Ascend Wellness Is A Improbable Alternative For Hashish Traders

lorozco3D

I final wrote about Ascend Wellness (OTCQX:AAWH) greater than a month in the past, calling it a purchase at what was a greater value. Issues have gotten higher, however the value is definitely decrease at the moment than then. Final week, the corporate acquired some good news, and we’re getting very near hashish rescheduling doubtlessly. I believe that AAWH is dirt-cheap, and I’m elevating it to a Robust Purchase.

Ascend’s Outlook Has Improved

As I wrote in late Might, Ascend had a robust Q1. Income elevated 25%, and adjusted EBITDA grew 39%. Money move from operations was $3.9 million, harm by a construct in stock.

Within the final piece in late Might, I shared 2024 and 2025 outlooks utilizing Sentieo. I’m now utilizing AlphaSense, which acquired the corporate, and it does not use the entire analysts. I’m able to have a look at the historic AlphaSense estimates, and the outlook has been bettering.

For 2024, a single analyst is projecting that income will broaden 13% to $588.3 million. The adjusted EBITDA is predicted to extend 18% to $126.4 million, a margin of 21.5%. In its Q1 press launch, the corporate guided to income progress of 12-15% in 2024 with adjusted EBITDA progress of 17-22%. It additionally guided to money move from operations for the 12 months of $55-65 million. In its 10-Q, it projected further capital expenditures of $35-40 million in the course of the 12 months. Assuming the low finish on money move from operations and including $40 million to the Q1 expenditure, the corporate will generate constructive free money move of $8 million.

For 2025, income is predicted to extend 8% to $636.4 million, with adjusted EBITDA gaining 25% to $156.8 million, a margin of 24.6%. That estimate is above the estimate of Andrew Semple of Ventum Capital Markets (PI Monetary and Echelon Wealth), who referred to as the inventory a prime decide in a analysis report shared on 7/16. Semple tasks 2025 adjusted EBITDA of $140.6 million. Each of the AlphaSense estimates are unchanged since mid-Might, however are larger than forward of the Q1 report.

For Q2, the corporate is scheduled to report its financials on 8/5. The analyst that AlphaSense tracks expects income to extend to a report $148 million, up 25% from a 12 months in the past, with adjusted EBITDA projected at $30 million. That is robust progress relative to friends.

Ascend Extends Its Debt Due in 2025

In that final write-up, I mentioned the steadiness sheet, suggesting that its $275 million credit score facility was set to mature in August 2025. On the convention name, the CEO advised that the corporate would tackle this earlier than it could grow to be a present legal responsibility, and it did. Here’s what was said on the convention name:

With reference to refinancing, we have had very constructive conversations on our time period mortgage that’s due in Q3 of 2025. Over the previous few months, we have actively sought suggestions from each present and potential new lenders receiving a number of indications of curiosity. Now we have fastidiously balanced the necessity to tackle this debt promptly with the potential for a extra favorable surroundings sooner or later. Our working plan is to have the refinancing accomplished earlier than it turns into present.

On Monday, it introduced that the corporate had lined up lenders, and it closed the deal on Thursday. The 12.75% coupon wasn’t so nice. It additionally wasn’t so nice that the $235 million of debt was bought at a reduction. What was nice, although, was the maturity of 2029.

280E Is More likely to Go Away

On April thirtieth, hashish shares soared on the information that the DEA is planning to reschedule hashish from Schedule 1 to Schedule 3. This not solely makes a whole lot of sense, it makes cents too. The American hashish firms have lengthy been chargeable for paying an enormous tax that was applied by President Reagan a long time in the past. Those that promote Schedule 1 or Schedule 2 medicine are chargeable for paying tax primarily on gross revenue slightly than web revenue. This wipes out enterprise bills. The American hashish operators are inclined to have debt, and these taxes eat up money move. It has been a giant problem to the trade.

The DEA put in place a remark interval that ends on 7/22. It is rather doubtless that hashish can be rescheduled and that 280E will go away, however it’s not a finished deal. President Trump by no means supported hashish, and he really put Jeff Periods in because the Lawyer Basic, which was problematic. It isn’t clear how Trump will deal with hashish if he’s elected in November, however this can be a potential threat to rescheduling not happening or being reversed later.

Ascend has damaging tangible fairness, and, whereas its debt has been prolonged by the top of the time period for the subsequent president, it nonetheless has debt. 280E going away can be very constructive for the corporate.

AAWH Is Very Cheap

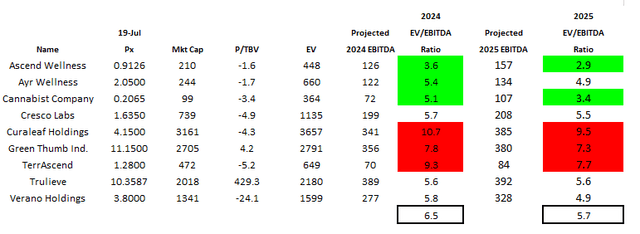

Ascend has a market cap of $210 million. Including within the web debt as of 03/31, the enterprise worth is $448 million. That is solely 3.6X the projected adjusted EBITDA for 2024, which may be very low completely and relative to friends.

For concentrating on functions, I exploit the 2025 outlook for predicting a year-end value, and Ascend is the most affordable of the Tier 1 and Tier 2 names at present:

Alan Brochstein, utilizing AlphaSense

Within the piece that I shared in late Might, my goal was $3.97 primarily based on a a number of of 8X for the enterprise worth to projected adjusted EBITDA for 2025. I’m reducing it now to simply 6X, which appears very low. This helps cut back the chance that the projection is simply too excessive, although it is sensible to me. Utilizing 6X, my goal is $3.05, which is up 234%.

