BIZD: Revisiting The Fund’s Three Largest Constituents (NYSEARCA:BIZD)

Klaus Vedfelt

It’s excessive time to revisit one of many highest yielding sectors. Enterprise improvement firms, abbreviated to BDCs, are high-yielding firms that specialize on this planet of secured lending. Earlier than diving deeper, let’s zoom out on what that basically means.

BDCs are specialty lenders that function capital suppliers for firms that lie between small companies and huge companies. These firms are usually too small to interface with massive funding banks or difficulty conventional company bonds. This class known as “the center market.” These firms can vary in measurement, usually with annual income within the tens of millions, not billions. These firms range extensively by way of creditworthiness, measurement, and administration.

Enterprise improvement firms present numerous types of capital. This could vary from conventional loans to revolving traces of credit score. In uncommon circumstances, enterprise improvement firms will even make fairness investments in their shoppers.

The credit score profile of a typical consumer of a enterprise improvement firm is usually too low to work with conventional lenders like banks. These firms might have small stability sheets, excessive leverage, or restricted property that will result in an funding grade credit standing. For the lender, because of this these loans may be dangerous. Diversification and different threat administration instruments turn into paramount for BDC administration.

Nonetheless, the significance of diversification results in one other proposal totally. Why not take an listed method to the sector? Spend money on considerably all enterprise improvement firms to unfold round this threat and scale back firm degree publicity. That is the worth proposition of the VanEck BDC Revenue ETF (NYSEARCA:BIZD), which tracks the MVIS US Enterprise Growth Firm Index.

The aim of this text is to revisit our prior thesis round BIZD which asserted that the fund’s largest constituents would outperform the broader listed method with consistency. This thesis was revealed almost one 12 months in the past, so we’ll look at how the thought course of unfolded.

Fund Overview

We cowl BIZD on a recurring foundation. Our previous protection of BIZD included complete overviews of the fund and its underlying index. For that motive, our overview might be transient, specializing in present updates to the portfolio.

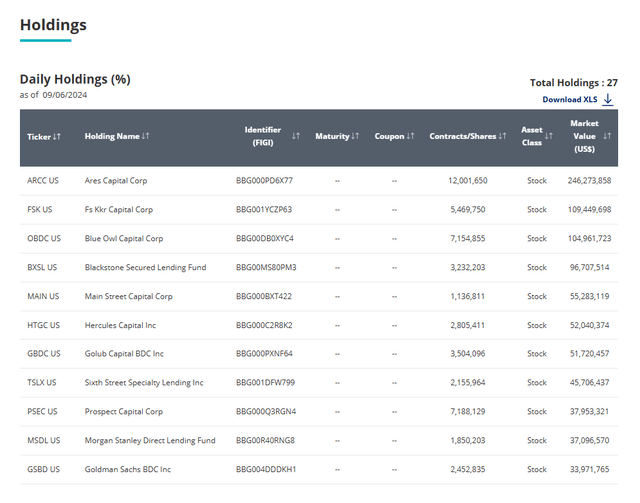

BIZD tracks the MVIS US Enterprise Growth Firm Index, which is a market capitalization weighted index of public enterprise improvement firms. The fund doesn’t spend money on any non-listed BDCs. This method mixed with a small sector means the portfolio is closely concentrated in the direction of the biggest BDCs within the trade.

BIZD Reality Card

Presently, BIZD’s largest holdings are Ares Capital (ARCC) and FS KKR Capital Corp (FSK), the 2 largest enterprise improvement firms by market capitalization. Over the previous twelve months, ARCC has turn into a a lot bigger piece of the index as the corporate grows. Collectively, these two investments account for greater than 30% of BIZD’s property, in keeping with Searching for Alpha.

