Broadstone Web Lease: Larger For Longer Curiosity Charges Maintaining The Inventory Undervalued

EyeMark

As rates of interest stay larger for longer, there may be one business that has continued to be punished, and that’s the actual property business. The truth is, we might not see charges come down for an additional 3-6 months, which can imply REIT inventory costs may stay low. Nonetheless, regardless of the macroeconomic impacts and lots of fears within the REIT house from an office-space perspective, Broadstone Web Lease (NYSE:BNL) shines vibrant, decreasing these fears – attributable to their particular actual property focus, steadiness sheet composition and efficiency. The particular focus that calms the fears is Industrial. Why Industrial? Assume – warehouse house for giant consumer-driven corporations (i.e., Amazon (AMZN), Goal (TGT), and many others.).

BNL is a diversified, single-tenant operated REIT. The focus of business stands at 54.2% of their whole portfolio, however in addition they present diversification by being concerned in restaurant (14.2%), healthcare (13.4%), retail (11.9%) and their lowest focus – workplace (6.3%).

Broadstone Portfolio Web page

Not solely is the chance lowered, with their lowest focus in workplace house, on a per tenant foundation, all tenants lease underneath 5% of complete accessible sq. footage. The most important tenant is an industrial shopper, Roskam Meals, with 4.2% of the portfolio. Subsequently, not closely depending on one business, nor one tenant.

As well as, BNL could be very strategic with what sort of buildings and tenants they’ve. Given industrial is their largest focus, as an illustration, BNL states, “We search for industrial properties which might be positioned in shut proximity to main transportation thoroughfares equivalent to airports, ports, railways, main freeways or interstate highways.” This makes full sense, as that is what the tenants would need or their finish customers would need – pace. How briskly can a product get picked up, saved after which shipped out? That is what BNL likes to be in – a fascinating location to fulfill the necessity for pace.

Subsequently, it is time to see if not solely is the REIT business an ideal house to speculate proper now, however particularly if BNL is a good inventory to purchase at present costs and maintain for the long run. We’ll achieve this by wanting on the steadiness sheet and the monetary efficiency.

Steadiness Sheet

BNL’s steadiness sheet after the current quarterly earnings launch is kind of attention-grabbing. Whole belongings barely grew from year-end, however but – liabilities are down.

Particular areas the place liabilities had been down was the $17M lower of their credit score facility. In a high-rate setting, that may be a good factor, as which means the curiosity expense might be plateauing, which we are going to see extra within the monetary efficiency part.

BNL’s debt maturity schedule is damaged out inside the 10-Q footnotes, between unsecured and secured. The unsecured time period loans mature in 2026-2029 at variable charges, that are roughly 6.00%-6.60% charges. When charges flip down, these charges will go down with it. The senior unsecured time period loans mature 2027-2031 and are fastened, with the very best price at 5.19% (which matures in 2029). The 2031 unsecured senior word has a price of two.60%, which is considerably a below-market price and, fortuitously for them, is the longest type of a maturity schedule. The secured mortgages, that are pretty insignificant general at $78M (Insignificant as a result of the unsecured time period loans are over $1.7B), with price starting from 3.6%-4.9%, maturing from 2025-2028.

Total, BNL’s debt schedule seems adequately managed, with the unsecured time period loans being tied to a short-term variable price, which is wise if charges begin to flip south and something that’s fastened is at a low price as properly, with the very best fastened price at 5.19%.

Rental property belongings had been down roughly $190M from 12 months’s finish, and you may see that is greater than probably from the sale of 39 properties within the quarter, as a part of their simplification of their healthcare focus. Subsequently, BNL used a part of the proceeds to accumulate $40M value of properties, however the the rest moved to money and equivalents.

After evaluating the steadiness sheet, it seems that BNL ought to be arrange for additional acquisition, because of the credit score facility being down from year-end and money and equivalents sitting at over $221.7M, up from $19.5M at year-end. Subsequently, I’d anticipate an energetic marketplace for BNL within the upcoming 6 to 12 months. The final properties had been acquired with a mean capitalization price of 8%, which I’m certain that BNL wouldn’t wish to go a lot decrease than that.

To conclude, on the steadiness sheet, BNL has room to increase on the proper opportune time, however can nonetheless earn a excessive price on idle money from their steadiness sheet. Subsequent, BNL’s monetary efficiency is on deck.

