Traton’s Q2 Earnings: A Turnaround Play At A Crossroads (OTCMKTS:TRATF)

jetcityimage/iStock Editorial by way of Getty Photographs

Traton Group (OTCPK:TRATF; OTCPK:TRATY) is among the largest truck and bus producers on the earth, and it’s numbered amongst these shares that up till March outperformed the market and turned up as good surprises for traders. Nonetheless, since its final quarterly report, the Traton shares have consolidated and began buying and selling sideways between $30 and $36.

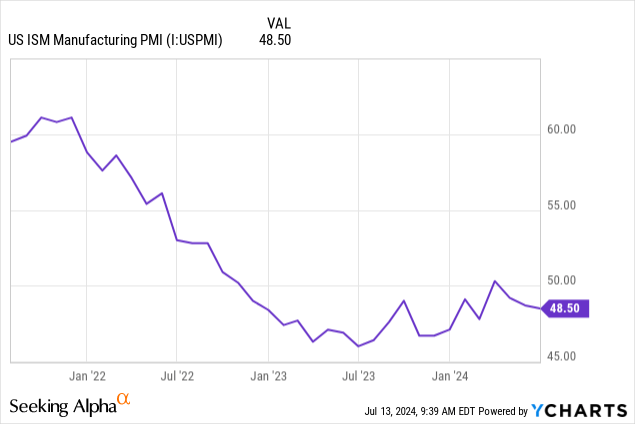

Typically, industrials haven’t carried out effectively up to now 12 months. The manufacturing index has dropped considerably under 50, and we have now been solely just lately seeing indicators of a restoration, though we aren’t but in enlargement territory.

Particularly, beginning in April, most equipment and car producers – be they automobiles, vehicles, or tractors – have both entered right into a bear market or haven’t been capable of sustain with the market. The explanation could be seen: demand is slowing. That is the impact of two causes: provide has caught up with pent-up demand accrued within the two years after the pandemic; excessive rates of interest are making many customers postpone their buy of pricey discretionary items that usually require financing. If this second development goes on for a bit extra time, we may very well see a push-forward impact that will trigger a brand new fast surge in demand as soon as charges ease.

As the brand new earnings season approaches, we have already got some fascinating information that Traton has launched earlier than its quarterly report. The truth is, Traton launched its Q2 preliminary gross sales.

Traton: The Firm

Many should still not be conversant in this firm as a result of it’s a latest spin-off from Volkswagen. In Europe, up to now few years, we have now seen three principal spin-offs within the trade that I in contrast. Apart from Traton, we additionally had Daimler Truck (OTCPK:DTRUY) and Iveco Group (OTCPK:IVCGF).

Traton owns 4 business manufacturers: the Swedish Scania, the German Man, the American Navistar, and Volkswagen Truck and Bus which primarily operates in Latin America.

In 2023, it bought 338k automobiles and obtained 265k orders. The vast majority of its enterprise is finished with vehicles (281k automobiles bought), with buses accounting for lower than 10% of complete gross sales.

In complete, Traton’s income was €46.9 billion in 2023, and its working revenue was €4 billion, which resulted in a RoS of 8.6%. This was notably good wince in 2022, the RoS was 5.1% and in 2021 it was barely constructive.

The income combine additionally reveals how the corporate is a real producer: €45.7 billion comes from industrial operations, with the financing providers department incomes solely €1.6 billion.

Amongst Traton’s 4 manufacturers, Scania was essentially the most worthwhile, with Man and Navistar struggling. Nonetheless, on the finish of 2023, Man reported a 7% RoS, a consequence not seen up to now 15 years.

Traton is very uncovered to Europe, the place 82.5k vehicles had been bought (39% of complete vehicles), North America WITH 53.2k vehicles bought (25.3%), and Latin America with 47.2k vehicles bought (22.4%), 40.5k of which had been bought in Brazil. The most important bus market is North America, with 14k automobiles out of 29.8k bought there. After all, the corporate is already energetic within the BEV enterprise and bought 2,430 models in 2023.

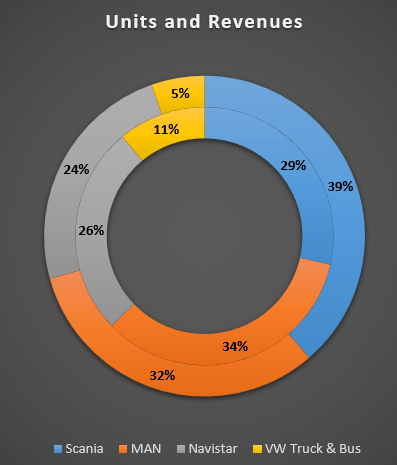

Beneath, we see the breakdown of models bought and revenues by model. The internal circle represents the proportion of models bought, and the outer circle reveals the income of every model.

