ACCO Manufacturers: Has New Administration Discovered The Fireplace Extinguishers? (NYSE:ACCO)

stevecoleimages/E+ by way of Getty Pictures

ACCO Manufacturers (NYSE:ACCO) is a producer of shopper merchandise largely targeted on workplace and faculty environments, in addition to sure digital merchandise which serve these markets and prolong past into gaming. ACCO’s main historic characteristic from an funding standpoint is as a perpetual worth inventory – no matter money flows and earnings, the corporate’s shares have all the time been low cost from an goal standpoint. We’ve beforehand argued {that a} key issue for this perpetually low valuation was the corporate’s longstanding monitor document of losing shareholder property on questionable acquisitions which finally yielded little by way of income, profitability, or intrinsic worth.

Certainly, our final article on the corporate – in June 2021 – expressed our view that administration was uniquely able to losing the corporate’s money flows on poor acquisitions that had generated no important advantages for shareholders regardless of tons of of thousands and thousands in acquisition prices. The article was met with a handful of feedback from extra optimistic traders, much less skeptical of the corporate’s prospects – together with one daring prediction that the shares would commerce as much as $12.00 to $15.00 by the top of 2022 whereas shareholders had been “paid to attend.” We had been skeptical of the expectation, based mostly on our view that there was little purpose to anticipate a valuation reassessment with out basic change on the firm. Certainly, not solely did a rebound in share value fail to materialize – the shares traded primarily flat for the stability of the yr earlier than embarking on a gradual decline all through 2023 – however we additionally suspect that the interim dividends had been of little comfort.

The long-overdue departure of Boris Elisman, the corporate’s CEO for a decade, does mark a big potential shift and removes what we take into account the first obstacle to improved valuation. The almost $800 million spent throughout his 10-year tenure as president and chief government officer – which yielded primarily nothing for the corporate and even much less for shareholders – could also be a factor of the previous. The corporate’s new administration, although nonetheless sourced from throughout the agency, has to this point set forth a trajectory which is markedly totally different than throughout Mr. Elisman’s tenure with a said renewed give attention to debt discount, transformation, and natural progress leveraging inner product growth and cross border advertising and marketing of current manufacturers and merchandise. The truth is, the corporate’s long-term leverage ratio aim of two.0 to 2.5 would characterize a fabric shift within the firm’s use of free money flows, capital construction, and probably within the valuation of the agency’s shares.

We’ve since revisited our evaluation of the corporate given the departure of Mr. Elisman. In our view, whereas sure challenges stay unchanged and administration’s wherewithal to observe by way of on said debt discount targets stays to be seen, there may be extra purpose to consider that ACCO could also be embarking on a brand new course than was the case in prior years. We’re taking administration’s dedication with a grain of salt till additional progress is made on debt discount however, for the primary time, have decided that ACCO does current a chance for extra threat tolerant traders. Contingent on administration following by way of with a concerted debt discount strategy – and assuming the corporate’s underlying enterprise doesn’t deteriorate sooner than anticipated, it’s not unreasonable to anticipate appreciation of the shares to round $6.00 to $7.00 – a 20%-40% enhance – throughout the subsequent two years even assuming ongoing modest income erosion. Within the occasion the corporate can stabilize and develop revenues subsequent yr, this vary may nicely show too conservative.

ACCO doesn’t want to realize important feats as a way to generate such compelling returns for shareholders – or occasion to exceed them. Certainly, arguably the corporate must do little or no so as to take action past avoiding a return to the money move bonfire that outlined a lot of the final 10 years.

A Monetary Abstract

ACCO Model has lengthy been on the worth checklist, though expertise has demonstrated it to be a price entice regardless of producing notably substantial free money flows over the past decade. The truth is, between 2014 and 2019, the corporate averaged annual free money move per share of $1.44 per yr. The corporate’s shares briefly reached almost $15.00 per share in 2017 and 2018 – their highest ranges since 2006 – however for many of this time period the corporate’s free money move yield was solidly within the double digits and typically exceeding a uncommon 20%.

