AUD/USD: The Current Rally Of The Aussie Greenback Could Face A Ceiling Under 0.6900

TexPhoto

After the worldwide risk-off episode that occurred from mid-July to five August, the Aussie greenback has managed to get better all its losses in opposition to the US greenback in the identical interval.

The AUD/USD, being a higher-beta play among the many FX majors rose by 7.4% from its 5 August low of 0.6348 to print a current excessive of 0.6824 on 29 August bolstered by a transparent change of financial coverage stance by the US Federal Reserve from “hawkish-higher for longer” to “dovish-time has come for coverage to regulate” ex-post Fed Chair Powell’s 23 August Jackson Gap Symposium speech that cemented a possible upcoming 25 foundation factors minimize to the Fed funds fee on the 18 September FOMC assembly.

Weak macro knowledge from China is within the limelight once more

The most recent China NBS Manufacturing PMI knowledge for August has pointed to a fourth consecutive month of contraction in manufacturing actions; it slipped additional to 49.1 from 49.4 in July, beneath the consensus of 49.5.

Its new orders subcomponent declined at a barely larger magnitude from 49.30 in July to 48.90 in August which is an alarming reason for concern as a good portion of China’s financial progress thus far in 2024 has been pushed by exterior demand and prime policymakers’ heavy allocation of state sources in the direction of China’s high-tech industrialization programme.

If China’s manufacturing actions languish at this fee in This fall, it’s unlikely that China can meet its 5% annualized financial progress goal for 2024. As well as, a weak state of producing manufacturing coupled with the housing market in China that’s nonetheless not exhibiting any clear indicators of stabilization from a persistent pattern of unfavorable progress charges (worth of recent house gross sales from the 100 greatest actual property corporations plunged to 26.8% y/y in August from -19.7% in July), there’s probably much less demand for industrial metals comparable to iron ore.

Iron ore costs have moved in direct lockstep with AUD/USD

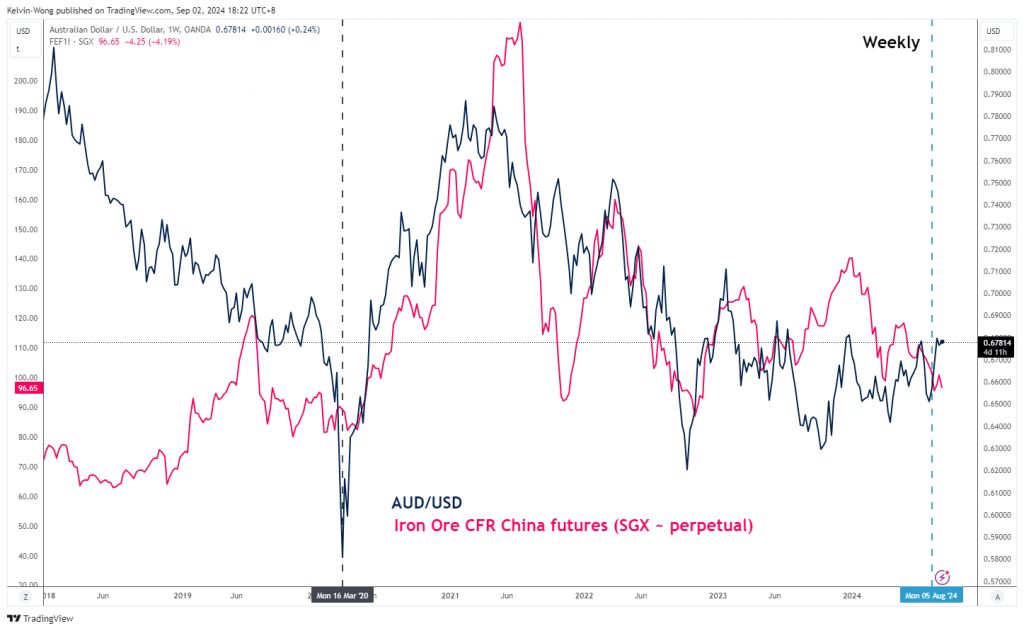

Fig 1: AUD/USD & Iron Ore futures correlation motion as of two Sep 2024 (Supply: TradingView)

Provided that iron ore is certainly one of Australia’s key useful resource exports and a good portion of it goes to China, if China’s financial progress languishes, there shall be probably much less demand for iron ore, in flip, put draw back stress on Australia’s commerce steadiness that will set off a unfavorable suggestions loop into the AUD/USD.

