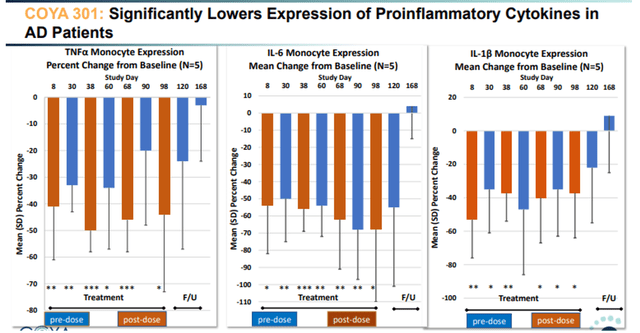

From a biomarker standpoint, LD IL-2 restored Treg operate and numbers and lowered pro-inflammatory cytokines.

COYA 301 lowers inflammatory cytokines slide 1 (Company Presentation) COYA 301 lowers inflammatory cytokines slide 2 (Company Presentation)

TNF-levels reductions post-dosing have been between -40% and -50% in comparison with baseline. TNF is related as a result of it’s a grasp pro-inflammatory cytokine, and in addition the realm of curiosity of INmune Bio. In conclusion, LD IL-2 confirmed very encouraging optimistic outcomes right here each on biomarker and on cognitive assessments.

Coya 302

Introduction

COYA 302, comprised of COYA 301 and CTLA-4 Ig, has a twin immunomodulatory MoA meant to boost the anti-inflammatory operate of Tregs and suppress the irritation produced by activated monocytes and macrophages.

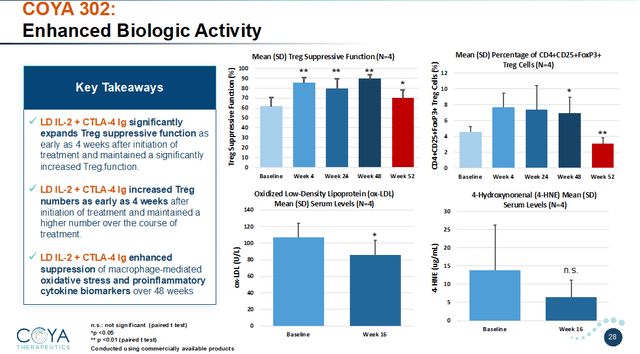

COYA 302 MoA (Company Presentation) COYA 302 biologic exercise (Company Presentation)

Outcomes thus far: stabilization or substantial slowdown of illness development

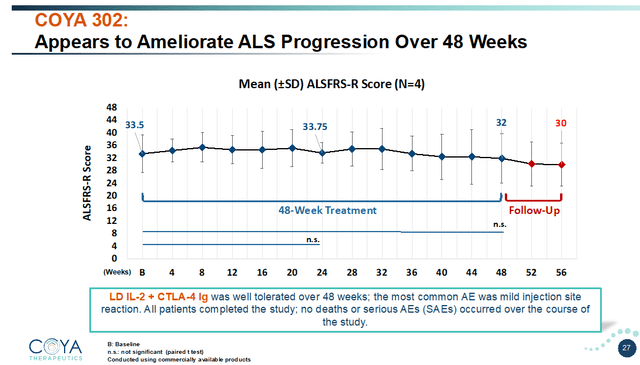

LD IL-2 + CTLA-4 Ig was first administered in an open-label examine in 4 sufferers with ALS, for 48 weeks. Coya introduced outcomes of this examine in February 2023. Outcomes on the ALSFRS-R scale, assessing motor operate, have been probably the most attention-grabbing. Sufferers sometimes decline 1 level per 30 days on the 48-point ALSFRS-R scale. On this open-label trial, Coya’s sufferers have been progressing at an analogous price previous to therapy.

Total, these sufferers remained secure over the primary 24 weeks. They solely declined by 1 level for the next 24 weeks. That represents a minimal change in comparison with the anticipated 12-point decline. LD IL-2 + CTLA-4 Ig both stabilized or dramatically slowed illness development. That’s completely unprecedented in ALS. Through the 8-week follow-up interval, when no additional therapy was given, sufferers declined at their earlier price of 1 level per 30 days, once more proving therapy impact.