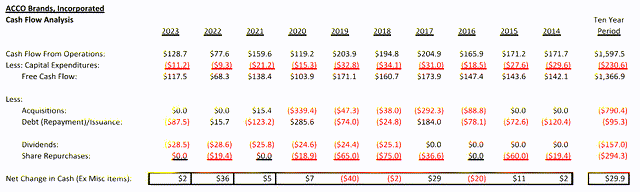

Largely, this perpetual low cost is related to the numerous waste of free money flows on largely ineffective acquisitions. Within the final 10 years, ACCO spent $790.4 million in money on acquisitions – almost 58% of free money flows over the interval. In the identical interval the corporate decreased debt by a internet $95.3 million, though just about all of that internet discount got here in the newest yr after the departure of Mr. Elisman.

Winter Harbor Capital, L.L.C.

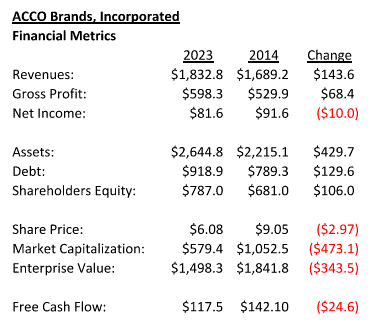

The $790.4 million interprets to roughly $7.60 per common share excellent over that 10-year interval – a considerable share of the share value in 2014 and excess of the share value on the finish of 2023. It’s price asking what the corporate acquired on account of these money expenditures, and the reply, as summarized by the next desk, is lower than stellar.

Winter Harbor Capital, L.L.C.

Certainly, over the 10-year interval, the corporate underperformed on just about each necessary metric. Revenues and gross revenue elevated marginally, as did property and shareholders’ fairness, although largely on account of amassed goodwill and intangibles. Nevertheless, internet revenue (after adjusting for impairment and restructuring prices), free money move, share value, market capitalization, and enterprise worth all declined considerably over the identical interval. Importantly, market capitalization and enterprise worth each declined greater than the worth of the corporate’s share repurchases over the identical interval, such that the corporate didn’t merely tread water however truly misplaced worth. We’d argue that shareholders ought to have anticipated way more for $790.4 million.

We acknowledge that it will be unfair – at the least barely – to put full blame on Mr. Elisman for this efficiency. ACCO’s workplace oriented enterprise has been in secular decline for a while, though the speed of abrasion has been inconsistent. A portion of the general decline in efficiency may moderately be related to the continued challenges in its core markets. Nevertheless, we do attribute substantial fault to Mr. Elisman as this doesn’t excuse the burning of free money flows on acquisitions which have persistently turned out to be underperformers.

A Lingering Acquisition Catastrophe

Arguably, this laying of fault is exemplified by Mr. Elisman’s final materials acquisition and, we might argue, most up-to-date catastrophe. In 2021, we had been skeptical concerning the rationale and timing of the corporate’s acquisition of gaming accent maker PowerA. The corporate didn’t strike us as complimentary to just about any of the corporate’s current merchandise or throughout the firm’s then current competencies. The following efficiency has confirmed our preliminary perspective.

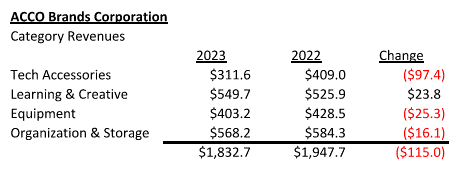

PowerA has been an unmitigated catastrophe for the corporate, regardless of a promising preliminary yr beneath the ACCO umbrella. PowerA’s annual revenues had been anticipated to strategy $200 million in 2020, the yr the corporate was acquired for about $339 million. In 2021, ACCO’s annual report said that PowerA’s income contribution was $249.6 million, representing progress of almost 25%, representing roughly half of the corporate’s whole tech accent class income of roughly $506.3 million. In distinction, ACCO’s annual reviews have been noticeably silent about PowerA’s particular contribution to the highest and backside traces over the past two years, though we will get a way of efficiency based mostly on the corporate’s tech accent disclosures.

In 2022, ACCO reported that tech accent revenues – which additionally embody the corporate’s legacy Kensington model – had been 21% of revenues ($409.0 million) and fell to 17% of revenues in 2023 ($311.6 million). In essence, tech accent income declined roughly 20% in 2022 and one other 25% in 2023. Clearly, the acquired enterprise has collapsed (or maybe held up whereas the Kensington enterprise collapsed, although we suspect this isn’t the case) such that class revenues are barely greater than PowerA’s whole reported revenues in 2021.

