AbbVie Q2 Preview: Improve To Purchase – Higher Late Than By no means (NYSE:ABBV)

cacaroot/iStock through Getty Pictures

ABBV’s Funding Thesis Stays Sturdy – We Had Been Too Bearish After All

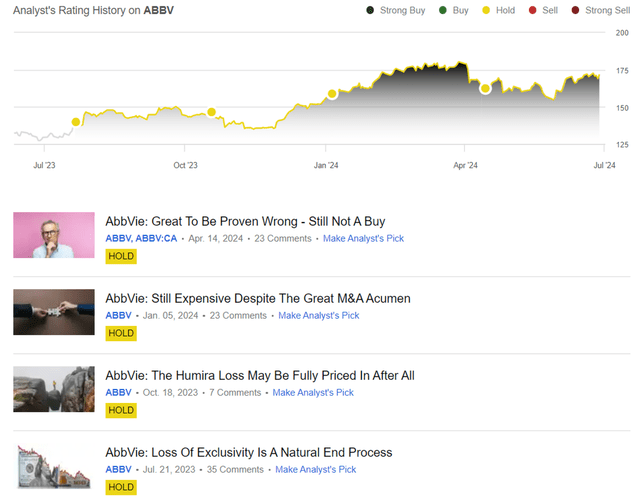

We beforehand coated AbbVie Inc. (NYSE:ABBV) in April 2024, discussing the way it had outperformed our initially extra bearish expectations, with Humira remaining the market chief regardless of the Loss Of Exclusivity [LOE] and biosimilar headwinds.

Mixed with its pipeline’s current US FDA approval, the market continued to award the inventory with steady FWD P/E valuations, additional aided by strong shareholder returns. Regardless of so, we had maintained our Maintain ranking then, with there prone to be reasonable headwinds to Humira’s gross sales in 2024 as a instantly interchangeable biosimilar had been accepted by the US FDA.

Since then, the inventory has principally traded sideways with a +5.1% complete return in comparison with the broader market at +6%. It’s obvious over the previous few Maintain rankings that ABBV has confirmed itself to be an outperformer in each monetary and inventory performances, regardless of the unsure LOE points and macroeconomic situations.

We may even be highlighting just a few metrics to look out for within the upcoming FQ2’24 earnings name on July 25, 2024, underscoring the well being of ABBV’s companies together with near-term prospects.

1. We Had Been Too Bearish On Humira’s LOE

We have now been beforehand involved in regards to the impression of biosimilars on Humira, and it’s obvious that these fears are being overly executed. This is the reason.

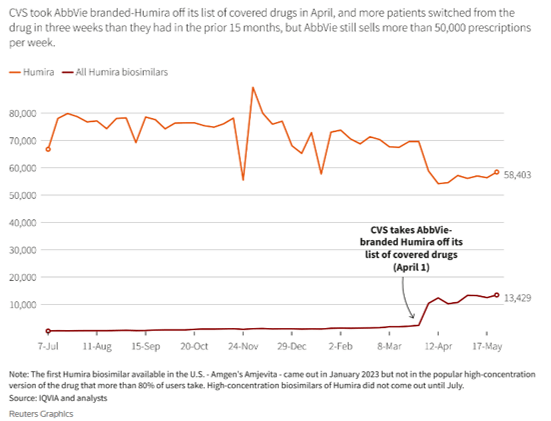

For context, ABBV’s patent safety for Humira had expired by the start of 2023, with the pharmaceutical firm going through impacted Humira gross sales of $2.27B in FQ1’24 (-31.2% QoQ/ -35.8% YoY/ -59.2% from peak quarterly gross sales of $5.57B in FQ4’22).

Even so, Humira continues to command the main market share of over 80% within the US by early June 2024 regardless of “going through 9 lower-priced rivals within the final yr.”

These developments underscore why ABBV’s larger rebates and decrease Humira pricing have paid off extraordinarily nicely in retaining market share regardless of the notable impression on its high/backside traces.

Weekly Prescriptions For Humira Since July 2023

Reuters

Whereas CVS Well being Company (CVS) has eliminated Humira from its checklist of coated medicine, it appears that evidently the worst might already be over, with the remedy’s weekly prescriptions persevering with to develop after the sharp drop in April 2024.

With a number of levers to tug, we imagine that ABBV continues to command the main mindshare within the US market and is prone to stay so within the intermediate future, as equally commented by the administration within the FQ1’24 earnings name:

We proceed to anticipate that Humira will keep parity entry to biosimilars for a big majority of affected person lives this yr. (Searching for Alpha)

That is very true since Alvotech’s (ALVO) and Teva Pharmaceutical Industries Restricted’s (TEVA) instantly interchangeable biosimilar possibility for Humira, Simlandi, is just slated to enter the US market from February 2025 onwards. The delayed entry might briefly reasonable Humira’s erosion because the area includes 78% of the remedy’s world gross sales in FQ1’24 (-5 factors YoY).

Maybe this growth has contributed to ABBV’s comparatively promising FY2024 steerage, with the US Humira erosion at “roughly -32%” principally attributed to cost rebates and, to a smaller extent, CVS’s formulary change.