Monetary Efficiency

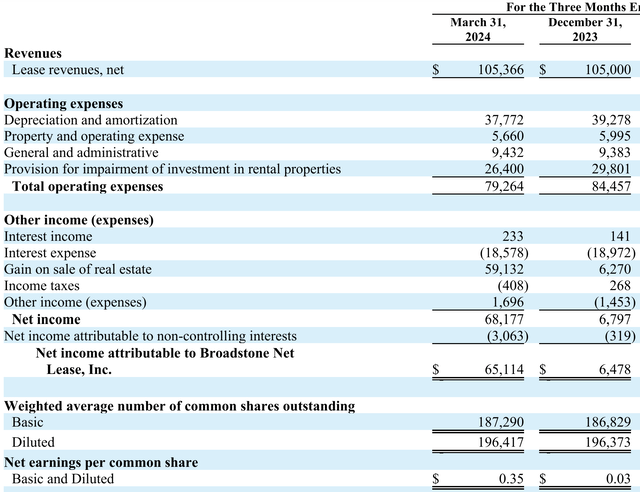

Echoing comparable feedback I made concerning the steadiness sheet, income for the primary quarter of 2024 remained pretty flat/constant to the fourth quarter of 2023, at $105M.

Nonetheless, listed here are the brilliant spots:

- Bills had been down $5M

- Curiosity Earnings up $90K

- Curiosity Expense down $400k

- Acquire on sale of actual property up $53M from the healthcare simplification mentioned earlier.

Broadstone Web Lease Earnings Launch

Adjusted funds from operations ended up at $0.36, which is just one cent larger in comparison with their fundamental and diluted EPS you see above. AFFO was additionally $0.36 the quarter prior and $0.35 the quarter earlier than that. Subsequently, AFFO progress is pretty low for the time being. This did not cease administration from rising their quarterly dividend from $0.28 to $0.285; which continues to be lined by funds from operations at $0.36.

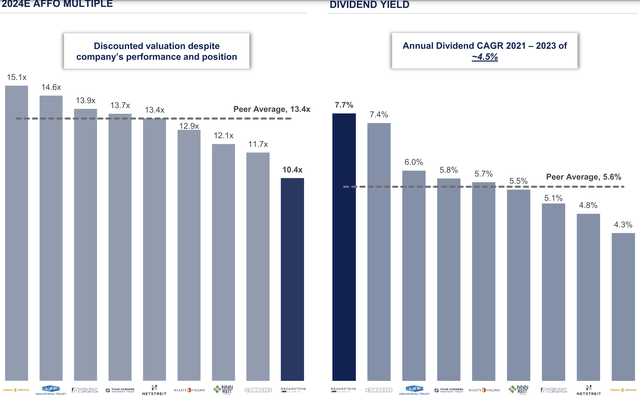

From a valuation perspective, BNL is buying and selling at 10.5x worth to ahead AFFO ratio, based mostly on ahead steering from administration ($1.41-$1.43) and a inventory worth of $14.96 (Could twenty eighth shut worth).

Broadstone Web Lease Occasion Presentation for Final Quarter

My 10.5x calculation intently matches administration’s presentation that you just see above. Administration in contrast BNL to their competitors, together with Realty Earnings (O), which has been a darling amongst dividend traders, and BNL reveals they’ve probably the most undervaluation based mostly on this metric. Amongst BNL’s friends for Value to Ahead AFFO Ratio: Realty Earnings (O) has 12.9x, Agree Realty Corp (ADC) has 13.9x and even W. P. Carey (WPC) has 11.7x; one would say BNL is undervalued comparatively to their friends.

In conclusion, given BNL’s stronger steadiness sheet, liquidity being important, paired with their diversification, imagine a case will be made the corporate is undervalued within the present market circumstances towards their competitors. It will seem BNL has upside from right here, given the liquidity and the room to increase their operations publish the healthcare simplification gross sales they’d final quarter. Danger components, although, would come with if rates of interest stay larger for longer, equivalent to into 2026 and 2027, the place a major of their loans mature. Additional, if we fall right into a recession and customers scale back spending, thus inflicting much less of a necessity for corporations to wish industrial warehouse house, as items wouldn’t be shifting as swiftly as they’re now, may pose a danger to BNL. To notice, the dividend is protected and lined by AFFO, to which we must always see one other dividend improve probably later this 12 months, as BNL usually will increase their dividend 2x per 12 months. Subsequently, revenue traders ought to maintain their eye on BNL.

At present costs, I’d be a purchaser of BNL. After all, I like to recommend performing your individual analysis, as I’m not an advisor. Thanks for studying, and I stay up for your feedback.