Writer, with information from Traton’s 2023 Annual Report

We are able to see clearly that Man is the main model by quantity, however its income per car is decrease in comparison with Scania, which accounts for 39% of revenues whereas promoting solely 29% of complete vehicles.

On the finish of 2023, Traton’s stability sheet carried €1.7 billion in money and €21.7 billion in LT debt. However Traton’s industrial operations have a internet debt/EBITDA ratio nonetheless round 1.

Money move from industrial operations was €3.6 billion in 2023, as an indication that the corporate can turn into extremely worthwhile.

Traton’s shareholder construction is sort of easy: at present, Volkswagen holds virtually 90% of the share capital and the remaining 10% is free-float. This implies Volkswagen has a giant affect on the corporate, leaving little room for activist traders or funds to step in and turn into the main voice of the board.

Traton’s Q2 Gross sales

Let’s transfer now to the core of this text. As mentioned, Traton already revealed its preliminary Q2 information, displaying that unit gross sales had been down 5% globally to 79k. The identical 5% decline is true if we have a look at the entire first six months of the 12 months. Electrical automobiles’ deliveries had been down, too, posting a -7% YoY for the primary half and a -26% in comparison with the prior-year quarter.

On the identical time, Scania elevated its gross sales by 8% for the quarter and 13% for the primary 6 months of the 12 months. Navistar and Man went in the wrong way. Traton’s administration repeatedly mentioned that the markets are normalizing. This implies Europe and North America are softer, whereas Latin America is seeing a robust bounce again. However Traton has thus far been capable of hold its pricing up even earlier than normalizing demand. This has created greater margins and better income per car. The truth is, in Q1 2024, Traton reported a staggering 9.4% RoS, which is the very best ever for Traton.

On the finish of Q1, Traton’s administration mentioned it remained optimistic and did not must revise downwards the corporate’s targets, with the double-digit margin as the primary one.

After all, the freight market, as Traton admitted, just isn’t doing effectively and costs have been reducing for nearly 2 years. Because of this, the end-customers Traton sells its vehicles to have turn into cautious and hesitate earlier than lengthy lead instances due to the uncertainty of the surroundings they function in. On the identical time, fleets are outdated and are growing older. So, though some extra weaknesses could also be seen, the need to start out renewing the prevailing fleets will ultimately emerge and drive new demand.

Let’s now make some estimates on what the upcoming report might appear to be.

We already know Traton’s models bought might be down round 5%. However we additionally know that manufacturing prices – particularly uncooked supplies – have been taking place, aside from wages. On the identical time, pricing has remained robust and this may absolutely assist Traton’s margins.

In Q1 2024, the common income per car was €145k, whereas in Q1 2023 it was €132k. I do not anticipate Q2 to have a a lot greater income per car, so I’ll use €145k to run my forecast. Primarily based on the deliveries Traton already disclosed, we’re going to see an €11.5 billion quarter. Contemplating a RoS near 10%, we might even see Traton report an working revenue of €1.15 billion. Internet earnings may very well be round €800 million and this might make Traton report quarterly EPS round €1.60.

Nonetheless, whereas I believe the report might be financially talking good, what is going to matter extra would be the phrases Traton’s administration will spend on the outlook. Likelihood is the surroundings retains on being smooth and Traton might must warn traders about decrease annual outcomes. If so, Traton shares will in all probability drop. True, Traton shares at present commerce under a 6 PE and a 0.3 P/S. Its FCF yield is an absurd 16%. The inventory is reasonable, however Mr. Market just isn’t keen to pay far more for cyclical producers linked to the car trade. Because of this, the actual driver of the inventory goes to be the variety of incoming orders. If this drops considerably greater than 5%, then Traton’s shareholders might even see some volatility.

All in all, I believe Traton is at present pretty priced given the gloomy outlook. On the identical time, if we see its administration capable of enhance its profitability even throughout softer instances, then we should always put Traton on our watchlist as a result of it could turn into a chance to purchase on the dip whereas ready for the subsequent rebound in gross sales.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please pay attention to the dangers related to these shares.