Furthermore, it’s notable that the income loss over the past two years within the tech accent class exceeds the entire decline in ACCO’s revenues over the identical interval. In different phrases, ACCO’s different enterprise truly grew (thought barely) over the identical timeframe because the tech accent division noticed revenues crater almost 40%.

Winter Harbor Capital, L.L.C.

New Administration on Probation

It’s for these causes that we take into account the departure of Boris Elisman to be a doubtlessly important materials change for the corporate – or at the least one important sufficient to warrant revisiting our earlier evaluation. The corporate’s new administration – which nonetheless comes from throughout the firm and subsequently isn’t wholly with out connection to prior management – has to this point appeared to emphasise putting the corporate and a unique – and rather more viable – trajectory. The indications are primarily an elevated give attention to debt discount and rationalization of the enterprise. Actions talking louder than phrases, this contains at the least within the first yr observe by way of by way of the dedication of free money flows to debt discount and the closing/consolidation of sure manufacturing and distribution services. We’re additionally inspired by administration’s specific aim of decreasing the corporate’s leverage ratio, over time, by roughly 50% to a variety of two.0 to 2.5. We’d favor an excellent decrease leverage ratio given the character of the enterprise, however we’ll set that apart for the second.

Furthermore, the corporate’s not too long ago closed manufacturing and warehouse property in Sydney, New York is at the moment listed on the market by way of Cushman & Wakefield. The complicated consists of roughly 757,000 sq. toes (300,000 manufacturing, 380,000 distribution/warehousing, and ancillary workplace house) over 45 acres which makes it tough to search out comparable industrial properties within the area from which to develop a possible sale value for the property. Nevertheless, our expectation is that the property, if bought in a single transaction, may yield someplace between $20 million to $40 million. A valuation on this vary would end in a slightly low value per sq. foot, which we consider isn’t unlikely given the dimensions of the ability and its uncommon location. Regardless, the potential sale of the property for any important amount of money would enable the corporate to additional scale back debt – an expectation on our half and, in our view, a possible take a look at of administration’s dedication to debt discount.

We’re much less sure what financial profit the corporate might understand from its owned property in Portugal, which can be scheduled to shut in 2024 and, presumably, additionally topic to sale. The property is a single story manufacturing constructing with roughly 65,000 sq. toes per our estimates so we don’t anticipate something notably materials from the liquidation of this location given the comparatively small dimension of the constructing. Nonetheless, any potential proceeds may nonetheless additionally contribute to debt discount.

Nonetheless, regardless of the constructive preliminary indicators, we take into account the corporate’s new administration to stay on probation because it’s not but fully clear that the corporate as a complete has damaged from previous expertise. In his departure announcement, Thomas Kroeger, the impartial lead director, said that “we want to thank Boris for his exemplary management and devoted service as CEO. Boris’s innumerable contributions throughout his 18-year tenure, the final 10 main the Firm as CEO, have efficiently expanded the expansion alternatives for the Firm.”

That is demonstrably false. As famous earlier, over the past 10 years the corporate has spent almost $800 million in money on acquisitions which have yielded primarily no long-term outcomes or, at finest, served to offset decline in different elements of the enterprise – not precisely indicative of efficiently increasing the expansion alternatives for the corporate. The newest acquisition of PowerA, additionally as mentioned earlier, has additionally not yielded important new progress alternatives.

Clearly, there is a component of politeness in such statements, however on the identical time, it’s mandatory that the corporate and the corporate’s management, together with the board, totally acknowledges and perceive the catastrophe which characterised the final 10 years of Boris Elisman’s management.

A Sense of Déjà vu?

The latest strikes at ACCO mildly remind us of an analogous sequence of occasions a number of years in the past at one other small producer – LSI Industries (LYTS). Within the years previous to new administration becoming a member of LSI, the corporate had been making varied acquisitions – some fairly questionable – in a useless try to beat deterioration within the stability of the enterprise. The development was not particularly totally different from previous occasions at ACCO. LSI’s new administration subsequently refocused the corporate on bettering current enterprise traces, restructuring legacy companies by aggressively closing and consolidating services, promoting extra actual property, and decreasing debt, all whereas supporting a strong and fairly well-supported dividend. In 2018 and 2019, after we wrote favorable articles on LSI Industries, the corporate’s shares had been buying and selling within the vary of $4.00 to $5.00, having come down from the low teenagers in prior years, and paying a dividend of round 4.5%. The corporate had been an underperforming industrial producer very like ACCO has been, though in a unique business. The numerous adjustments finally led the corporate to changing into nearly debt free and noticed the shares rise as excessive as $16.00 per share for a compound annual return exceeding 20% for the reason that publication of our articles.

