Accenture: IT Spending Seems To Be On ‘Weight loss program,’ However I’m Nonetheless Optimistic (NYSE:ACN)

HJBC

Funding Thesis

Accenture (NYSE:ACN) continues to face headwinds which can be weighing down on all the enterprise consulting business all around the world. One of many largest challenges enterprise consulting firms face in the mean time is the depressed spend atmosphere seen within the IT companies sector. In gentle of the depressed IT spend, firms are reorganizing their organizations and reallocating their money and capital in direction of investments and different priorities that place them for future progress.

Within the Q2 FY24 name to debate outcomes, Accenture’s CEO mentioned, “The corporates have put themselves on a eating regimen,” when explaining the backdrop in IT spend. However the firm remains to be aligning itself in direction of its future imaginative and prescient of progress intelligently.

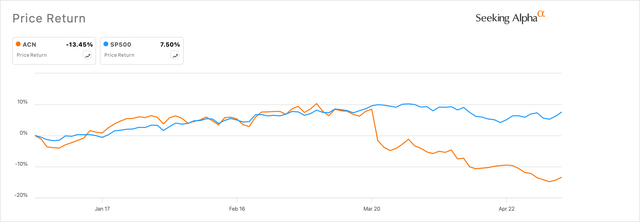

I had written about Accenture, the place I expressed my optimism about how Accenture was “resourcefully working its money to reposition itself” in direction of future progress. Since then, Accenture has reported its Q2 FY24 earnings and reduce its steerage for Q3 FY24. The earnings report appears to have thrown chilly water on any progress Accenture was making because it tracked the S&P 500 index, as seen in Exhibit A under.

Exhibit A: Accenture’s efficiency vs. the S&P 500 index on a year-to-date foundation (sa)

Nonetheless, after factoring within the newest estimates and adjusting my forecasts to mirror Accenture’s outlook, I nonetheless anticipate upside within the inventory. I proceed to suggest a Purchase on Accenture.

Accenture continues to sustainably lay its constructing blocks in direction of progress

Administration continues to work in direction of its objectives of investing sooner or later progress of the corporate and positioning the corporate as a enterprise power to supply AI and digital transformation companies. Digital transformation, or Trade X, as the corporate calls this sub-segment, Cloud and Safety are among the strongest rising sub-segments for Accenture. Within the Q2 FY24 quarter, whereas Trade X grew at double-digit progress, Safety grew at “very sturdy double-digit” progress charges.

On the identical time, the arrival of GenAI final yr modified the spend priorities of CIOs throughout the enterprise. This has impacted Accenture and its friends within the short-to-mid time period, however Accenture has shortly moved to align itself with future spend areas, that are at the moment centered on GenAI, Cybersecurity and Digital transformation. Because of the fast tempo of innovation that the world has witnessed over the previous ~15 months, Accenture’s administration has indicated that it’s investing its money into buying startups that have already got a consumer base in any of the expansion areas I identified earlier. Purely from a growth-objective standpoint, I agree with Accenture’s strategy in the mean time as a result of I consider acquisitions will assist the corporate quickly enter its progress markets, develop its presence, push scale, and purchase shoppers.

For instance, I see that Accenture is ready to witness sturdy double-digit progress in safety as a result of acquisitions they made all year long (Morphus, Innotec Safety, MNEMO Mexico, and so on.). All these acquisitions look like within the managed cybersecurity area, which I consider is a robust space of progress inside cybersecurity. One of many main cybersecurity product firms, CrowdStrike (CRWD), launched their very own Managed Safety Providers final yr in response to the demand. I had additionally coated this in earlier analysis notes, the place CrowdStrike’s friends are launching their very own managed companies, which is the consulting experience Accenture has been ramping up through its acquisitions.

