Christopher ‘Shooter McGavin’ McDonald Says ‘Fully glad Gilmore 2’ Will ‘Be Unbelievable’

TMZ.com

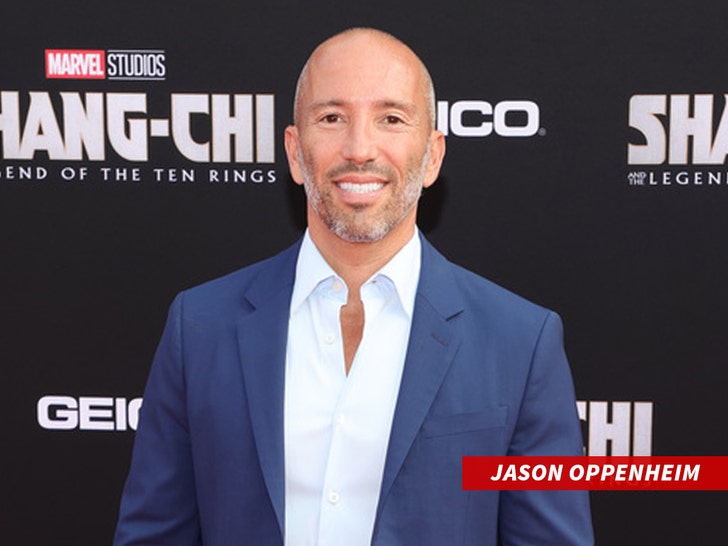

Jason Oppenheim says fireplace insurance coverage protection costs have skyrocketed given that Los Angeles wildfires burned by principal neighborhoods inside the metropolis … and, he says all Californians are going to pay for it for inside the years to come back again.

We caught up with the “Selling Sunset” star exterior LAVO — a popular Italian restaurant in West Hollywood — Friday evening time whereas he was headed out to his birthday dinner … and, we would have liked to ask him in regards to the value of fireside insurance coverage protection going by the roof.

Oppenheim says costs went method up inside the quick aftermath of the fires … and, whereas they’re coming down as a result of the market corrects, they won’t be returning to pre-fire prices.

JO tells us fireplace insurance coverage protection costs will sustain about 20 or 30% elevated than they was as soon as for all Californians — not merely Angelenos. Oppenheim half-jokes that until A.I. drones can immediately put out fires, the fees is not going to be shifting down.

Whereas many in CA are seeing their costs go up, Jason says his consumers are literally renting after their homes burned inside the January fires … so, they don’t appear to be paying fireplace insurance coverage protection the least bit.

Jason moreover affords a way for patrons to get increased costs … relying on free market capitalism. Watch the clip until the tip to take heed to his clarification.

On prime of chatting with Jason, we moreover spoke with numerous housing and insurance coverage protection specialists … like Karl Susman of Susman Insurance coverage protection Firm who tells us the property insurance coverage protection market has been trying to rebalance for years with costs slowly going up attributable to elevated hazard.

January fires have been the ultimate straw … an occasion of big wildfires occurring too normally and destroying an extreme quantity of for insurance coverage protection firms to put an appropriate worth on a catastrophic loss like this.

TMZ.com

Susman says the commerce has to bear a bureaucratic course of to find out who they’re going to insure and for the best way quite a bit … nonetheless, it takes time — and, inside the interim, the fees will preserve unbelievable extreme.

We’re instructed Susman sees a number of folks trying to find out their plans … whether or not or not they should rebuild in CA or switch some place else altogether.

Rodeo Realty’s James Respondek supplies points are going to be “utterly utterly totally different” by way of dwelling insurance coverage protection prices … claiming State Farm is searching for an emergency 22% value hike on house owners insurance coverage protection — so of us can depend on prices to soar.

Native climate change, Respondek says, will lead to these kinds of factors everywhere, not merely CA … and, insurance coverage protection firms are utterly leaving Los Angeles on account of it is just too troublesome to insure.

Relating to those larger houses, house owners are spending an entire lot of 1000’s of {{dollars}} a yr on fireplace insurance coverage protection, Respondek supplies.

We moreover chatted with Walter Lopes — who says he’s the first specific individual to have his dwelling rebuilt in Pacific Palisades.

Lopes says he was adamant about getting the house constructed as soon as extra … and, he says he’s no insurance coverage protection specialists — so he doesn’t know within the occasion that they’re overcharging him. Nevertheless, he needs an insurance coverage protection agency that has his once more — together with in the event that they’ll value additional nonetheless guarantee simple crusing if the house burns as soon as extra, then he’s large with it.

Walter is altering his insurance coverage protection plan though … ‘set off his safety wasn’t ample for this most recent disaster.

The Los Angeles wildfires burned by 1000’s of acres, destroyed an entire lot of constructions and reportedly killed 30 of us … and, it appears desire it’s impression has totally modified California’s insurance coverage protection commerce with out finish.