The parallels with ACCO usually are not actual on each measure. LSI primarily operates in a rising business (lighting and lighting controls) with a big proportion of the corporate’s revenues pushed by massive contracts with homeowners implementing related techniques throughout many places. As well as, LSI had a bigger portfolio of disparately owned manufacturing and warehouse actual property, which might be consolidated and bought to generate substantial money for debt compensation. In distinction, ACCO’s actual property holdings are extra restricted, thus decreasing administration’s means to proper the enterprise by way of actual property gross sales alone. LSI’s debt load was additionally lower than is the case for ACCO making the power to repay primarily all the corporate’s long-term debt in a comparatively quick time frame (with concerted effort) extra achievable. Lastly, LSI’s board and administration made a extra outlined and intentional change in basic route and tone with the administration change than has to this point occurred at ACCO.

Nonetheless, we see the potential for a fabric change in ACCO’s route alongside the traces of that which occurred at LSI Industries. ACCO’s resent strikes to shut and consolidate a handful of services, although extra restricted, ought to nonetheless enhance the corporate’s capital construction and working margins. The said refocusing on natural progress and dedication of money flows to debt discount over acquisitions can be a welcome signal that administration intends to be extra accountable with shareholder funds going ahead. Debt discount will in flip contribute to increased internet revenue and money flows, as increased rates of interest have pushed internet curiosity expense to 32% of the corporate’s adjusted working revenue. A halving of curiosity expense alone would enhance earnings per share by round $0.17 – not insignificant for an organization with core earnings per share (on a GAAP foundation) of round $0.80 and a share value close to $5.00. Basically, a give attention to debt discount alone may over time enhance earnings per share by 20% with all else remining equal.

Dividends

A give attention to debt discount – and a excessive dividend yield – typically results in questions surrounding the sustainability of an organization’s dividend. The identical query occurred at LSI Industries and for primarily the identical causes we had been assured that LSI may maintain its dividend by way of its transition, so we’re equally assured that ACCO also can maintain its dividend supplied the core enterprise doesn’t fall off a cliff.

ACCO’s annual expenditure for dividends is roughly $28.5 million per yr, a comparatively small fraction of the corporate’s earnings energy and free money flows. Certainly, the dividend represents solely about 25% of the corporate’s annual free money flows (together with our ahead free money move projections) leaving important margin for debt compensation whereas sustaining the present dividend.

We’re thus not involved concerning the dividend in the intervening time, barring a big drop in annual revenues, i.e., exceeding 10% over the following two years.

Projections

Our confidence within the sustainability of the dividend is predicated on our ahead projections for the corporate based mostly on our monetary fashions.

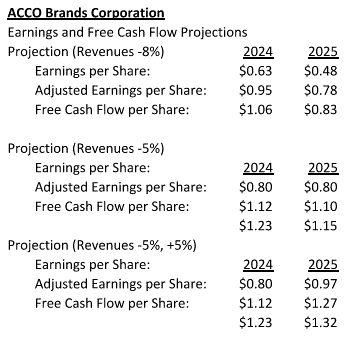

On stability, our monetary fashions give attention to base valuation and potential draw back threat. Our fashions subsequently usually anticipate persevering with erosion in revenues, comparatively secure gross, and working margins, that are barely extra pessimistic than prompt by administration’s most up-to-date steering. We anticipate a continued emphasis on debt discount for at the least the following two years (and ideally past) per administration’s said long-term goal leverage ratio. As well as, we carried out projections incorporating extra extreme income erosion than projected by administration in addition to extra pessimistic gross margin and working margin outcomes to estimate at what level income declines would place the corporate’s emphasis on debt discount – and doubtlessly the dividend – at important threat.