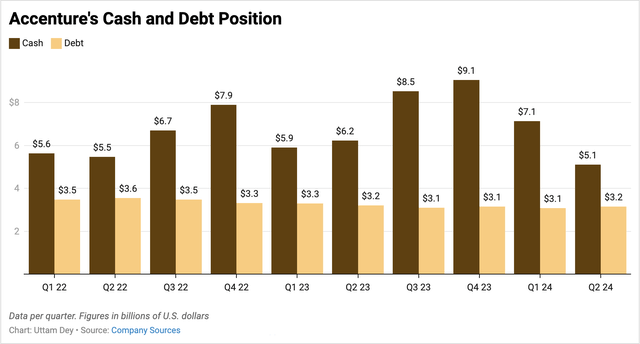

On the identical time, the corporate remains to be keeping track of sustaining a strong steadiness sheet, as I see under. Per Q2, its money and equivalents have declined ~17.7% to $5.1 billion.

Exhibit B: Accenture’s money declines because of re-allocation of money in direction of acquisitions (Firm sources)

Though complete debt has marginally elevated to $3.2 billion on a sequential foundation, complete debt continues to pattern decrease from Q2 22, as seen above in Exhibit B. I strongly suppose that this definitely offers the corporate a aggressive benefit that’s “our funding capability that enables us to pivot to increased areas of progress,” to cite administration. I consider this gives administration with extra room to make the most of its money in direction of acquisitions and return money to shareholders within the type of buybacks and dividends.

Administration expects progress uptick subsequent yr

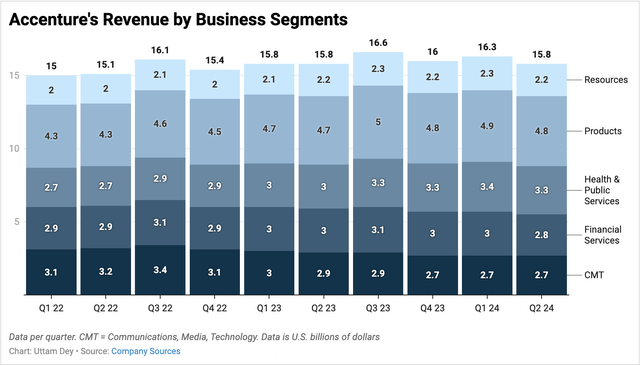

In Q2, Accenture noticed its income stay flat on a y/y foundation, with firm gross sales of ~15.8 billion in its second quarter. Progress charges for Accenture flattened out throughout all its geographical segments, so the deceleration developments had been the identical for all its shoppers all around the world. As might be seen in Exhibit C under, gross sales in its Monetary Providers and CMT business teams continued to say no on a y/y foundation. Nonetheless, its Merchandise and Well being+Public Providers teams continued to develop. A lot of the shoppers in these business teams are both within the Meals & Beverage and Retail industries or Healthcare and Well being techniques industries which can be pushing by means of with their digital transformation initiatives.

Exhibit C: Accenture’s quarterly income developments by business teams (Firm sources)

Nonetheless, I consider the corporate ought to see an uptick within the again half of 2024. For Accenture, which means the primary half of its FY25 yr since Accenture’s reporting yr ends in August. Additionally, the second half of the yr tends to get stronger as venture budgets open up.

Administration has guided in direction of a delicate Q3 with simply 1% progress however on the identical time has guided for full yr FY24 income to develop ~1.6% to ~$65 billion. This implies administration expects a comparatively vital ramp in income progress of ~6% in This autumn FY24. I consider Accenture could also be on the flip of the tide right here as its income declaration charges stabilize from right here on.

Accenture continues to supply engaging entry factors

To estimate my goal value for Accenture, I’ll assume a couple of issues:

-

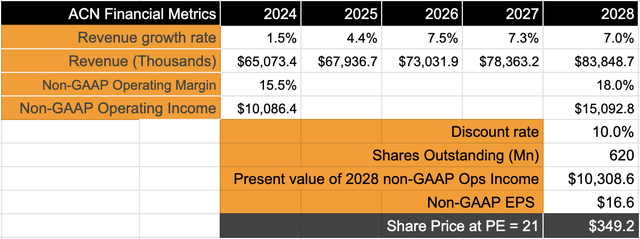

Primarily based on my outlook for income that I said within the earlier part, I anticipate Accenture will develop its income within the mid- to excessive single-digit vary, ~6.5% CAGR.