Since March 2020, the motion of the Iron Ore CFR China futures contract listed on the Singapore Trade has a optimistic correlation with the AUD/USD. Nevertheless, this optimistic correlation flipped to unfavorable for a brief interval just lately from 5 August to 29 August as a result of resurgence of worldwide risk-on behaviour (see Fig 1).

Provided that China’s lacklustre financial progress narrative is again on the radar display screen once more, the Iron Ore CFR China futures contract (SGX) has declined by -4.2% on Monday on the time of the writing, its longer-term optimistic correlation motion with AUD/USD could come again to affect the motion of the Aussie greenback.

AUD/USD rally has virtually reached its 0.6900 main resistance

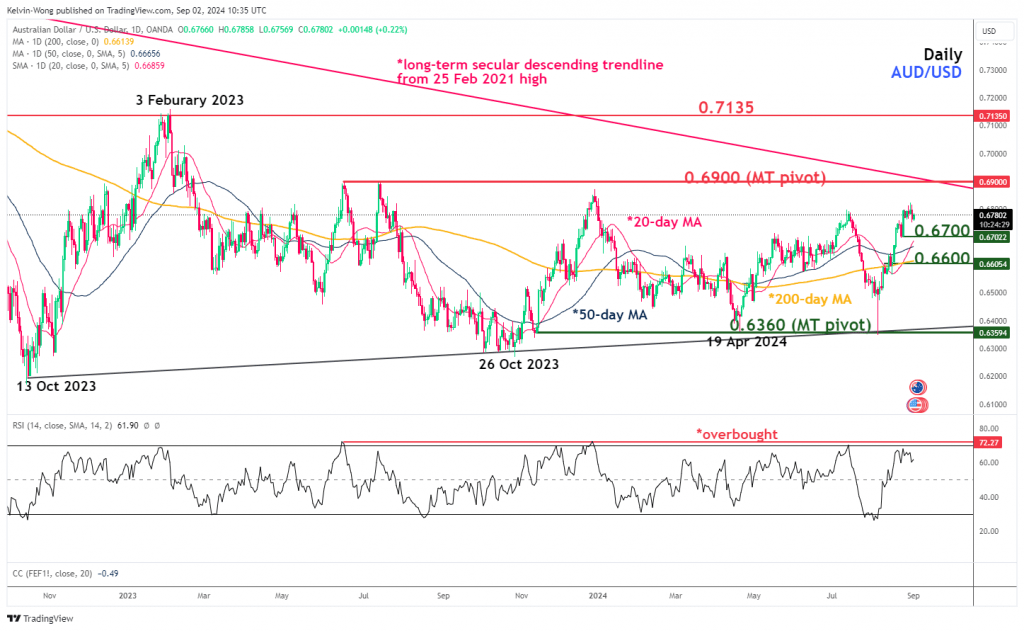

Fig 2: AUD/USD main & medium-term tendencies as of two Sep 2024 (Supply: TradingView)

The current rally of seven.4% from its 5 August low seen in AUD/USD has now virtually reached a serious resistance of 0.6900 (the medium-term swing highs of 16 June/13 July 2023 and long-term secular descending trendline from the 25 February 2021 excessive).

As well as, the day by day RSI momentum indicator has virtually hit an overbought stage of 72 which has capped prior advances of the AUD/USD since 15 June 2023.

If the 0.6900 key medium-term pivotal resistance is just not surpassed to the upside, the AUD/USD may even see a imply reversion decline situation unfolding to show the subsequent intermediate helps at 0.6700 and 0.6600 (additionally the 200-day shifting common) (see Fig 2).

Nevertheless, a clearance above 0.6900 invalidates the bearish situation on the AUD/USD for the subsequent intermediate resistance to return in at 0.7135.

Editor’s Be aware: The abstract bullets for this text had been chosen by Searching for Alpha editors.