Adobe: The Early Stage Of GenAI Monetization (Score Downgrade) (NASDAQ:ADBE)

grinvalds/iStock by way of Getty Photos

Funding Thesis

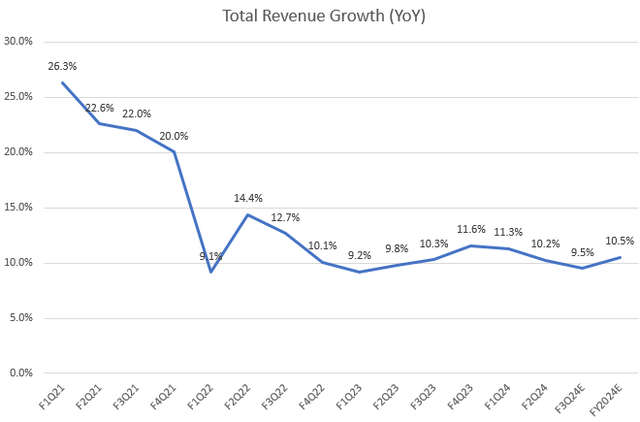

Adobe (NASDAQ:NASDAQ:ADBE)’s inventory rallied greater than 15% after its Q2 FY2024 earnings, pushed by depressed market sentiment and better-than-expected earnings outcomes. Regardless of an optimistic tone from the road concerning this quarter, my view is extra muted for 2 causes. First, the corporate’s income outlook isn’t solely beneath market consensus but in addition doesn’t point out a robust progress rebound. Second, its top-line progress is predicted to be 10.5% YoY in FY2024, which doesn’t help its premium valuation as an AI-driven progress inventory.

In my earlier evaluation, I initiated a purchase score and mentioned ADBE’s main give attention to GenAI to spice up its top-line progress and discover completely different monetization plans. Though the inventory is up 10.5% since then, it has underperformed the S&P 500 index by virtually 15%. Given the present progress trajectory, I feel ADBE’s AI monetization may take longer than anticipated to feed into its progress outlook. Due to this fact, I downgraded the inventory to carry from purchase as a result of I am not impressed with the corporate’s income steering.

2Q FY2024 Takeaway

Whereas ADBE topped each income and non-GAAP EPS in Q2 FY2024, the corporate supplied conservative income steering in keeping with Searching for Alpha. Its Q3 FY2024 income steering is beneath market consensus, and the FY2024 income outlook is in keeping with the consensus. As proven within the chart, the corporate’s top-line progress has considerably decelerated since FY2021 and remained flat year-over-year regardless of latest AI initiatives. This means that the corporate has not achieved a progress inflection in income but. Particularly, the guided 9.5% YoY progress for Q3 FY2024 exhibits a slight deceleration from 9.8% YoY in Q3 FY2023. In the meantime, the corporate is predicted to develop 10.5% YoY in FY2024, practically in keeping with 10.2% in FY2023. Due to this fact, I imagine that the corporate’s AI monetization plan won’t probably reaccelerate its top-line progress within the close to time period.

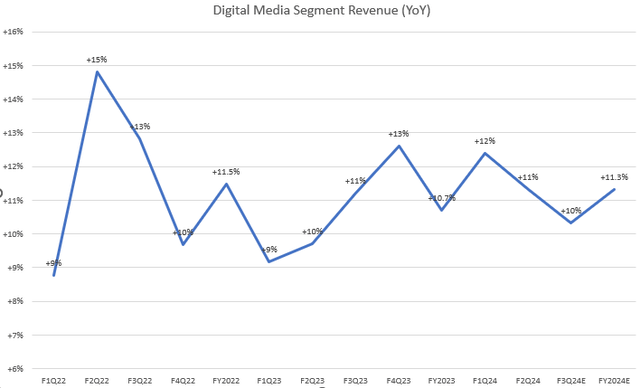

Let’s delve deeper into its income segments. The digital media income section comprised 74% of complete income within the final quarter. We will see that the corporate has forecasted a ten% YoY progress within the present quarter, which is decrease than the 11% YoY progress seen in Q3 FY2023. Due to this fact, this section has not but established an upside progress momentum both, provided that the guided 11.3% YoY progress for FY2024 nonetheless falls beneath the 11.5% YoY progress achieved in FY2022. However, it is nonetheless encouraging to see that the non-GAAP EPS outlook for Q3 FY2024 and FY2024 beats market consensus.

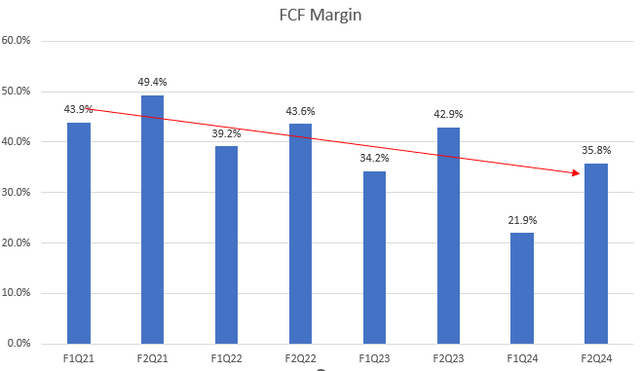

Concerning its FCF technology, ADBE has skilled destructive year-over-year progress in FCF over the previous three quarters. To take away seasonality, I’ve targeted on 1Q and 2Q information for evaluation within the chart. We will see that FCF margins in these quarters have additionally declined over the previous three years. This pattern may point out weak year-over-year progress in billings, which represents the amount of money influx that ADBE truly receives from prospects. Nonetheless, I can already see early indicators of success in its AI-driven progress narrative.