COYA 302 seems to ameliorate illness development (Company Presentation)

What makes this compelling in favor of COYA 302 is that ALS progresses a lot quicker in comparison with AD and Parkinson’s illness, and sufferers within the examine have been seeing typical illness development earlier than therapy.

The unmet want in ALS is excessive. In comparison with the prevailing drug Radicava, which had proven a few 33% slowing of decline, that distinction is main. Intravenous Radicava acquired FDA approval in 2017. Amylyx’s (AMLX) drug Relyvrio had been FDA-approved in 2022, however has already been taken off the market after lacking main and secondary endpoints in a Section 3 trials.

In April 2024, Coya reported that 4-HNE ranges correlated strongly with the speed of illness development and survival. 4-HNE is a biomarker of lipid peroxidation, identified to be extremely poisonous for neurons.

Upcoming Section 2 trial in ALS

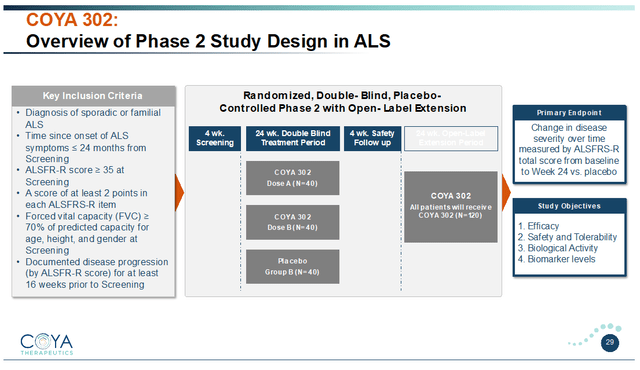

The initiation of Coya’s Section 2 trial in ALS needs to be across the nook at this level. It was introduced to begin within the second half of 2024, and that second half is now coming to an finish. I due to this fact count on this trial to provoke within the coming weeks.

In January 2024, Coya had introduced having had a profitable pre-IND assembly with the FDA for the event of COYA 302 for the therapy of ALS. That hopefully leads to a straightforward validation by the FDA after the IND-filing. After Coya has filed its IND, a 30-day interval begins working, throughout which the FDA could request further info earlier than initiating the trial. I assume in any case that the IND submitting and subsequent trial initiation can be within the close to future.

Coya’s Section 2 trial in ALS can be in 120 sufferers with an ALSFRS-R rating equal or larger to 35 at screening and a well-documented price of illness development. The examine will consider two dosing regimens of COYA 302 versus placebo over 24 weeks, adopted by a 24-week open-label extension interval. The trial’s main endpoint is change within the ALSFRS-R rating in comparison with baseline.

COYA 302 Section 2 ALS examine design (Company Presentation)

Shifting right into a Section 2 trial might entice traders, and valuation typically turns into greater as an organization strikes right into a subsequent trial part.

If profitable, I imagine this trial might give rise to an accelerated approval in ALS. Amylyx’s Relyvrio had, in reality, been accredited on the premise of a randomized placebo-controlled trial in 137 sufferers with a six-month period adopted by an open-label extension.

For many sufferers with ALS, life expectancy is 2-5 years. A 24-week placebo-controlled trial adopted by a -24-week open-label extension covers a big time span during which one would usually see illness development. As compared, the placebo decline for Radicava and Relyvrio was 7.5 and 9.97 ALSFRS-R factors respectively over the course of 24 weeks.

Topline knowledge readout in Alzheimer’s illness deliberate for the summer season of 2024

Section 2 randomized placebo-controlled trial in Alzheimer’s

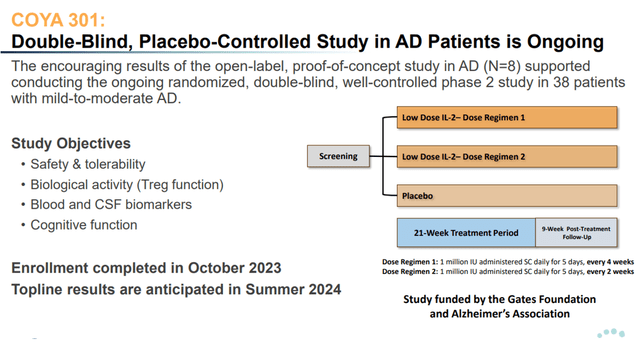

Over the summer season of 2024, Coya will report on an investigator-initiated, double-blind, placebo-controlled Section 2 trial of LD IL-2 funded by the Invoice Gates Basis and the Alzheimer’s Affiliation.

