What Second Place Means For AMD (NASDAQ:AMD)

serggn

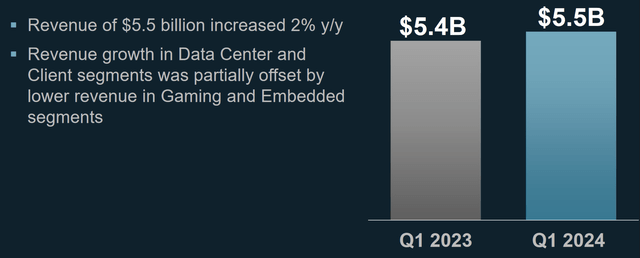

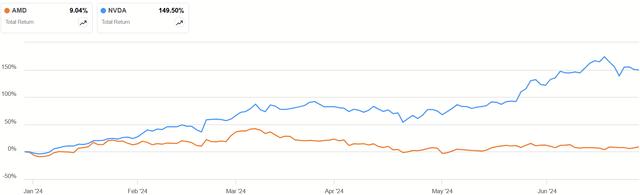

It has been a couple of 12 months because the craze of generative AI took off, triggering a spike within the share value of semiconductor firms, whose GPUs naturally feed into that market. Essentially the most outstanding of the 2 have been Superior Micro Gadgets, Inc. (NASDAQ:AMD) and NVIDIA Company (NVDA), the previous being my focus right now. Whereas each shares initially took off, the primary half of 2024 hasn’t been as favorable to AMD.

AMD vs. NVDA 6M Whole Returns (Searching for Alpha)

In fact, this does not essentially say something about fundamentals. It may simply replicate market sentiment. That mentioned, the standard knowledge appears to be that whereas Nvidia and AMD are each higher chipmakers than Intel Company (INTC), Nvidia nonetheless beats AMD.

But, with a a lot flatter inventory motion, it may even be the case that AMD is attractively priced for what has been a context of quickly bettering fundamentals for each firms. Whereas I coated AMD earlier than and was dismissive, I made a decision to have a look at what AMD brings to the desk and consider it by itself deserves, even when it is simply #2.

Beforehand, I thought-about that AMD was unrealistically valued and that the way forward for AI was too unsure to pay that a lot of a premium. With extra up-to-date info on enterprise tendencies, nonetheless, we will see a clearer future for AMD’s function in it.

With the present money flows, tendencies, and capital allocation, I do not suppose the $160 is a good entry value, and I am going to clarify why the inventory is only a Maintain for now.

Financials

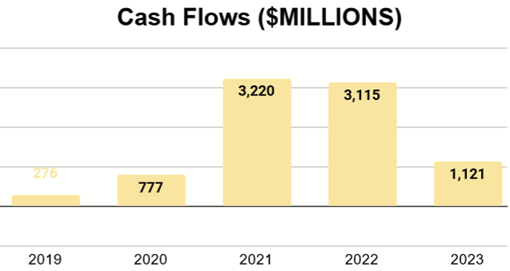

AMD’s free money movement skilled vital progress during the last 5 years, with a dip in 2023 after 2022, exhibiting indicators of their business’s cyclicality.

Creator’s show of 10K information

This dip was largely pushed by barely much less income and an uptick in R&D, which is sensible contemplating the AI alternative that opened up that 12 months.

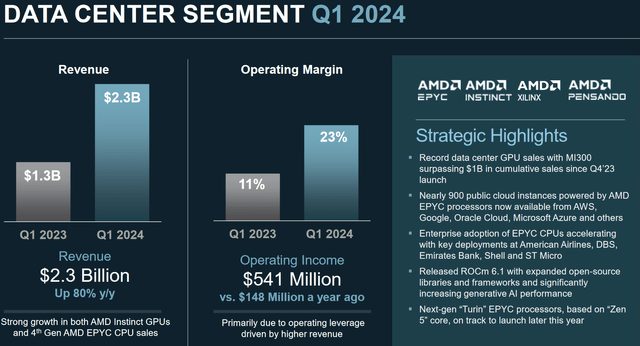

Q1 Outcomes, in the meantime, confirmed that revenues are on the rise once more. It was solely a slight improve, however a considerable quantity of this got here from their Information Middle Section.

It is a $1 billion distinction in comparison with a 12 months prior. It is also a phase that exhibits an bettering margin.

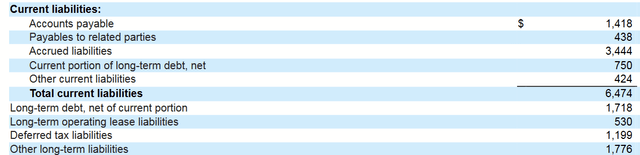

Liabilities (Q1 2024 Type 10Q)

The latest 10-Q exhibits little or no debt, indicating a really lean and wholesome stability sheet.