Firefly, A Progress Engine in GenAI Portfolio

As mentioned in my earlier article, considered one of Firefly’s standout options is its means to effectively generate copyright-free pictures for direct use in ongoing initiatives. By March 2023, Firefly had produced over 70 million pictures inside its first month alone. In the course of the 2Q FY2024 earnings name, administration reported that Firefly had been utilized to generate over 9 billion pictures throughout Adobe’s inventive instruments in 15 months, marking an almost 40% progress since 1Q FY2024. Moreover, administration indicated that extra prospects are upgrading to higher-tier plans pushed by enhanced Firefly capabilities. In addition they introduced that Firefly may be customizable by builders, enabling the creation of 1000’s of asset variations in minutes reasonably than months. This functionality can speed up AI monetization by elevated content material creation. Nonetheless, with the rising demand for AI-powered instruments, the crucial query stays when these AI-driven demand will translate into the corporate’s top-line progress.

Demand Is Choosing Up, However Timing on Income?

The corporate mannequin

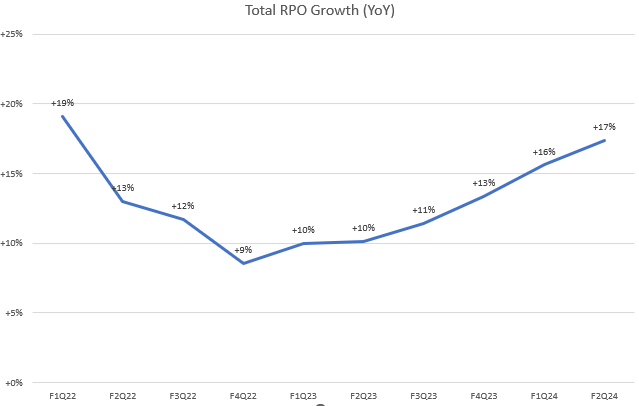

I imagine ADBE remains to be on observe for progress acceleration, as we’re seeing early indicators of a requirement rebound beneath its AI progress initiatives. Trying on the chart, the corporate’s complete Remaining Efficiency Obligations (RPO) have constantly accelerated over the previous 5 quarters since 2Q FY2023. Nonetheless, I am ready to see a strong backlog progress translate into sequential income progress, which I don’t presently observe.

Some new readers might not perceive the connection between RPO and income. Basically, RPO refers back to the backlog of contracts that an organization will fulfill sooner or later. These obligations may be transformed into future billings, finally contributing to income technology. In different phrases, RPO is future income. When a buyer indicators a contract, the corporate information “bookings,” which equals the change in RPO stability plus income. Nonetheless, the timing of income derived from complete RPO stays unsure. It is potential that the corporate’s progress rebound story might not materialize within the close to time period.

Valuation

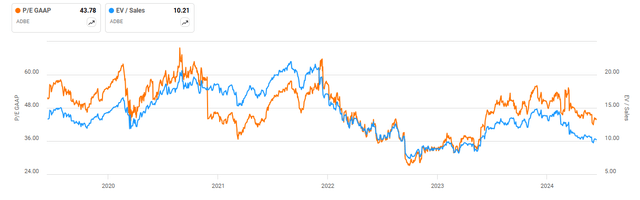

From a 5-year horizon, ADBE’s valuation multiples (GAAP) have been buying and selling at premium ranges, though the numbers have come down from latest highs. When contemplating non-GAAP forward-looking foundation, the inventory is presently buying and selling at 29x non-GAAP EPS FY2024E if we contemplate the midpoint of the EPS steering from the final quarter. This quantity is barely greater than the 28x non-GAAP EPS FY2023E reported in my earlier protection in June 2023.

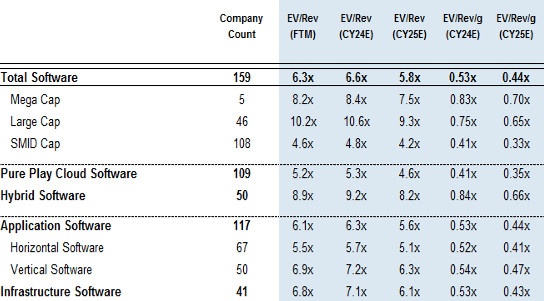

JP Morgan

As talked about earlier, ADBE is predicted to attain a ten.5% YoY income progress based mostly on the steering. We will see that its EV/Gross sales FY2024E presently sits at 10.9x. This means an EV/Income progress ratio (EV/Rev/g) for FY2024 of 1.04x, which is greater than any class within the desk above. Based mostly on this valuation metrics, it seems that ADBE’s near-term progress outlook can’t totally justify its present valuation. Nonetheless, contemplating the present sturdy demand trajectory based mostly on its backlogs, I like to recommend that buyers stay on the sidelines and look ahead to any indicators of a rebound in income progress within the upcoming quarters.

Conclusion

In abstract, ADBE has made vital progress with its AI plans. Whereas the corporate has exceeded income and earnings expectations within the final quarter and proven sturdy backlog progress largely pushed by strong demand for its AI-driven merchandise, income progress has not but began to select up. The corporate’s FY2024 steering suggests a flat progress trajectory in comparison with earlier years, elevating issues about reaching a strong rebound within the close to time period. Valuation metrics akin to EV/Gross sales and EV/Rev/g ratios point out the inventory is buying and selling at a premium, probably reflecting optimistic long-term progress expectations. Nonetheless, given the uncertainties, I’m downgrading the inventory to carry to replicate these issues. I might rethink a extra bullish view if the corporate efficiently converts sturdy AI demand into precise income progress rebound in H2 FY2024.