Goldman Sachs: Why It Is A Maintain At Present Costs (NYSE:GS)

Dan Totilca

The inventory of Goldman Sachs (NYSE:NYSE:GS) has just lately achieved all-time highs, surpassing the $500 mark for the primary time. Moreover, through the 12 months, the inventory of GS has outperformed the overall market by roughly 11.6% and by 13.3% the SPDR® S&P Capital Markets ETF (KCE). On this evaluation, I’ll analyze the corporate’s state of affairs, outlook, and valuation, to justify my causes for holding the inventory.

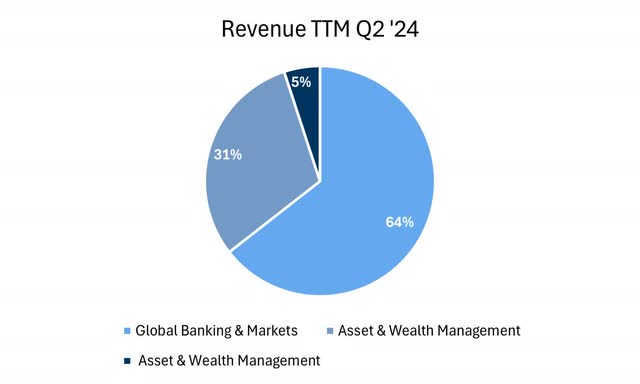

Goldman Sachs’s Enterprise Segments and Income Distribution

Goldman Sachs is the biggest firm within the Funding Banking and Brokerage trade, with roughly $170 billion in market cap and $11 billion in trailing web earnings. The agency is split into three working segments which are International Banking & Markets (64%), Asset & Wealth Administration (31%), and Platform Options (5%).

Writer’s Compilations | Knowledge FinChat.io

The core enterprise comes from the International Banking & Markets section, which collectively present classical companies equivalent to funding advisory, underwriting, analysis, and market-making actions in FICC and Equities. Not way back, these have been two impartial segments however have been consolidated into one following a enterprise reorganization plan. Though many of the revenues come from this section, it has the particularity of holding the very best amount of money stream uncertainty, since revenues listed below are extremely depending on market exercise.

Subsequent, the Asset & Wealth Administration section presents funding merchandise to most people and financing and funding options for wealth administration purchasers. As well as, their shopper banking platform, Marcus, was consolidated inside this section along with the proprietary investments of the agency throughout totally different private and non-private belongings (CIE).

Final, Platform Answer is only a tiny a part of the group and is the section liable for producing banking companies for company and institutional purchasers, with essentially the most notable one being Apple’s bank card and financial savings account.

GS’s Funding Banking Income: Selecting Up

Income Progress Goldman Sachs

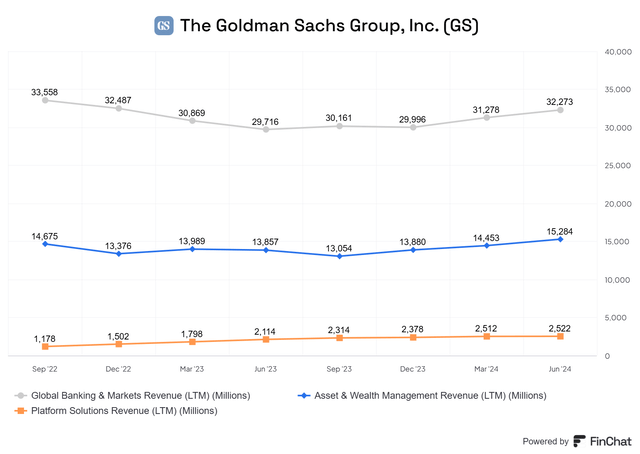

By way of earnings, 2022 was a difficult 12 months for a lot of funding banks and asset managers. On one aspect, deal exercise plummeted, and on the opposite, market efficiency in each fairness and glued earnings was lackluster.

From Asset and Wealth Administration, asset valuations have risen vastly since 2023, making the funding administration arm surpass the trailing income achieved in Q3 ’22. Though this section can also be market-dependent as administration charges are for essentially the most half collected from AUM, the cashflows are considerably extra steady than the IB section.

Transferring on to the funding financial institution, the highest line has been hit over time because of decrease underwriting and M&A exercise. Within the final quarter, FICC and Fairness introduced collectively 3.66x extra in charges. A state of affairs that was fully totally different prior to now. For instance, in This fall ’21, charges from Funding Banking vs. International Markets have been roughly the identical and now there’s a notable divergence.

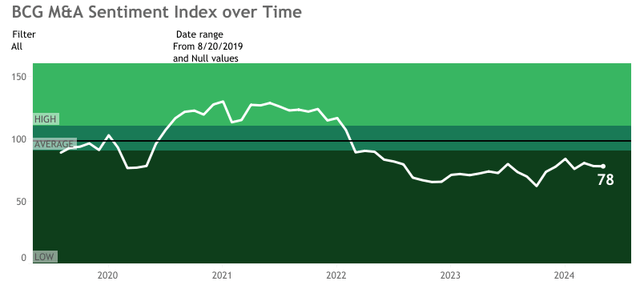

Nonetheless, as seen within the graph above, the income part of the entire section has been progressively recovering from its lows as a result of a slight restoration in deal exercise and better buying and selling volumes. This is according to the Boston Consulting Group M&A Index, that since November of 2023, sentiment in deal exercise has been slowly rising. On the identical time, the present index mark of 78, continues to be far away from the historic common of 100. This will present extra room for companies equivalent to Goldman Sachs to get well their income entrance from M&A sooner or later. Lastly, tailwinds such because the cuts in rates of interest would most definitely be a brand new market situation that may speed up acquisition exercise.