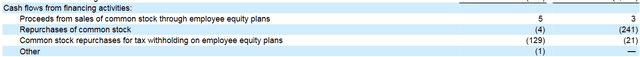

Money Circulate Assertion (Q1 2024 Type 10Q)

In the meantime, correct buybacks on the open market (not these associated to stock-based compensation) fell to near-zero year-over-year, which I truly discover to be a optimistic (I am going to elaborate later).

AMD’s Robust Fits

One fascinating sample that AMD has been touting lately is what preferences customers are displaying in regard to their information heart wants, as that is additionally the place NVDA has seen vital progress.

CFO Jean Hu has been on a tour of a number of investor conferences up to now couple of months. In every of these, she has spoken about the place AMD is exhibiting energy. I am going to quote her (emphasis added) from the June 2024 NASDAQ Investor Convention about price financial savings:

…while you have a look at the CIOs right now, they’re going through a number of challenges. They’re restricted by energy, by house. And likewise, they’re attempting to determine undertake AI. So with all these issues, the TCO will turn out to be actually vital, while you have a look at the AMD Answer, we truly can present the identical quantity of compute with 40% much less servers with our Gen 4 household. What which means is you’ll be able to reduce CapEx by half on the very starting and the operation price to function these servers will likely be additionally 40% much less, so while you have a look at the entire TCO, we do suppose that can assist the refresh cycle, proper?

On the June BofA Securities Convention, she additionally elaborated:

…we’ve been working with our prospects, hyperscale enterprise prospects for a multiyear roadmap. So, when you concentrate on the type of choices they’re making and the CapEx they’re spending, it acquired to be multiyear. You have to plan out not solely this technology however future generations.

In abstract, all through these convention calls, she argued that AMD has a job to play in price discount for the long run. This essentially makes it a long-dated gross sales course of, one which requires AMD to win over the CIOs of a company for large commitments. It isn’t a quick win, however it’s a worthwhile one which will likely be long-dated too.

A lot of that is owed to AMD’s merchandise are being most well-liked for inferencing. As she put it:

Individuals want to coach the mannequin first, then the inference is the place they earn money.

Furthermore, she defined that generative AI is not only a GPU sale; CPUs have one thing to supply too:

Once you have a look at the standard foundational functions, your ERP system, your database and your buying web site, your Meta, Fb, Instagram, and all these issues, you do not want the GPU. The CPU has the very best TCO for that type of foundational conventional functions.

These are vital prospects and makes use of that she is describing right here, a part of our mainstream thought of tech and the way it’s virtually used.

Even on the GPU entrance, AMD has received the arrogance of Microsoft Company (MSFT), teaming up with them to offer a aggressive cloud product.

It’s for all of those causes that I count on AMD may have some degree of certainty about its progress going ahead, as unsure as the longer term round AI nonetheless is.

Share-Primarily based Compensation and Buybacks

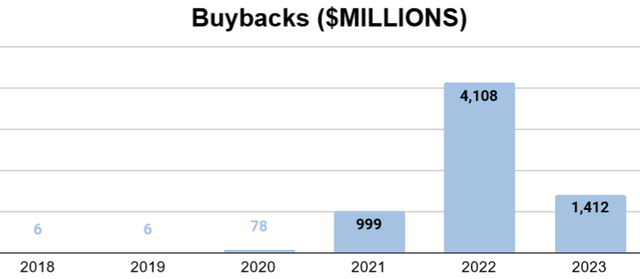

One other factor we have to take into account is how the longer term appears to be like for share-based compensation and buybacks. I discussed earlier that I assumed it was good the buybacks had declined, an issue I highlighted after I coated NVDA.

Lengthy-term returns on particular person shares, no matter is true of the entire firm, are damage when shares are repurchased at a premium. Equally, they’re value-additive when repurchased discounted. A typical pattern I’ve seen throughout tech shares, whether or not they’re tied to AI hype or not, are buybacks at excessive multiples and thus pretty low returns on capital.

Creator’s show of 10K information

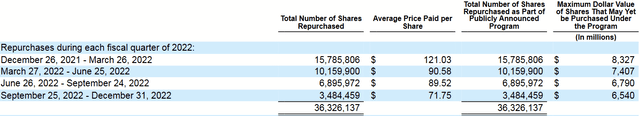

As we will see, buybacks did not actually take off till free money movement did, so we solely have just a few years to make use of for our personal “inferencing” about how AMD will allocate capital going ahead. 2022 was a 12 months when free money movement was about as excessive as 2021, however the buybacks had been far much less.

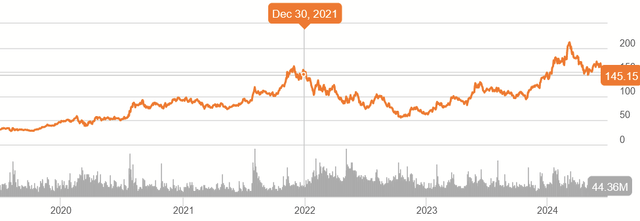

AMD 5Y Worth Historical past (Searching for Alpha)

As seen right here, 2021 ended on one thing of a peak after which proceeded to say no by means of 2022, presenting nice shopping for alternatives.