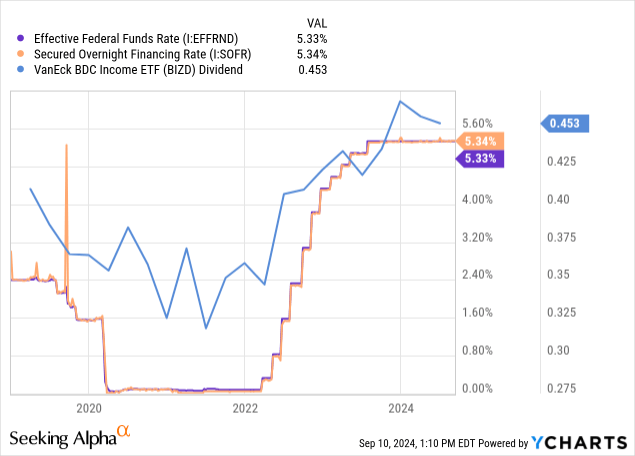

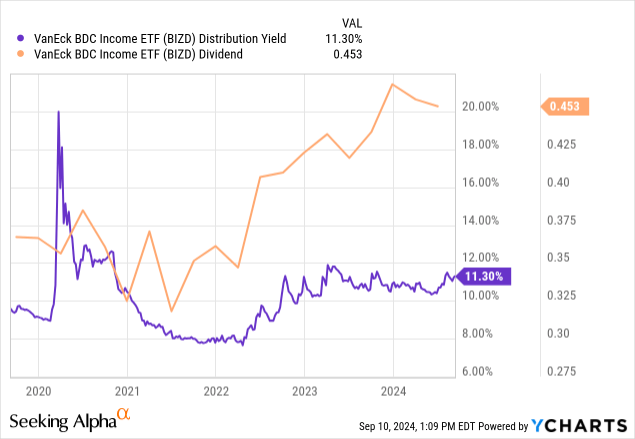

As in step with firms within the BDC sector, BIZD pays a hefty distribution corresponding to just about 12% based mostly on present share costs. Over the previous few years, the federal funds price has elevated, inflicting the secured in a single day financing price, or SOFR, to comply with. Since most BDC loans are floating price and tied to SOFR, this meant rising curiosity revenue for firms within the fund.

This rising revenue is topic to related distribution guidelines to actual property funding trusts, that means that almost all of this revenue should be distributed to shareholders. Excessive-yielding loans mixed with distribution necessities and rising rates of interest means a excessive yield which has elevated additional.

Expense Evaluation

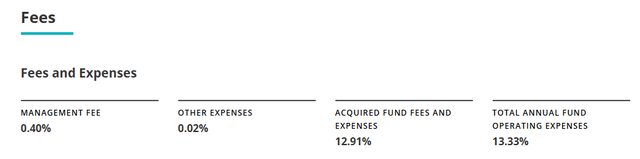

One of the vital widespread areas of query round BIZD is the fund’s administration payment. Searching for Alpha quotes the fund’s expense ratio as 13.3%, which inevitably makes its strategy to the remark part from confused readers. VanEck clarifies the expense construction on their web site, offering three parts for the fund’s bills. From left to proper, we’ll break down the fund’s bills.

BIZD Reality Card

BIZD fees a administration payment of 40 foundation factors of property underneath administration. That is excessive for an index fund like BIZD, which passively follows a market capitalization weighted index. Nonetheless, it’s roughly half of the 75 foundation level administration payment charged by the actively managed fund from Putnam known as the Putnam BDC Revenue ETF (PBDC).

The second part is a line merchandise labeled “different bills” charging two foundation factors. These are usually administrative bills from the fund, which could embrace buying and selling prices or providing prices.

Now comes the extra difficult piece of the puzzle, which accounts for a lot of the bills. VanEck lists an expense merchandise known as “Acquired Fund Charges and Bills.” This class consists of BIZD’s share of bills charged by the underlying investments. Consider, BIZD owns a portfolio of enterprise improvement firms, most of that are externally managed. These sometimes have an advisory payment construction near the standard “2 & 20” method, which features a 2.0% administration payment and a 20% incentive payment. These charges are calculated based mostly on disclosures within the annual studies of the underlying funds. These charges are usually not collected by VanEck and are mirrored within the efficiency of the person firms.

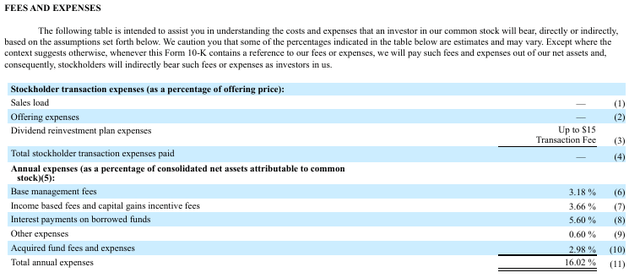

For instance, if you are going to buy shares of ARCC, you’re paying charges to Ares Administration (ARES) as an exterior advisor. ARCC makes use of a conventional payment construction based mostly on a administration payment and supplemental incentive payment. Wanting deeper inside ARCC’s annual report, we will perceive the payment construction of BIZD’s largest holding. The expense construction of ARCC combines to a complete annual expense larger than 16% when combining administration charges, incentive charges, curiosity funds, and different line gadgets.

