Ryanair FY This fall Earnings Preview: Heady Progress Is Slowing (NASDAQ:RYAAY)

Ryanair plane at Bergamo, Italy

MaxBaumann/iStock Unreleased by way of Getty Photographs

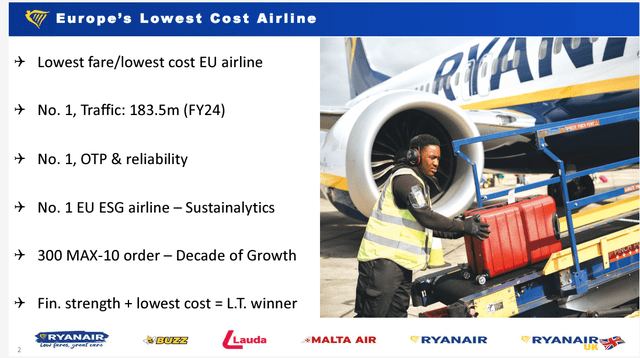

Ryanair (NASDAQ:RYAAY) is an ultra-low-cost provider headquartered in Eire however serving most nations of Europe plus components of the Center East and North Africa. A comparatively younger airline, RYAAY has aggressively constructed its community over lower than 4 many years to change into the biggest airline in Europe working a near-exclusive fleet of Boeing 737 jets.

Ryanair has thrived due to its aggressive give attention to price management, monetary energy, and its skill to stimulate site visitors with low fares. On a continent the place the legacy carriers dominate main airports, Ryanair has constructed its presence round secondary airports and what some would name bare-bones service; it has gained a loyal following indicated by its skill to fill its jets (close to 100% load elements) and ship dependable fundamental transportation that covers the European continent and past. Typically accused of crossing the road of being “too low cost,” RYAAY has formed European aviation in the identical approach that Southwest (LUV) has formed U.S. aviation – by extending air transportation to the plenty. In contrast to Southwest which has given up its title of being the lowest-cost U.S. massive airline, Ryanair has relentlessly centered on driving its prices at all times decrease than its opponents – even when discovering no use for a few of the values that helped construct Southwest.

RYAAY Europe low price airline (investor.ryanair.com)

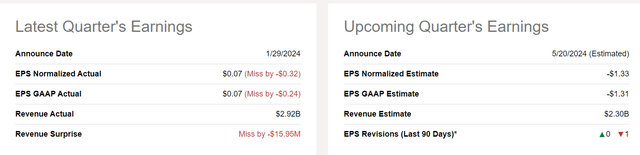

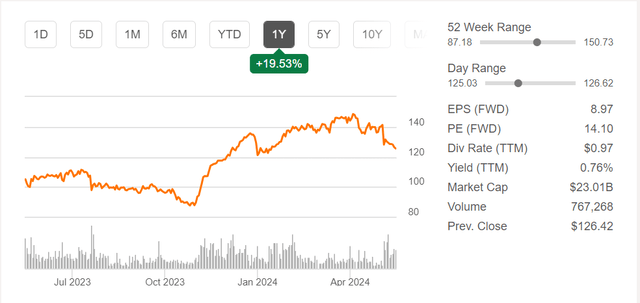

Ryanair is scheduled to report its first quarter of calendar 2024 or RYAAY’s fourth quarter fiscal 12 months 2024 earnings earlier than market open on Monday 20 Might 2024. Analysts anticipate RYAAY to report a $1.31 GAAP loss per share, worse than its loss one 12 months in the past. Because the airline with the second highest market cap on the planet – behind Delta Air Traces (DAL) – RYAAY’s current inventory efficiency is regarding and a sign that a few of the similar issues afflicting low price airways in the USA are producing disparate outcomes inside the airline business in Europe. Rivals resembling Worldwide Consolidated Airways Group (mum or dad of British Airways and Iberia of Spain) are seeing improved outcomes whereas continental European superpowers Air France/KLM (OTCPK:AFLYY) and Lufthansa Group (OTCQX:DLAKF) are seeing weak outcomes. Whereas Ryanair has historically generated above-average margins not simply in comparison with different European airways however within the international airline sector, anticipated deeper losses in the latest quarter increase issues.