2022 Common Worth Per Share (2022 Type 10K)

The repurchases had been extra concentrated within the higher finish of that decline, with little or no in the end used for the lower cost. All of those are decrease than the present value, and the sharp discount in buybacks in 2023 and particularly in Q1 2024 appear to indicate that the corporate has developed a style for value.

Nonetheless, we’ve to contemplate the impact of stock-based compensation, or SBC, which has elevated yearly for the previous decade, with 2023’s ranges rivaling the whole free money movement. Buybacks on this context successfully flip SBC into an working expense that merely is not reported as such, however however is felt by means of the fact of the money flows.

Semi Cycles

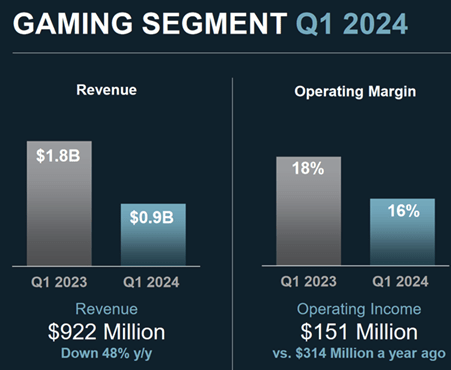

Whereas a few of these segments are rising, a few of them are nonetheless uncovered to the cyclicality that’s frequent to the semiconductor business.

Q1 2024 Firm Presentation

For instance, gaming phase income declines had been nearly as a lot as the information heart’s positive aspects. Specifically, gaming is influenced by the cycle of its new consoles, and issues are at a little bit of a lull, significantly as that is non-essential and would not enhance most enterprise backside or high strains like information facilities can.

My level? Count on some noise within the sign of free money movement progress, particularly, as the opposite segments ebb and movement whereas the information heart grows.

Valuation

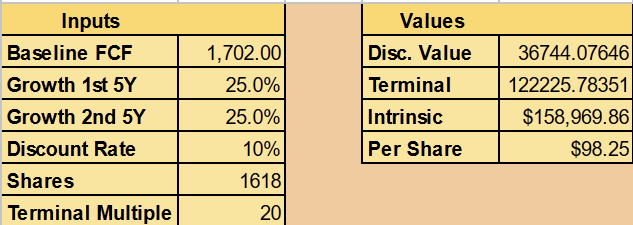

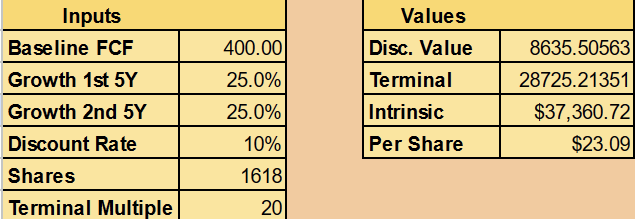

Primarily based on this abstract, I will present two valuations, each utilizing a Discounted Money Circulate, or DCF, mannequin. I am going to make the next assumptions:

- $1,702M in annual free money movement.

- CAGR of 25% for the subsequent decade.

- Terminal a number of of 20.

My FCF determine is the typical for 2019-2023, which I believe captures the latest patterns with cycles. With the chance offered by AI, I believe a really excessive progress fee like 25% is possible, even so long as a decade. I give a terminal a number of of 20 simply to permit for some potential decline as we attain the opposite aspect and as maybe present ranges of hype could not exist.

Creator’s calculation

This means a good worth per share of about $98. That is priced at a ten% low cost fee (typical return of a broad market index), so optimistic returns are nonetheless doable, perhaps not as excessive as that of the market. Nonetheless, we have to take into account the potential draw back posed by the SBC and buybacks.

Creator’s calculation

If we issue within the outflows from previous buybacks which have coincided with SBC, that roughly brings present ranges of FCF all the way down to about $400M, suggesting a a lot decrease intrinsic worth.

Conclusion

With sturdy monetary outcomes and a latest marketing campaign by CFO Jean Hu to make clear the place AMD thrives, the corporate is poised to stay within the sport and provides Nvidia a run for his or her cash. The primary dangers to long-term Superior Micro Gadgets, Inc. buyers aren’t on the operational aspect, however within the potential without spending a dime money movement misplaced on stock-based compensation and buybacks. We must always proceed to watch what sort of urge for food the corporate has for its personal shares and if this regime of SBC will proceed.

Even when that performs out favorably, the present value is not signaling a transparent low cost to that future. Contemplating how simply the market was in a position to bitter on AMD in 2022, maybe right now’s potential consumers could be higher served by asking for a greater entry value. For these causes, I take into account AMD to be a reasonably strong Maintain.