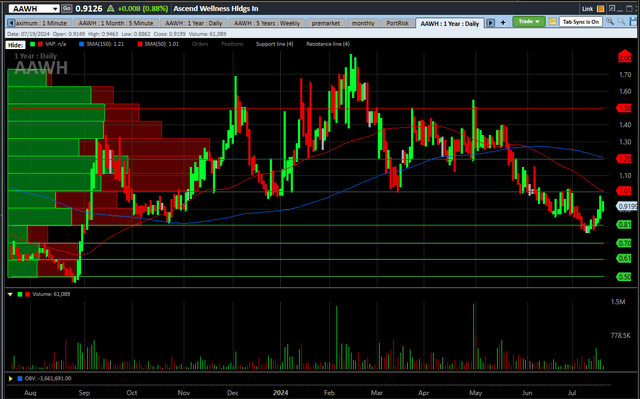

The Ascend Chart Is Extremely Enticing

Nearly a 12 months in the past, AAWH set an all-time low beneath $0.50, so it’s up rather a lot since then. It is usually down rather a lot since its latest peak in February:

Charles Schwab

I see assist at $0.80 and under. I see some resistance at $1.00, $1.20 and $1.50, although these ranges are far under my goal value. The inventory ended 2023 at $1.00.

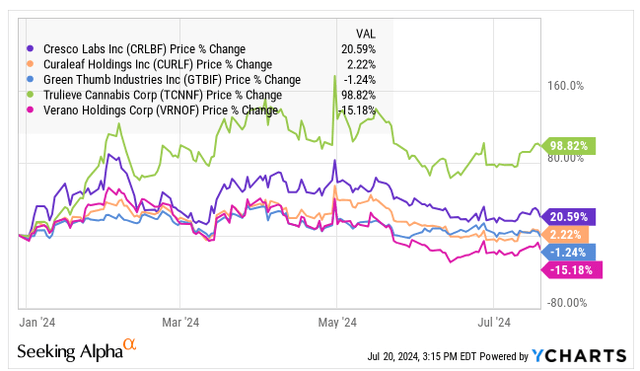

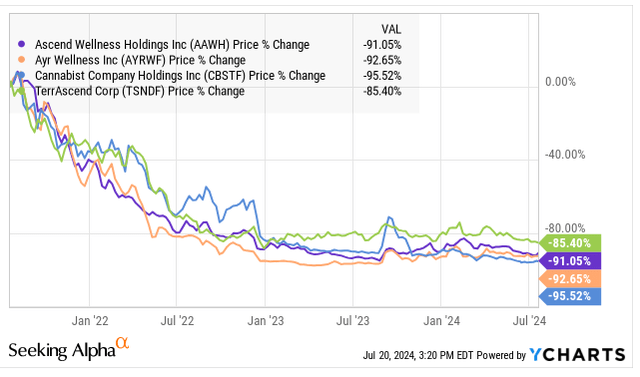

Ascend, down 8.7% to this point, has underperformed most MSOs in 2024. The New Hashish Ventures American Hashish Operator Index has dropped 1.8%. There’s one Tier 2 title that’s up, Ayr Wellness (OTCQX:AYRWF), and the opposite two are down. TerrAscend (OTCQX:TSNDF) has dropped 21.5%, and Cannabist (OTCQX:CBSTF) has dropped 54.1%. The Tier 1 names have typically finished higher:

YCharts

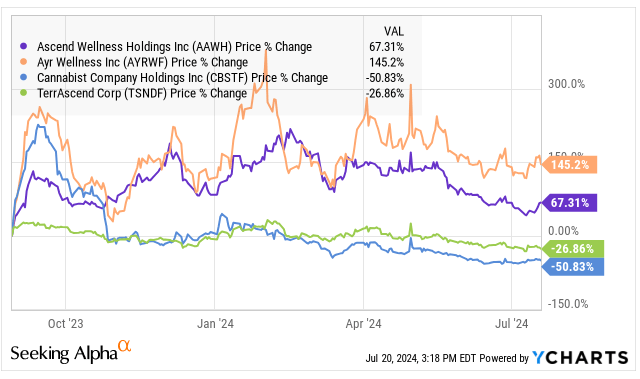

Trying on the motion since 8/29, the day earlier than the potential rescheduling information hit the market, the entire Tier 1 names have rallied greater than 42%, however the Tier 2 names have been combined:

YCharts

Whereas AAWH has rallied rather a lot since late August, it’s up lower than AYR Wellness and a lot of the Tier 1 names regardless of the excellent news on extending its debt. Maybe a greater look is the previous three years, and AAWH has dropped 91.1%.

YCharts

So, the inventory is down however seems to be like it’s bottoming. The large rally from the all-time low is because of the potential of 280E to go away and strong working outcomes. This week’s continuation of the bounce that started virtually a 12 months in the past is sensible to me.

Conclusion

Whereas I’m saddened by how poorly Ascend has carried out in 2024, I’m completely happy to have the ability to increase it from Purchase to Robust Purchase at the moment. I’ve additionally been happy to have been capable of increase it in my Beat the World Hashish Inventory Index mannequin portfolio that I share with my investing group. After the information got here out Monday, I used to be stunned that the inventory did not rally, and I added a major variety of shares to the mannequin portfolio, which at present has an 18% weight. AAWH isn’t within the index.

For readers, I take into account this a improbable progress funding thought. A 12 months in the past, I shared a price concept that ended up working fabulously on Organigram (OGI), which I nonetheless embrace in my mannequin portfolio and maintain at a excessive weight of 20%. Ascend gives vital upside potential, although it together with different hashish shares face a threat of rescheduling not happening.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please concentrate on the dangers related to these shares.