Boston Consulting Group

Goldman Sachs’ Transfer: Divesting Shopper Banking to Concentrate on Capital Markets

In 2016, Goldman Sachs began adventuring within the shopper banking enterprise with the launch of digital financial institution Marcus. Later on, a partnership with Apple (AAPL) began, providing the Apple Card. Nonetheless, some years later, this enterprise in the direction of shopper banking did not find yourself as anticipated and now GS is within the strategy of slowly divesting from this enterprise because it turned out to end result in collected losses. Thus far, the agency has bought GreenSky, plans to exit the bank card program with Basic Motors (GM), and based mostly on CNBC, Apple has proposed Goldman finish their partnership. This is along with offloading its Marcus Make investments clients, amongst different Marcus debt divestments. With this, the group plans to deal with what they know greatest, which are the capital markets, and cut back their publicity to shopper banking.

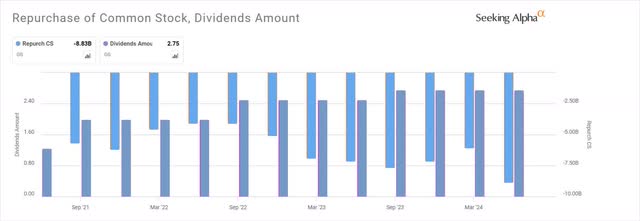

Dividends and Repurchases of GS

Searching for Alpha

One interesting facet of Goldman Sachs is its stability sheet. At the moment, they’ve $206 billion in money and equivalents and simply $77 billion in short-term borrowings. Giving them the flexibility to be resilient when it comes to their dividend funds in case issues within the economic system unfold as was significantly feared some weeks in the past. Thus far in H1, Goldman has paid roughly $1.856 billion in frequent dividends and spent $5 billion in share repurchases. This is with out contemplating the $3 dividend per frequent share paid just lately in Q3.

Now, when including the dividends paid and shares repurchased in H1, with two dividend funds of $3, multiplied by the most recent whole frequent shares excellent, implies a shareholder yield of roughly 5.2%. But, shareholder yield throughout the G-SIBs must be taken with a grain of salt as their heavy regulatory surveillance could prohibit them from ongoing share buybacks and even their dividend funds, so these distributions are partly Basel III dependent. Nonetheless, GS at present has a CET1 ratio of 13.0%, which is comfortably above the minimal requirement for international systemic banks.

Peer and Historic A number of Valuation of Goldman Sachs

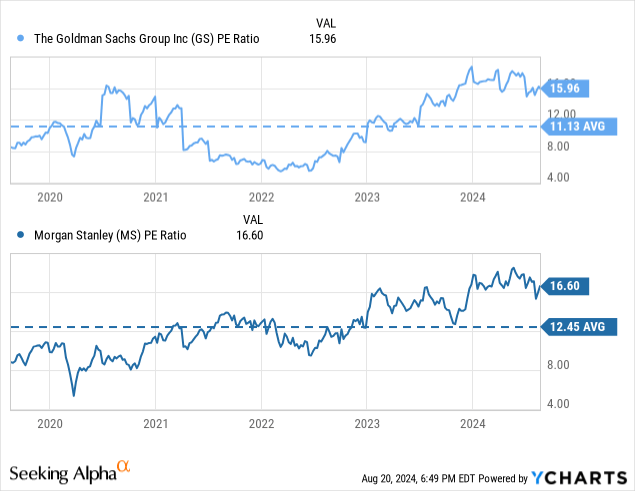

Since November, the worth return of GS has been roughly 64%, as a result of an improved outlook when it comes to rates of interest. But, that upward development has include some valuation prices. At the moment, the inventory of GS trades at virtually 16x which is way away from its 5-year common of 11x, implying that the potential for a number of expansions is most definitely minor.

In comparison with its closest peer Morgan Stanley (MS), Goldman Sachs trades modestly above, however traditionally (previous 5 years), MS has maintained a slight valuation premium over the inventory of Goldman Sachs, but additionally nonetheless sits overvalued in comparison with its historical past. This concludes that the top-tier funding banks—excluding JPMorgan (JPM) as a result of its shopper banking composition— are buying and selling effectively above their historical past as a result of robust positive factors since November.

Takeaway and Inventory Score

Though a a number of enlargement that trades far above its historical past may set off a promote signal, as a result of tailwinds from charge cuts, and a modest restoration in M&A exercise with the potential to rebound again once more to historic ranges, I’ll charge the inventory of Goldman Sachs as a maintain. Additionally, it could possibly be (or not) the case that rising earnings alone in Q3 might simply make the a number of normalize with out the inventory essentially dropping. However what’s true, is that the 64% rise since November, is especially an trade phenomenon, as different funding banks have additionally gained related returns inside these ranges. Subsequently, a maintain makes extra sense to me.

Searching for Alpha