RYAAY earnings abstract Might 2024 (Looking for Alpha)

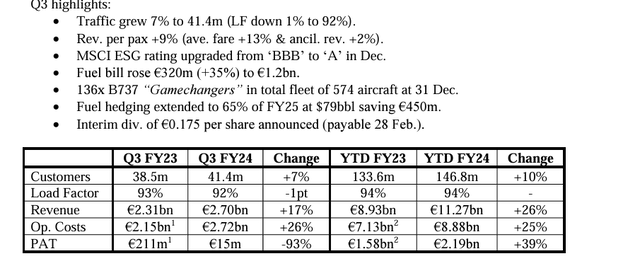

Reviewing RYAAY’s 3Q FY 2024 Efficiency and Steering

Within the December quarter of fiscal 2024, Ryanair reported income progress of 17% however a good bigger enhance in working prices of 26% which led to a 93% discount in after tax revenue from the 12 months earlier quarter which gave them a small revenue of EUR 15 million additionally pushed by a 35% enhance in gas prices. Their fiscal 12 months thus far metrics present that the primary and second quarters have been far more form to RYAAY.

The market was not initially rattled by RYAAY’s diminished steerage that was launched with its December quarter earnings during which the corporate guided to increased prices based mostly on the necessity to enhance operational reliability in addition to an approximate 5% discount in its annual earnings.

RYAAY 3Q F2024 abstract (investor.ryanair.com)

Progress Challenged Enterprise Mannequin

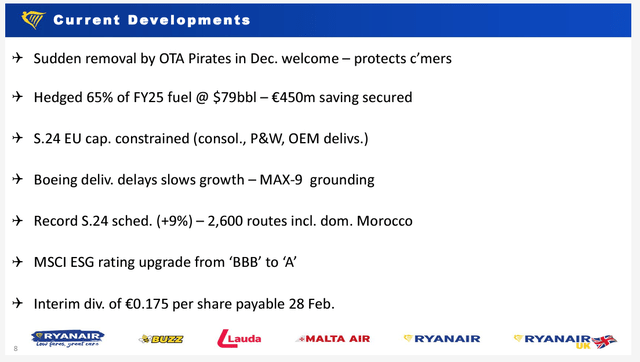

RYAAY said that it faces income pressures as a result of a few important elements. Many extremely low price carriers have been constructed round a mannequin of bookings by shoppers straight on the airline’s web site which is the least costly distribution channel for many companies. As a result of RYAAY is so massive and so in style, they’ve been the goal of on-line journey brokers (OTAs) that need to distribute their product. Due to Ryanair’s low fares, some OTAs have added unauthorized charges to RYAAY’s fare construction so as to enhance their income which additionally complicates RYAAY’s skill to take care of its passengers within the occasion of irregular operations resembling delays or cancellations. As well as, no airline desires to lose management of its pricing construction which rogue OTAs can simply do. Different OTAs have been keen to go Ryanair’s unadulterated fare and schedule info to shoppers and RYAAY has embraced these intermediaries.

RYAAY has tried numerous technological and authorized strategies so as to attempt to shake unwelcome OTAs however a number of massive OTAs lastly withdrew distribution of Ryanair’s fares and schedules within the third fiscal quarter which resulted in the necessity to low cost their fares extra aggressively and a slight discount within the variety of seats crammed. The impression into the fourth fiscal quarter seems to have accelerated over the third quarter as additional income weak point seems to have been in play. Though the corporate notes that having Easter fall in March helped site visitors, there may be not prone to be a big sufficient enhance in income from the vacation shift to offset the lack of some on-line journey agent bookings. The corporate is prone to additional deal with the OTA challenge and the ensuing income weak point in its earnings launch however it is vitally attainable if unlikely that it’ll take RYAAY’s typical busy summer season season till they can see sufficient natural demand progress to totally overcome the change in distribution.

RYAAY present developments (investor.ryanair.com)

As well as, the corporate notes that gas and labor prices are up. Gas remained elevated at first of this 12 months as a result of instability within the Center East that solely started to wane within the now-current quarter. Whereas the safety state of affairs within the Center East can change shortly, it isn’t anticipated that there will probably be important spikes in gas costs. RYAAY does anticipate that their internet gas prices will enhance within the fourth fiscal quarter due to expiring carbon credit. Labor prices are anticipated to extend as the corporate will increase pilot pay in a number of main markets. Though the pilot staffing mannequin in Europe is completely different than within the U.S., charges for expert labor proceed to extend as demand recovers and grows past pre-covid demand sooner than new labor could be educated and built-in into the workforce.

One other Huge Boeing Buyer Struggles

Ryanair, like Southwest, has been an extremely loyal buyer for the Boeing (BA) 737. Regardless that Airbus (OTCPK:EADSY) made early inroads with its A320 household of jets with European airways, RYAAY has remained trustworthy to Boeing apart from as a part of acquisitions of airways the place the A320 household of plane was already in service.