The three-arm examine consists of 2 completely different dosing regimens of COYA 301 and a placebo arm. Remedies are administered over a 21-week interval with a 9-week post-treatment follow-up interval.

COYA 301 Section 2 trial design (Company Presentation)

The primary aim of this trial is to information Coya in direction of designing a double-blind, well-controlled Section 2 trial in AD with COYA 302. For that purpose, the trial will consider not solely security and cognition, however a variety of biomarkers, together with NfL and GFAP. On the premise of the outcomes, Coya can resolve whether or not it must prespecify subgroups and whether or not it could want to incorporate inclusion standards into its trial, e.g. on the premise of sufferers’ Treg operate or degree of irritation.

The thresholds for fulfillment: security and efficacy

The latest FDA’s Advisory Committee on the Eli Lilly’s (LLY) BLA for anti-amyloid antibody donanemab has allowed the FDA’s insights into the present therapy panorama for AD and the security points accompanying anti-amyloid antibodies. For reference, Biogen (BIIB) has in 2024 deserted commercialization of the a lot–contested anti-amyloid antibody Aduhelm. Presently, the one accredited anti-amyloid antibody is Biogen/Eisai’s (OTCPK:ESALF) Leqembi, accredited on an accelerated foundation in January 2023 for having slowed cognitive decline by 27% over 18 months on the CDR-SB scale. The FDA had denied accelerated approval to Eli Lilly, after which Eli Lilly filed for full approval. The FDA’s considerations don’t essentially relate to efficacy, I imagine, as donanemab barely outperformed Leqembi each on its main endpoint iADRS as on the CDR-SB ranking scale.

Donanemab share slowing on CDR-SB (Company Presentation)

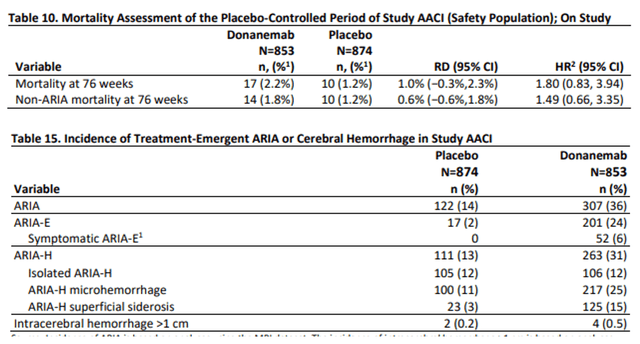

The elephant within the room is security in my eyes. Anti-amyloid antibodies lead to so-called ARIA, mind microhemorrhage that results in critical antagonistic occasions and dying in some instances. Mortality for donanemab was considerably greater than for placebo sufferers, and the incidence of ARIA was fairly excessive in sufferers on donanemab.

Donanemab mortality and TEAE slides (FDA briefing doc donanemab AdComm)

Catalyst potential

LD IL-2 is secure and well-tolerated

Opposite to anti-amyloid antibodies, LD IL-2’s security and tolerability profile is milder. Aside from some web site injection irritations, administration of LD IL-2 thus far has not led to critical antagonistic results. In mild of earlier considerations over Aduhelm in addition to Leqembi, and the latest FDA’s considerations over donanemab, this accomplishment shouldn’t be underestimated.

Efficacy: potential outperformance of anti-amyloid antibodies / biomarkers

The brink for efficacy in Alzheimer’s presently is outperformance of anti-amyloid antibodies, slowing cognitive decline both by 27% or 29% on the CDR-SB scale. If LD IL-2 would be capable to present a clear security and tolerability document and a 30% slowing of cognitive decline, then it’s a clear win and unprecedented. By no means earlier than has there been a placebo-controlled randomized trial that might have proven such security and efficacy in Alzheimer’s illness.