Our baseline projection (together with amortization expense and excluding any extra goodwill impairments or restructuring prices) for each 2024 and 2025 is between $0.76 and $0.82 per share. We venture free money move for every year will vary between $105 million and $115 million, which is barely beneath the corporate’s said ahead expectations. As well as, based mostly on these values, our baseline projection for internet debt discount over the following two years is roughly $180 million assuming a comparatively secure working capital place and with none contribution from actual property sale proceeds. A short abstract of our mannequin projections based mostly on varied situations (together with midpoint values) is mirrored within the following desk:

Winter Harbor Capital, L.L.C.

As well as, whereas earnings per share, free money flows, and debt repayments are impaired, we don’t see important threat to the dividend till income declines strategy roughly 12% each year. On this case, dividend funds may nonetheless be made based mostly on free money flows though the payout ratio would doubtlessly exceed 100%. On this case, the low finish of our projected earnings per share is roughly $0.20 to $0.25 in 2025. This isn’t exterior of the vary of potentialities for the corporate, particularly given administration’s personal admission in the newest earnings name that income developments are trending decrease than their expectations originally of the yr. Nevertheless, it will characterize a big extra deterioration in revenues past latest expertise and would want to persist into 2025.

Unusually, we didn’t carry out intensive evaluation of potential constructive income and working consequence outcomes in our sensitivity evaluation, as we might usually do to ascertain a valuation vary. The rationale on this occasion is because of the truth that just about any working final result which exceeds our base case of income decline within the vary of 5% to eight% and secure gross margins (except value reductions fall nicely wanting the corporate’s aims) solely leads to considerably increased earnings and valuation outcomes versus, as we talk about subsequent, is an already compelling potential return.

Valuation

We strategy valuation from varied views to develop a holistic viewpoint. Within the case of ACCO, we take into account the twofold problem of creating a reputable valuation for the corporate. First, the corporate’s historic efficiency has been various, at finest, which makes ahead projections for the corporate’s efficiency extremely unsure and incorporates an inherent low cost to the market value which could be tough to estimate. Certainly, the corporate’s personal administration has at occasions struggled to develop correct projections for the enterprise, initially anticipating income a decline for 2024 of 5% which was revised to a extra important decline of as a lot as 7% in the newest earnings name.

Second, ACCO has not traditionally traded in a fashion the place the straightforward utility of widespread valuation multiples gives a convincing ahead valuation. The worth/earnings ratio has various broadly over the past a number of years, as have measures corresponding to free money move yield, and so forth. On these measures, the corporate has typically appeared low cost (although not essentially cheap) and precise outcomes have confirmed the unreliability of merely making use of valuation multiples. The explanations are varied, together with not simply the corporate’s uneven operational efficiency and excessive debt load however, we might argue, a reduction related to previous administration’s failures. Furthermore, within the occasion new administration reverses a few of these points, previous valuation multiples might not moderately mirror future valuation multiples.

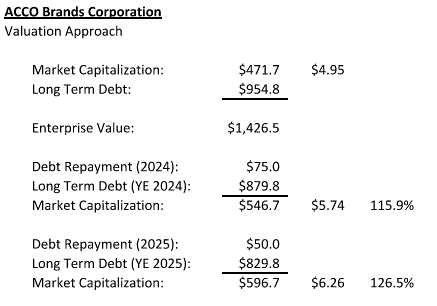

Nonetheless, some benchmark is required and given the above, we now have approached creating a valuation based mostly on administration’s emphasis on debt discount. In an effort to assess the potential ahead worth of the shares, we now have subsequently assumed that the corporate’s enterprise worth stays fixed and assessed the potential affect on share valuation of debt compensation based mostly on free money flows developed in our monetary fashions. On this foundation, we estimate ahead valuations as proven beneath:

Winter Harbor Capital, L.L.C.

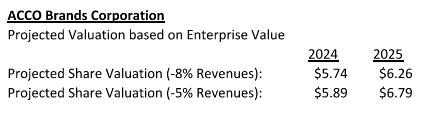

A barely much less pessimistic perspective on revenues, i.e., annual declines of 5% as a substitute of 8% suggests increased valuations as debt compensation is accelerated, as proven within the following desk:

Winter Harbor Capital, L.L.C.

Notably, our valuation expectations don’t depend on a big enhance in most of the firm’s enterprise valuation metrics (or any enhance for that matter). This strategy merely assumes that debt worth is actually transformed to fairness worth on a one-for-one foundation as debt is repaid by the corporate. We must always be aware that whereas these are level estimates, they’re usually the midpoint of valuation ranges developed by way of our monetary fashions.