2. FQ2’24 Efficiency & FY2024 Steering

For context, ABBV has already raised their FY2024 adj EPS steerage to $11.23 on the midpoint (+1% YoY), up from the steerage of $11.15 (+0.3% YoY) provided within the FQ4’23 earnings name and the unique $10.85 (-2.3% YoY) provided within the FQ3’23 earnings name.

That is regardless of the a number of changes associated to the acquired IPR&D and milestones bills, together with $0.42 from the ImmunoGen and Cerevel Therapeutics Acquisitions to be accomplished in H1’24.

Whereas there could also be additional impacts from the not too long ago accomplished Celsius Therapeutics deal price $250M, we aren’t overly involved for now,.

It is because ABBV continues to report strong ex-Humira portfolio progress at +15% YoY in FQ1’24 whereas guiding strong FQ2’24 revenues of $14B (+0.9% YoY) and adj EPS of $3.07 (+5.4% YoY) on the midpoint, because of the simpler YoY comparability.

This growth additional underscores the pharmaceutical firm’s strong pipelines and M&A efforts whereas permitting it to overlap Humira’s painful LOE and high/ bottom-line erosion.

These elements additionally exhibit why ABBV’s inventory efficiency has outperformed Pfizer Inc.’s (PFE) and Bristol Myers Squibb Firm’s (BMY) so far, regardless of their comparable LOE points so far.

In consequence, we imagine that the upcoming earnings name might doubtlessly be one other beat and lift, as the way it has been over the previous 4 consecutive quarters (barring the -$0.01 adj EPS miss in FQ4’23).

3. Steadiness Sheet Well being & Dividend Hike

It goes with out saying that ABBV has been one of the crucial aggressive pharmaceutical firms in M&A actions so far, with 5 acquisitions introduced over the previous twelve months (on high of a number of partnerships).

This has contributed to its rising long-term money owed on stability sheet at $63.8B (+7.6% QoQ/ +7.6% YoY/ -4.3% from FY2019 ranges of $66.72B) and deteriorating net-debt-to-EBITDA ratio of two.53x in FQ1’24 (in comparison with 1.78x in FQ4’23, 2.40x in FQ1’23, and 1.77x in FY2019).

With this quantity being larger than the common 2.36x reported by the Normal Drug Producers, readers might wish to monitor ABBV’s execution and stability sheet well being over the following few quarters since borrowing prices stay elevated with the Fed but to pivot.

Whereas the pharmaceutical firm stays worthwhile, the elevated debt load and consequently larger curiosity bills might ultimately reduce into its capability to maintain the historic 5Y dividend progress charge of +8.34% and 10Y charge of +14.1%, with the final hike of +4.7% being considerably underwhelming.

So, Is ABBV Inventory A Purchase, Promote, or Maintain?

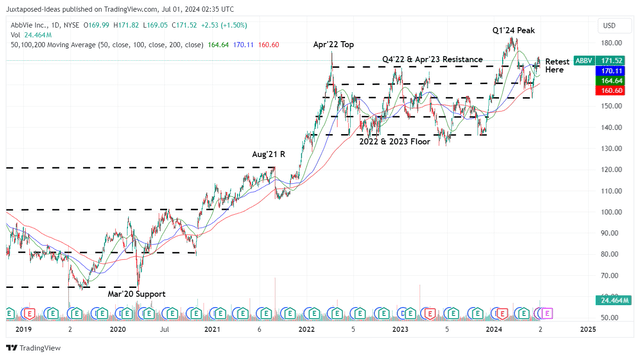

ABBV 5Y Inventory Worth

For now, ABBV has traded sideways since early 2024, with the inventory presently consolidating at $170s as we enter the Q2’24 earnings season.

For context, we had provided a good worth estimate of $167.40 in our final article, based mostly on the FY2023 adj EPS of $11.11 (after together with the 2023 acquired IPR&D/milestones bills) and the FWD P/E valuations of 15.07x.

Based mostly on the ABBV administration’s not too long ago raised FY2024 adj EPS steerage to $11.23 and the identical FWD P/E imply of 15.07x (close to to its 1Y imply of 15.05x), it’s obvious that the inventory continues to commerce close to our upgraded honest worth estimates of $169.20.

The identical could also be noticed in our reiterated long-term value goal of $201, attributed to the steady consensus FY2026 adj EPS estimates of $13.37 (in comparison with $13.34 in our earlier article).

On the similar time, ABBV stays a dividend aristocrat, with the strong ahead dividend yield of three.61% nonetheless richer than the sector median of 1.43%, and long-term shareholders doubtless wanting ahead to the following dividend increase within the FQ3’24 earnings name in October 2024, persevering with the pattern of ten consecutive years in payout progress.

Mixed with its strong ex-Humira portfolio efficiency and the administration’s constantly raised FY2024 steerage, we imagine that it’s lastly time to improve our ranking for the ABBV inventory to a Purchase certainly.

Writer’s Score

It goes with out saying, that our Purchase ranking has come comparatively late, with us lacking out on the +19.3% return since July 2023, in comparison with the broader market at +20.3%.

Nonetheless, we imagine that it’s higher to be late than by no means, particularly since ABBV has confirmed itself to be an outperformer in each monetary and inventory efficiency, regardless of the unsure LOE points and macroeconomic situations.

On the similar time, this Purchase ranking doesn’t include a particular entry level because it will depend on particular person traders’ greenback price averages and portfolio allocation.