U.S. Inflation Aid And Client Cooldown Boosts Probabilities Of Price Cuts

JLGutierrez

Inflation aid with a “low” 0.1%

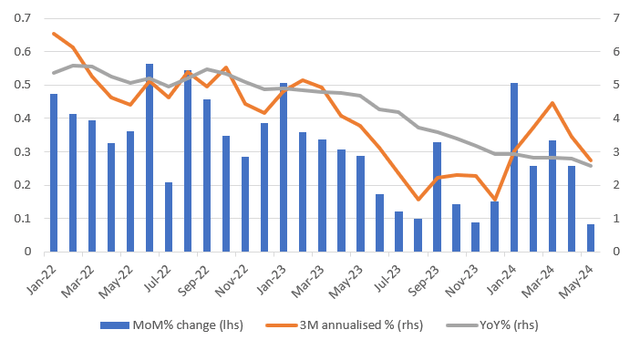

The Could private earnings and spending report has supplied some encouragement that inflation pressures are easing as soon as once more, after coming in far too sizzling within the first three months of the yr. The core private client expenditure deflator, a broader measure of inflation pressures than CPI that the Fed prefers to give attention to, got here in at 0.1percentMoM/2.6percentYoY. This was anticipated given the read-through from parts throughout the CPI and PPI studies, however after loads of upside surprises this yr, it’s a aid. The headline measure (together with meals & vitality) was 0.0percentMoM/2.6percentYoY, as anticipated.

Trying on the unrounded numbers, the month-on-month change in core inflation was truly a “low” 0.1%, coming in at 0.083% to three decimal locations, though April was revised up marginally to 0.259% from 0.249%, thereby making it a 0.3% MoM rounded, which is a tiny bit disappointing. Total although, it helps the argument that inflation is trying higher behaved, which can properly open the door to rate of interest cuts later within the yr.

Core PCE deflator

Supply: Macrobond, ING

Client cooldown continues

Family earnings was stronger than predicted, rising 0.5% MoM in nominal phrases, with actual family disposable earnings additionally up 0.5%. Spending additionally recovered, rising 0.3% MoM in actual phrases, after April’s 0.1% drop and downward revisions to first quarter numbers. Nonetheless, the pattern does look like slowing. Client spending averaged 3.2% actual annualised progress within the second half of 2023, however assuming we get a 0.2% actual MoM enhance in spending in June, that can imply annualised client spending progress of simply 1.5% within the first half 2024. As such, each inflation and spending counsel tight financial coverage is cooling the economic system and constraining worth will increase.

The Fed doesn’t wish to trigger an pointless downturn – price cuts from September

The Fed believes financial coverage is restrictive at 5.25-5.50% in an setting the place it views the impartial rate of interest as being round 2.8%. The Fed doesn’t wish to trigger a recession if it doesn’t must and if the info permits it to start out making financial coverage barely much less restrictive, we predict the Fed will take that chance, doubtlessly as quickly as September. For officers to be comfy taking that plan of action, we predict the Fed must see three issues:

- Extra proof of inflation pressures easing. If we are able to get one other couple of 0.2% or under MoM core inflation prints in fast succession, that will likely be a mandatory, however not a adequate issue that results in a price reduce.

- Extra proof of labour market slack. The unemployment price has gone from 3.4% to 4.0%. If that strikes convincingly above 4% with extra proof of a cooling of wages, this too will assist swing the argument in favour of price cuts – jobless claims knowledge and weak enterprise hiring surveys counsel the roles market is softening.

- Softening client spending. It has been the first progress engine within the US, however as acknowledged, the speed of progress has halved between the second half of 2023 and first half of 2024. The Fed must see that proceed by into the third quarter. Weak actual family disposable earnings progress, the exhaustion of pandemic-era accrued financial savings for tens of millions of households and rising mortgage delinquencies counsel monetary stress is materialising for a lot of lower-income households, suggesting it will certainly proceed.

If we get all three of those, we consider the Fed will search to maneuver financial coverage from “restrictive” to “barely much less restrictive”, with 25bp price cuts on the September, November and December FOMC conferences.

Content material Disclaimer: This publication has been ready by ING solely for info functions regardless of a selected person’s means, monetary state of affairs or funding aims. The knowledge doesn’t represent funding suggestion, and neither is it funding, authorized or tax recommendation or a proposal or solicitation to buy or promote any monetary instrument. Learn extra

Editor’s Notice: The abstract bullets for this text have been chosen by In search of Alpha editors.