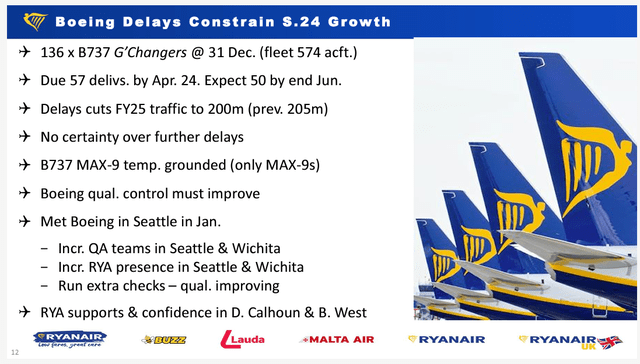

As with many airways world wide, RYAAY execs have been surprised after the in-flight failure of a door plug on an Alaska (ALK) 737 MAX 9 jet in January which led to the two-week grounding of the MAX 9 fleet. Subsequent investigations uncovered important manufacturing points at each Boeing and Spirit AeroSystems (SPR) which manufactures the 737 fuselage for Boeing. The U.S. FAA moved shortly to gradual Boeing’s manufacturing and work with Boeing to enhance its high quality management whereas additionally halting Boeing’s meant plan to extend manufacturing. The impression to airline methods on account of delayed Boeing deliveries is and will probably be one of the crucial important occasions in aviation historical past. Airways like Southwest, United, and Ryanair that are massive and main Boeing clients are watching their progress and fleet substitute methods be shredded as they’ll now not plan with certainty when they may obtain new plane.

RYAAY Boeing delays (investor.ryanair.com)

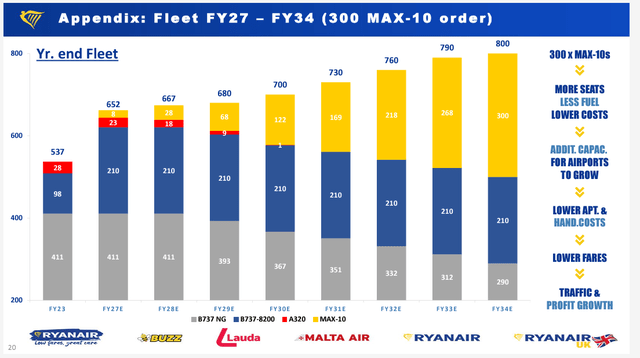

Ryanair is a loyal Boeing buyer and has been instrumental in bringing new fashions of the MAX such because the 737 8200, a high-density model of the 737-8 that prompts further emergency exits as a result of increased passenger ranges and which RYAAY calls its “gamechanger.” A part of RYAAY’s progress danger is because of supply delays on new Boeing plane; like United, Ryanair is a significant buyer for the MAX 10 which has but to be licensed and, just like the smaller MAX 7, is delayed past authentic plans though RYAAY is later within the supply timeline for MAX 10s than different clients. The provider was purported to obtain 57 Boeing Max 8200 planes by the top of April, however as a result of deepening disaster at Boeing, the supply will probably be diminished even additional to 40 jets by the top of June. As with many different airways, decrease plane deliveries won’t solely cut back revenues however may also enhance unit prices as fewer passengers could be carried and prices are unfold over fewer seat miles/kilometers.

It’s removed from clear when Boeing will be capable of return to its beforehand projected manufacturing ranges; catching up from the delayed deliveries is definite to take years. The corporate can’t afford to cancel orders however it isn’t recognized how a lot slack it has between its order e book and supply commitments so as to rebalance its supply commitments with its manufacturing capability. RYAAY’s future, simply as with different main Boeing clients, is closely tied to Boeing’s skill to show across the MAX program and to acquire certification for its present uncertified MAX 7 and MAX 10, the latter of which RYAAY desires to purchase within the a whole lot later this decade.

RYAAY fleet plan (investor.ryanair.com)

Progress and Alternative Stay

Whereas RYAAY’s distinctive income challenges associated to its on-line journey company state of affairs and the bigger challenge of aviation producer points cloud the horizon, RYAAY ought to expertise upset in a number of methods. First, Boeing’s manufacturing issues with the 737 MAX are additionally being accompanied by manufacturing issues with the Pratt and Whitney (RTX) Geared Turbofan engine which powers some A220 and A320NEO household plane. Pratt and Whitney found that a few of the metallic coatings utilized in its most fuel-efficient engine suffers degradation a lot earlier and worse than beforehand recognized as a result of excessive temperatures and harsh working circumstances of recent jet engines. RTX is having to take away a whole lot of engines worldwide from service for inspection with substitute of components in a course of that may take 9 months or extra as a result of restricted store capability and substitute components. RTX expects that the state of affairs with out of service engines and plane ought to enhance in 2025 and into 2026 which is likely to be in regards to the time that Boeing begins to return to increased ranges of manufacturing for the MAX and may additionally see certification of the MAX 7 and MAX 10. Like many massive Boeing clients, Ryanair is pushing Boeing to repair its issues and restore the reliability of its merchandise and timeliness in delivering its merchandise.