If the ample biomarkers Coya is assessing on this trial would be capable to underscore the impact on the neurodegenerative course of, that could possibly be a game-changer.

That, for me, is the edge for a win at this stage.

If, moreover, this trial would present a statistically vital outcome, I imagine that could possibly be world information, because it could possibly be the primary placebo-controlled trial to report higher outcomes than these of the anti-amyloid antibodies in such a fashion. I, nonetheless, don’t depend on that at this stage, given the scale of the trial.

Topline knowledge slated for summer season 2024

In Could 2024, Coya has introduced the completion of this trial, and topline outcomes are anticipated for the summer season of 2024. Summer time already begins in per week or two, so knowledge might come quicker than anticipated. If Coya sticks to not lacking deadlines, then I imagine it could possibly be a scorching summer season.

Dr. Reddy’s Partnership

In December 2023, Coya introduced its unique partnership with Dr. Reddy’s Laboratories (RDY) to develop and commercialize COYA 302 for ALS in america, Canada, the European Union and the UK. That partnership features a $7.5 million upfront cost, a $4.2 million cost upon IND acceptance by the FDA, a $4.2 million cost upon first affected person dosing, additional regulatory milestones as much as $40 million, sales-based milestone funds of as much as $677.25 million linked to cumulative web gross sales, and royalties primarily based on a share web gross sales of COYA 302.

I believe Dr. Reddy’s has moved exceptionally quickly right here.

Pipeline growth to frontotemporal dementia and Parkinson’s illness

In January 2024, Coya has introduced the growth of its pipeline for COYA 302 to FTD and PD, two different main neurodegenerative ailments with excessive unmet want, as all of those circumstances share the identical inflammatory hallmark.

Coya additionally plans the initiation of a Section 2 trial in FTD, which it has now acquired funding from the ADDF. No trial design for this examine has but been revealed.

Robust exterior validation

For the microcap that Coya is, the corporate is remarkably effectively validated. I rank them so as of their significance, in my eyes.

ADDF

In Could 2024, Coya introduced that it had acquired a $5 million non-public placement fairness funding from the Alzheimer’s Drug Discovery Basis [ADDF]. As a number one group, the ADDF considers controlling neuroinflammation on the forefront of latest therapy concepts for AD, and expects anti-inflammatory medicine to probably win approval over the subsequent 5 years. The ADDF solely funds about 25 initiatives per yr, and sometimes doesn’t take fairness stakes in corporations. Quantities of funding are extra typically under $1 million, making Coya’s $5 million funding venture amongst ADDF’s largest in recent times.

David Einhorn

Greenlight Capital, David Einhorn’s hedge fund, is an 8.8% holder of Coya shares, up from 5% once I lined Coya a yr in the past. David Einhorn has been on the board of the Michael J. Fox Basis since 2005 and may due to this fact be on high of the most recent developments within the neurodegenerative area. I’m due to this fact giving this fairness stake further worth.

Invoice and Melinda Gates Basis / Alzheimer’s Affiliation

Coya’s Section 2 trial in AD is funded by the Alzheimer’s Affiliation and the Invoice and Melinda Gates Basis.

Wilbur Ross

Former United States Secretary of Commerce Wilbur Ross, named one of many 50 most influential folks in world finance by Bloomberg Markets, has joined Coya’s board in December 2023 and has lately participated in a personal placement along with different institutional traders. Mr. Ross has loads of expertise in banking and personal fairness, and due to this fact is an out of doors validation of Coya of explicit curiosity.

Valuation concerns

AD is the most typical neurodegenerative illness on the earth, affecting 5.8 million folks within the US with the potential to triple by 2060, with a market measurement valued at $6.1 billion in 2021. Good outcomes from the above-mentioned trial would validate the open-label knowledge beforehand reported, and thereby additionally improve the potential efficacy of COYA 302 for ALS, AD, PD and FTD with an estimated mixed market measurement of $10+ billion. And these markets are rising at great speeds.