ARCC SEC Submitting

ARCC’s annual report supplies particulars on the fund’s administration payment construction and incentive charges. Apparently, we’ll word that ARCC has its personal share of acquired fund charges and bills.

Our base administration payment is calculated at an annual price of 1.5% based mostly on the common worth of our whole property (aside from money or money equivalents however together with property bought with borrowed funds) on the finish of the 2 most not too long ago accomplished calendar quarters; supplied, nevertheless, the bottom administration payment is calculated at an annual price of 1.0% on the common worth of our whole property (aside from money or money equivalents however together with property bought with borrowed funds) that exceeds the product of (A) 200% and (B) our web asset worth on the finish of essentially the most not too long ago accomplished calendar quarter. The three.18% mirrored on the desk is increased than 1.5% as a result of it’s calculated on our common web property (relatively than our common whole property) for the 12 months ended December 31, 2023…

Revenue based mostly charges are payable quarterly in arrears in an quantity equal to twenty% of our pre‑incentive payment web funding revenue (together with curiosity that’s accrued however not but obtained in money), topic to a 1.75% quarterly (7.0% annualized) hurdle price and a “catch‑up” provision measured as of the tip of every calendar quarter. Beneath this provision, in any calendar quarter, our funding adviser receives no revenue based mostly charges till our web funding revenue equals the hurdle price of 1.75% however then receives, as a “catch‑up,” 100% of our pre‑incentive payment web funding revenue with respect to that portion of such pre‑incentive payment web funding revenue, if any, that exceeds the hurdle price however is lower than 2.1875%. The impact of this provision is that, if pre‑incentive payment web funding revenue exceeds 2.1875% in any calendar quarter, our funding adviser will obtain 20% of our pre‑incentive payment web funding revenue as if a hurdle price didn’t apply.

Capital features incentive charges are payable yearly in arrears in an quantity equal to twenty% of our realized capital features on a cumulative foundation from inception by means of the tip of the 12 months, if any, computed web of all realized capital losses and unrealized capital depreciation on a cumulative foundation, much less the combination quantity of capital features incentive charges paid in all prior years

Now, circling again to BIZD, every share of ARCC held within the fund is paying its share of bills to ARES because the exterior supervisor. This expense is being communicated on an total foundation by means of every holding’s respective inner expense construction. On the entire of BIZD, this quantities to a weighted common expense of 12.91% for the acquired fund charges and bills. So the brief reply is “Sure, BIZD’s bills actually are over 13%” however it’s price noting that this consists of the blended bills of every particular person investments. For that reason, BIZD has drastically trailed the efficiency of its largest investments, as we’re about as an example.

Assessment Of Prior Thesis

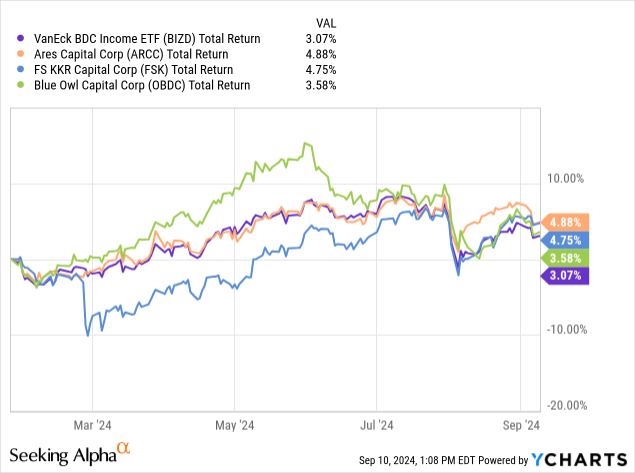

Originally of the 12 months, we revealed an article on BIZD taking a important have a look at the fund’s worth proposition. Extra particularly, we checked out whether or not the diversification provided by BIZD was really a dreaded case of “diworsification.” By together with almost each BDC, was BIZD unnecessarily exposing traders to poor high quality firms that merely shouldn’t move the take a look at? The article was known as “BIZD: Ditch This Fund And Purchase Its Largest Constituents As a substitute” asserting that traders had been higher off shopping for shares of ARCC, FSK, and Blue Owl Capital (OBDC) as a substitute. Our thesis boiled right down to this assertion:

