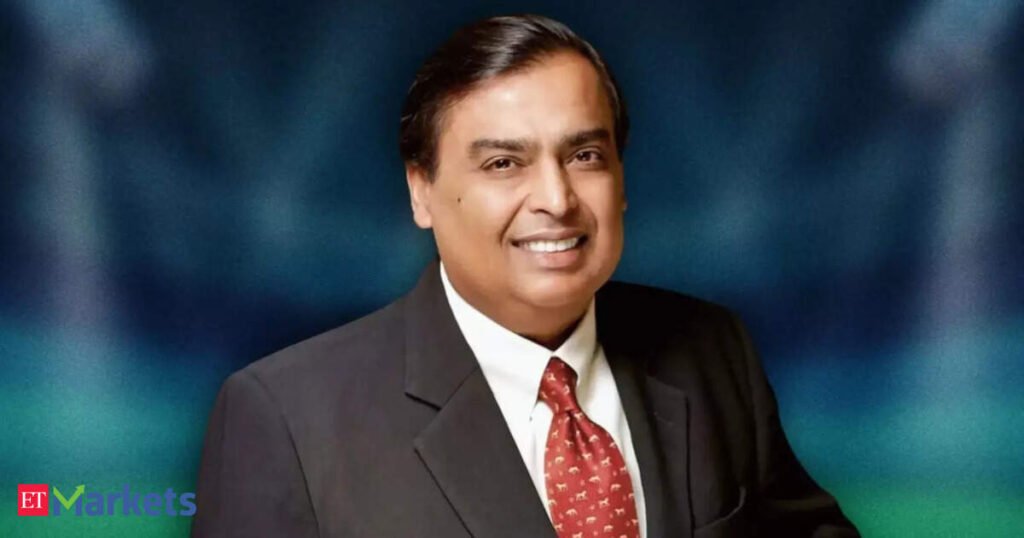

$16.5 billion in a yr! Mukesh Ambani leads India’s 2025 billionaire wealth surge

As per the Bloomberg Billionaires Index, Reliance Industries Chairman Mukesh Ambani added a considerable $16.50 billion to his web price in 2025. The surge coincided with a strong rally in Reliance Industries—India’s largest firm by market capitalisation—which posted its strongest efficiency since 2020 with shares climbing practically 30%. Increased refining margins, telecom tariff hikes, resilient retail efficiency and upcoming value-unlocking catalysts collectively drove the sharp rise in Ambani’s wealth.

Following shut behind is Lakshmi Mittal, Chairman of world metal main ArcelorMittal, the world’s second-largest steelmaker. Information reveals that Mittal, at the moment the seventieth richest individual globally, noticed his web price rise by practically $12 billion in 2025, taking his whole wealth to $31 billion.

Sunil Mittal, founding father of Bharti Enterprises, which owns telecom operator Airtel, additionally noticed a big leap in wealth. His web price elevated by $6 billion to $29 billion in 2025. Airtel’s inventory gained 31% year-to-date, whereas the corporate reported an 89% year-on-year leap in consolidated Q2 web revenue to Rs 6,792 crore.

Gautam Adani, founding father of the Adani Group, added $5.9 billion to his fortune in 2025, taking his web price to $84 billion. One of many key drivers of the rebound was the market regulator Sebi’s clear chit to Adani within the Hindenburg case, which helped restore investor confidence. Adani stays the second-richest Indian, behind Mukesh Ambani.

In the meantime, Kumar Mangalam Birla, Chairman of the Aditya Birla Group, with a web price of $22 billion, noticed his wealth develop by $4 billion throughout the yr. Uday Kotak, founding father of Kotak Mahindra Financial institution, added over $2 billion to his fortune, taking his web price to $16 billion and inserting him within the prime 10 richest Indians on the checklist.

Others featured on the checklist embrace Vikram Lal, founding father of two-wheeler main Eicher Motors, and Nusli Wadia of the Wadia Group, which additionally owns FMCG heavyweight Britannia Industries. They’re adopted by Rahul Bhatia, co-founder of IndiGo, India’s largest airline by market share. Samir Mehta, chairman of the Torrent Group, additionally makes the minimize with a web price of $7 billion.Among the many laggards, Shiv Nadar, founding father of IT main HCL Tech, tops the checklist. With a web price of $39 billion, his wealth declined by practically $4 billion, in accordance with the Bloomberg Billionaires Index. The drop comes amid heavy FII promoting in IT shares, with HCL Tech shares down 15% in 2025.

Azim Premji, Indian know-how veteran and former chairman of Wipro, additionally noticed his web price fall by $3 billion to $28 billion. Wipro’s inventory has slipped 12% for the reason that begin of the yr. In 2019, Premji handed over the function of govt chairman to his son Rishad Premji, whereas he continues as founder chairman.

Ok P Singh, founding father of actual property main DLF, has a web price of $14 billion, marking a decline of $3.38 billion in 2025. Shares of DLF have fallen 17% this yr, weighing on his wealth.

Rounding out the checklist are Dilip Shanghvi, managing director of Solar Prescription drugs, whose web price has dropped by over $4 billion to $25.5 billion, and Ravi Jaipuria, chairperson of Varun Drinks, whose wealth has declined to $13 billion, Bloomberg information confirmed.

(Disclaimer: Suggestions, recommendations, views, and opinions given by the specialists are their very own. They don’t symbolize the views of the Financial Occasions)