RYAAY 1 yr chart 17May2024 (Looking for Alpha)

The diminished capability from each Boeing and Pratt and Whitney’s issues is dramatically decreasing airline capability progress world wide which ought to put upward stress on fares and finally revenues. Sadly, the unpredictable nature of those manufacturing delays makes planning tough for airways. Some airways are having to maintain older plane in service longer, leading to increased upkeep prices whereas others are shifting to a much less optimistic outlook for enlargement and can use an sudden enhance in new deliveries, in the event that they happen, to retire older plane; the lead time for capability planning and the related investments in labor and services makes it too dangerous to proceed to wager on aggressive progress that won’t materialize. RYAAY and different airways can see increased unit revenues and optimizing of their networks for decrease quantities of capability by planning for much less capability than earlier hoped and utilizing it extra judiciously ought to it arrive.

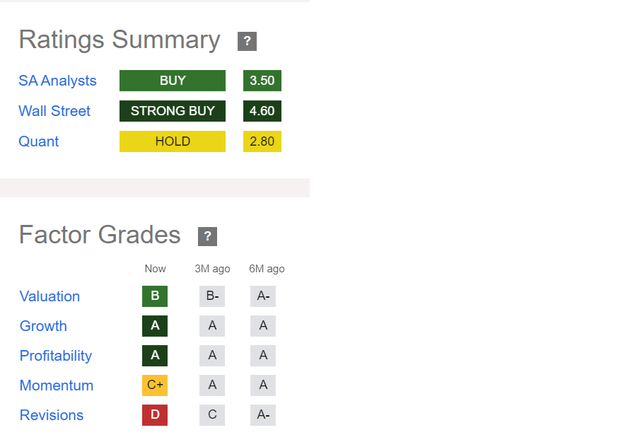

RYAAY scores abstract 17May2024 (Looking for Alpha )

Ryanair additionally desires to proceed to develop its presence in main markets. It has now change into the biggest provider in lots of markets together with in Italy the place it confronted weak native carriers for years. The restructuring of former Italian provider Alitalia into ITA has offered alternative not just for RYAAY to develop but in addition for big international carriers to restructure partnerships so as to higher entry the Italian market. Lufthansa Group (OTCQX:DLAKF) which is robust in Central Europe by way of its household of airways in a number of nations agreed to spend money on the restructured ITA. The European Union’s competitors authority has, thus far, expressed concern in regards to the transaction that may have resulted in important focus of companies. Lufthansa’s proposed treatments don’t look like ample to satisfy the EU’s necessities. A type of treatments concerned ITA/Lufthansa releasing slots at some Italian airports together with Milan’s close-in and coveted Linate airport the place Ryanair want to develop. Whereas it isn’t clear if a settlement could be reached between the EU and Lufthansa, RYAAY helps the transaction as a result of it expects it is going to be capable of obtain treatment slots. RYAAY’s place as a low-cost provider helps its case in arguing that it could actually assist examine the expansion of bigger legacy carriers.

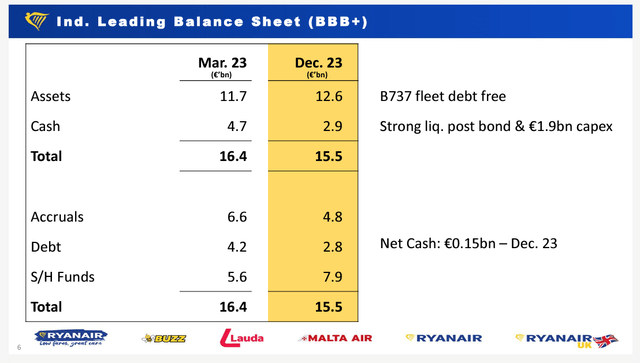

An Enviable Steadiness Sheet

Whereas the near-term for Ryanair is likely to be extra cloudy than some anticipated whilst early as six months in the past, the corporate does possess the most effective steadiness sheets within the business with little debt – really no internet debt, massive numbers of unencumbered plane, and greater than ample money readily available. Like Southwest, Ryanair can endure years of diminished earnings earlier than its steadiness sheet is diminished to the extent of a few of its bigger international opponents. Nonetheless, RYAAY seems to be managing the compromised atmosphere properly and is anticipated to announce initiatives mandatory to enhance its working funds till its progress price can return to deliberate increased ranges.

RYAAY steadiness sheet (investor.ryanair.com)

Whereas I rated RYAAY as one of many international airline business’s prime 5 shares simply 5 years in the past, I have to cut back my ranking to a HOLD based mostly on uncertainty relating to the airline’s income era and progress methods.