Enterprise improvement firms have distinctive drivers which decide their success, reminiscent of scale, relationships, and capital prices. First, bigger BDCs have the dimensions essential to mitigate dangers and uncover operational competencies reminiscent of G&A efficiencies. These bigger corporations will even be capable of work with a extra various set of shoppers. Second, relationships are important within the BDC sector. Blue chip opponents within the sector reminiscent of Ares Capital (ARCC) spent many years securing relationships throughout the center market which finally constructed a robust portfolio. Lastly, bigger BDCs have superior capital prices by way of higher credit score rankings and the flexibility to difficulty fairness at or above web asset worth or NAV. These benefits are uneven and permit corporations to distinguish themselves and refine their methods.

These three causes alone are ample to kind a compelling funding thesis. Reasonably than diversifying throughout a concentrated sector with solely 26 members, investing within the prime three constituents of the fund supplies ample diversification whereas capitalizing on vital aggressive benefits.

So, for the reason that begin of the 12 months, how has this thesis panned out? Are the biggest members within the sector nonetheless outperforming the index? Extra importantly, because the macroeconomic outlook begins to shift for BDCs, are the biggest constituents higher ready to face a falling rate of interest surroundings?

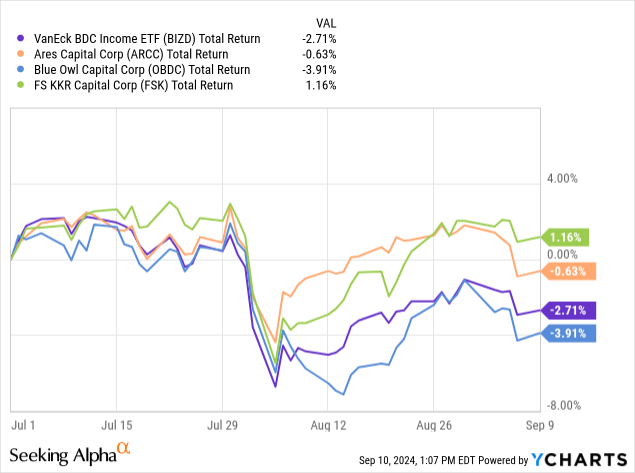

Since publication of our thesis article on BIZD, the fund’s three largest holdings have outperformed the ETF by a most margin of 1.7%. Now, stepping again, we should acknowledge that efficiency might be extremely correlated since these investments account for round 40% of BIZD’s portfolio. Nonetheless, the truth that the fund has underperformed these three signifies that the remaining 60% of property and the fund’s administration payment have created a web drag on the efficiency of the fund. Because the starting of the 12 months, these three massive BDCs have outperformed the index. As illustrated in our earlier article, this outcome additionally applies to longer time horizons.

The sector reversal for BDCs started on the onset of Q3. Because the Federal Reserve started to pivot, the outlook for BDCs modified equally. At the moment, BDCs face a much less enthusiastic investor crowd, because the probability that rates of interest will go increased seems to be low. Because the starting of July, two of the three largest holdings have outperformed BIZD by a margin of round 200 foundation factors. Solely OBDC has trailed over the short-term interval.

Conclusion

As rates of interest start to shift, we reiterate our main thesis that investing within the fund’s three largest constituents, ARCC, FSK, and OBDC, current a superior alternative as in comparison with investing in your entire sector. As this thesis continues to play out positively, we reiterate the idea that our unique three elements present a platform for BDC success.

With the present outlook, BIZD earns a Maintain. The fund continues to distribute one of many highest yields within the investible universe, reaching almost 12% based mostly on present share costs. This is a chance that traders shouldn’t overlook, however the brightest interval of BDCs has doubtless handed. Within the meantime, contemplating the biggest constituents of the index might be a superior method versus the fund of funds.