When it comes to valuation ratios, ACCO already trades nicely beneath many peer establishments, its personal historic multiples, and the broader sector. The compensation of ~$80 million per yr in debt alone ought to add considerably to the share worth, even with a persistently beneath common EV/EBITDA ratio.

On this evaluation, we additionally ignore for the second any potential valuation affect from company debt tax shields with respect to capital construction for a pair causes. The primary is avoiding overcomplicating an in any other case simple evaluation. The second is that whereas the lack of company debt tax shields related to debt payoff might affect enterprise worth and thus fairness worth, the affect is probably going immaterial and, furthermore, may very well positively affect valuation as there’s a robust argument to be made that the corporate’s debt degree relative to working efficiency and income trajectories is extreme, and thus the corporate is past what the market would take into account the optimum debt degree.

Nevertheless, the market will doubtless take time to acknowledge the shift of worth from debt to fairness by way of repayments till it’s clear that the corporate’s new administration is dedicated to a unique operational strategy than has been the case for the final decade. We’d not be stunned to see the corporate’s EV/EBITDA ratio proceed to say no within the instant future on account of debt reductions within the face of ongoing depressed share valuation. Nevertheless, barring a big change within the fundamentals of the underlying companies or administration’s return to questionable acquisitions, the valuation ought to alter in time.

When it comes to draw back threat, whereas we might argue that the above methodology presents a nonetheless slightly beneath common valuation for the corporate, extra declines can’t be dominated out. Within the occasion that income efficiency got here in on the low finish of our stress evaluation, it’s not inconceivable that shares may commerce down in to the vary of $3.00 based mostly on our estimates with no offset for restricted extra debt discount. The decline might be worse ought to the corporate elect to cut back the dividend. On this occasion, the worry of chapter threat, particularly whereas debt stays excessive, would overtake any advantage of adjustments to the corporate’s capital construction.

A Touch upon the Brazilian Actual

Lastly, we’d counsel the corporate can be nicely served to contemplate hedging its potential Brazilian tax legal responsibility in native forex. ACCO accrued a big legal responsibility for potential Brazilian revenue tax claims of $44.5 million in 2012. The Brazilian actual has depreciated considerably towards the greenback within the interim to the purpose the place the present accrual, together with accrued curiosity and penalties, is now solely $21.7 million. We don’t presume to foretell the long run worth of the Brazilian actual – that is past our experience – however would counsel an argument might be made to hedge the potential legal responsibility and get rid of part of the potential affect ought to the actual respect given the corporate’s different myriad challenges.

Conclusion

We’ve lengthy adopted ACCO because of the notably low (and chronic) valuation over time, though our skepticism of the corporate (and particularly its management) has all the time saved us on the sidelines. Our issues proved well-founded, as the continued development of losing shareholder funds on acquisitions yielding little long-term worth has induced the shares to say no by almost half since our final article.

Nevertheless, the long-overdue departure of Boris Elisman and new administration’s emphasis on debt discount has induced us to reevaluate our place. A major obstacle to the corporate’s enchantment has been eliminated, and the promise of a dedication to debt discount in coming years provides to the enchantment. The corporate decreased long-term debt by $87.5 million within the final yr and seems able to repay an extra $80 million in internet debt throughout the yr forward. If that’s the case, this may mark a big (and welcome) shift from previous expertise.

Nonetheless, the corporate’s new administration group should nonetheless display the energy of their newfound dedication to debt discount and higher stewardship of shareholder property and money flows, and our revised perspective depends on the veracity of their intentions. It’s essential to emphasise that our revised evaluation depends on administration remaining dedicated to debt discount. A fabric deviation on the a part of administration from that focus would characterize a fabric change within the basic nature of the corporate and considerably change our perspective. In the end, time will inform whether or not latest occasions warrant our current cautious optimism tempered by our years-long remark of the corporate from the sidelines and an acute consciousness of the corporate’s inherent and ongoing challenges.

Nonetheless, together with the all-time low valuation by just about any measure, moderately safe dividend, and (thus far) demonstrated dedication to debt discount, we now have positively adjusted our perspective on the corporate and established a modest place in ACCO. Barring a big collapse within the underlying enterprise or administration’s return to spendthrift methods, it’s tough to see many believable outcomes that aren’t constructive for shareholders at this level.