-

I anticipate adjusted working revenue to develop ~10.6% based mostly on my progress outlook for Accenture. As well as, administration has been slicing its workforce to extend productiveness and including different price management measures, which ought to assist in sooner progress in working revenue relative to its income progress charges.

-

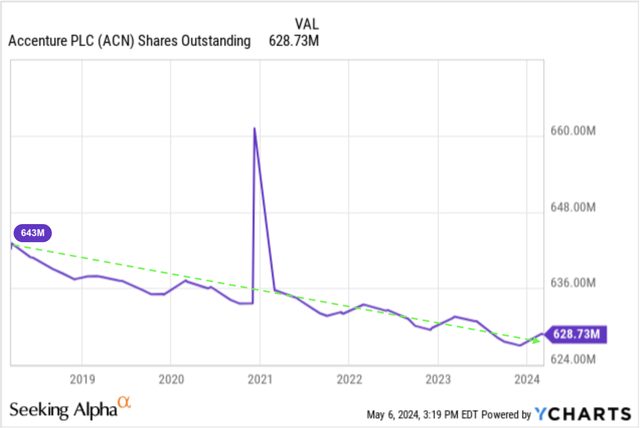

I’ve additionally tightened my outlook on shares excellent based mostly on their dilution charges, as seen in Exhibit E under.

-

Low cost charges of 10.0% are based mostly on micro-assumptions round low cost charge gadgets reminiscent of beta and threat premiums.

Exhibit D: Accenture’s shares excellent since FY18 (YCharts)

Exhibit E: Accenture’s valuation mannequin exhibits upside (Creator)

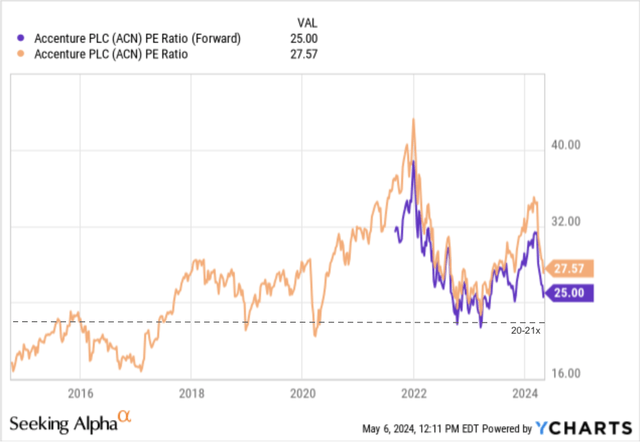

Primarily based on my forecasts of 10–11% compounded progress in adjusted revenue, the corporate ought to fetch a valuation premium of 20–21x if I examine it to the S&P 500’s long-term earnings progress of 8%. I’ll assume a ahead PE of 21x, which is on the decrease finish of its longer-term PE pattern, as seen in Exhibit F.

Exhibit F: Lengthy-term valuation multiples for Accenture (YCharts)

Taking a ahead PE of 21x, I consider Accenture nonetheless presents upside with my goal value of ~$350.

Dangers and different elements to search for

The IT Providers spend atmosphere might proceed to worsen from right here on, in case of a deeper slowdown or recession. Up to now, the administration of Accenture and different consulting companies remains to be not seeing indicators of a pickup in discretionary enterprise spending. Most lately, administration from one other agency, Cognizant (CTSH), mentioned that whereas “the timing of a return in discretionary spending stays unknown,” additionally they see that “shoppers proceed to prioritize spending that may ship price financial savings shortly and proceed to fund investments in transformation and innovation.” Furthermore, Gartner continues to venture stronger progress in IT companies in FY24.

Takeaways

Accenture does face headwinds by way of its slower income progress, however I consider income progress charges could also be at an inflection level. On the identical time, the corporate is demonstrating the way it plans to place itself for progress by allocating money in direction of clever acquisitions whereas sustaining a strong steadiness sheet.

I consider the corporate presents upaspect, and I charge Accenture as a Buy right here.