On the time of writing, Coya’s market cap is $105 million. The potential for beneficial properties is large right here if outcomes are good, whether or not or not they’re statistically vital given the small affected person inhabitants. For reference, the thrill surrounding Cassava Sciences’ (SAVA) open-label knowledge from a small AD affected person inhabitants in 2021 had seen their market cap surge to simply under $5 billion. In 2021 and 2022 respectively, Consider noticed Biogen’s Aduhelm and Eli Lilly’s donanemab respectively because the years’ most anticipated medicine, price $4.8 and $6 billion in annual gross sales respectively. Eli Lilly’s inventory had added greater than $20 billion on the announcement of donanemab’s efficacy knowledge, and equally, Biogen’s inventory had added greater than $10 billion upon efficacy knowledge from lecanemab.

COYA presently ranks at quantity 11 in relation to efficiency of 2022 IPO’s, with a 40% achieve. It has ranked a lot greater some months in the past. I imagine that, with good topline knowledge, it might rank amongst – or above – the highest performers.

Dangers

Coya is a microcap biotech firm. Microcap shares are sometimes characterised by excessive beta. Biotech corporations can transfer tremendously on information.

Moreover, regulatory threat is at all times current. The FDA can halt trials earlier than their graduation, or as they’re ongoing, for varied causes and never solely these associated to security.

There’s a giant aggressive threat as effectively. Coya is the one firm I’m conscious of that’s investigating modulation of Tregs and macrophages for the therapy of neurodegenerative ailments, however it’s not the one firm pursuing remedies for any of the talked about neurodegenerative ailments. There’s notably extra competitors within the AD area, and notably from biotech corporations equivalent to INmune Bio (INMB), Cassava Sciences, Denali Therapeutics (DNLI), Alector (ALEC) and lots of others.

Financials

Coya had $36 million in money and money equivalents on the finish of March 2024 and has picked up $24.1 million in web proceeds in a non-public placement some months earlier than. Upon IND-acceptance and Section 2 trial initiation in ALS, Coya needs to be eligible for cost of $4.2 million every time, totaling $8.4 million. The ADDF’s latest $5 million fairness funding means additional cash on the financial institution for Coya.

The typical web loss for the previous two reported quarters was $3.9 million. Annual money burn has been estimated at $11.7 million. At any of these charges, considering the anticipated Dr. Reddy’s funds but additionally a better quarterly expense because of the ongoing trial, I count on Coya to be funded effectively previous its ALS examine readout.

That might not preclude the corporate from selecting up some additional financing to run a Section 2 trial in AD, if the market would reply positively to the upcoming topline knowledge. It’s equally not excluded that at the moment, a giant pharma companions and facilitates the funding of additional trials.

Conclusion

Coya could also be at a transformative level of its development, as the corporate will quickly provoke a probably registrational Section 2 trial with COYA 302 in ALS, and can report topline knowledge from a placebo-controlled randomized Section 2 trial with LD IL-2 in AD this summer season.

LD IL-2 and LD IL-2 + CTLA-4 Ig have yielded distinctive leads to beforehand reported small open-label research. Although such research are typically not what attracts large pharma, Coya has already concluded a take care of Dr. Reddy’s for the event of COYA 302 for ALS. Additional exterior validation for Coya’s applications seems sturdy, from traders, scientists, and main establishments.

A randomized, double-blind, placebo-controlled trial is of nice worth to large pharma and traders. Success is outperformance of anti-amyloid antibodies on security and efficacy. A great security profile and a 30% slowing of cognitive decline are adequate. Illness stabilization or enchancment could be an incredible success, however it’s not mandatory. If, moreover, COYA 301 would have the ability to take action on this small trial in a statistically vital method, I imagine the world could possibly be watching. The market response to any of the above occasions could possibly be great, as historical past has proven. To that extent, I imagine Coya could be very a lot beneath the radar for the second.

Equally, I count on Coya to provoke its probably registrational Section 2 trial in ALS this yr. The corporate introduced it for 2H 2024. Once more, success is outperformance of Radicava’s outcomes, which have been strongly outperformed within the open-label examine. If outcomes exceed that and would be capable to present illness stabilization even when for some time, the importance of that trial shouldn’t be underestimated.

For the explanations above, I’m reiterating my Robust Purchase ranking on Coya Therapeutics.